Greek Speculative S&P Investments

In a decade defined by volatile markets and seismic shifts in shipping dynamics, Greek shipowners have taken bold investment stances that could shape the future of global trade. Dan Nash, Associate Director of Valuations & Analytics at Veson, explores the speculative bets made by Greece’s maritime giants and explores a critical question: what’s driving these unprecedented investments in gas and offshore assets?

Roaring 2020s for vessel values

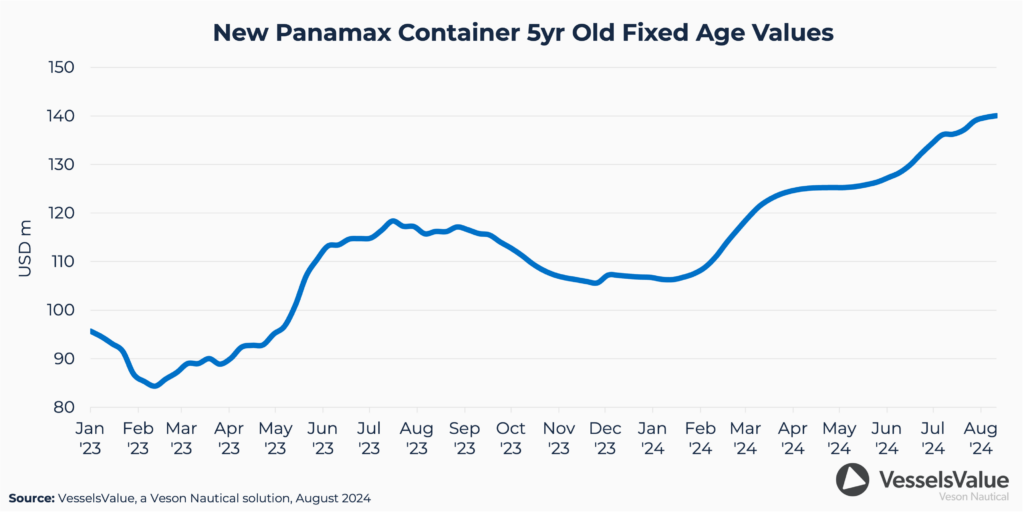

According to the World Bank1, the unprecedented disruption of liner shipping in the 2020s created the conditions for the greatest earnings the sector has ever seen. The argument is that a strong correlation exists between stalled Twenty-Foot Equivalent Unit (TEU) capacity and spot rate inflation on the Shanghai Container Freight Index (SCFI) to the tune of USD 2,300 for every 1 million TEU stalled. This bold statement could have substance given that this year alone has produced a severe drought in Panama, the Baltimore bridge collapse, abnormal hurricanes in the Atlantic, and a midterm Red Sea crisis with no obvious end in sight, which have collectively supported ‘higher for longer’ prices in the freight, charter, and sale & purchase (S&P) markets. Consequently, market values for five-year-old new Panamax container ships are now c.46% higher compared to January 2023, requiring buyers to pay in the region of c.USD 140 mil for tonnage basis charter free, up a staggering c.USD 44 mil inside twenty months.

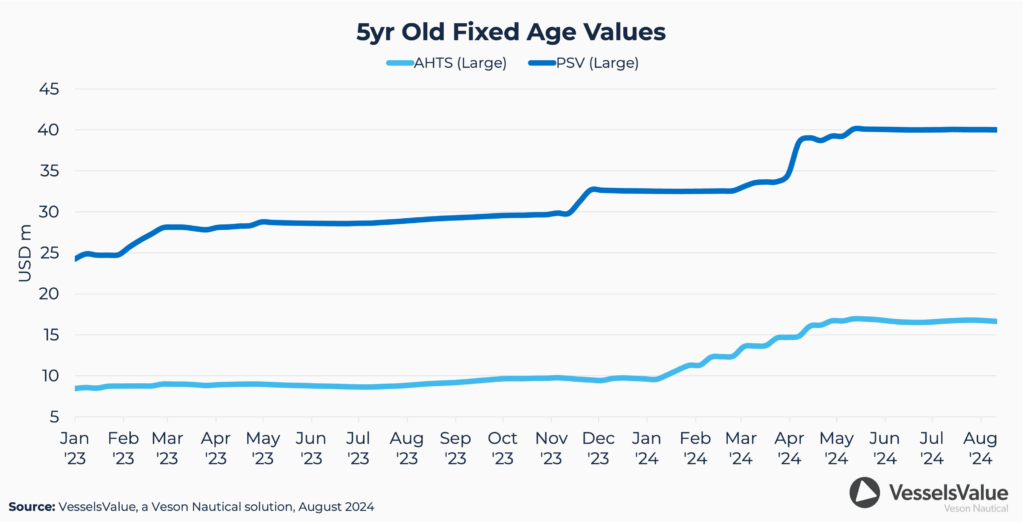

It is not just container vessels that have got more expensive. Offshore values for five-year-old AHTS (Large) and PSV (Large) have spiked c.97% and c.67% respectively over the same period, supported by a low orderbook of just c.2-3%. This perhaps explains why Marinakis’ Capital Group paid USD 180 mil for 4 x PSV units (5,500 DWT, DP2 fitted) at Fujian Mawei Shipbuilding in June with repeat options, followed by 2 x MPSV orders (4,4700 DWT) from the same shipyard in September, anticipating a strong forward offshore market.

By comparison, five-year-old capesize values have risen by c.52%, up c.USD 21 mil compared to the start of last year, while five-year-old VLCCs have gained c.17% requiring buyers to pay c.USD 17 mil more versus January 2023 prices. The industry may look back on this decade as the “roaring 2020s” for vessel values if disruptive trends persist in the second half of 2024. In the meantime, savvy diversified shipowners have been quietly placing their bets into new and alternative sectors. Not surprisingly, Greek shipowners have been front and centre, heavily backing gas.

Greek shipowners piling into Gas

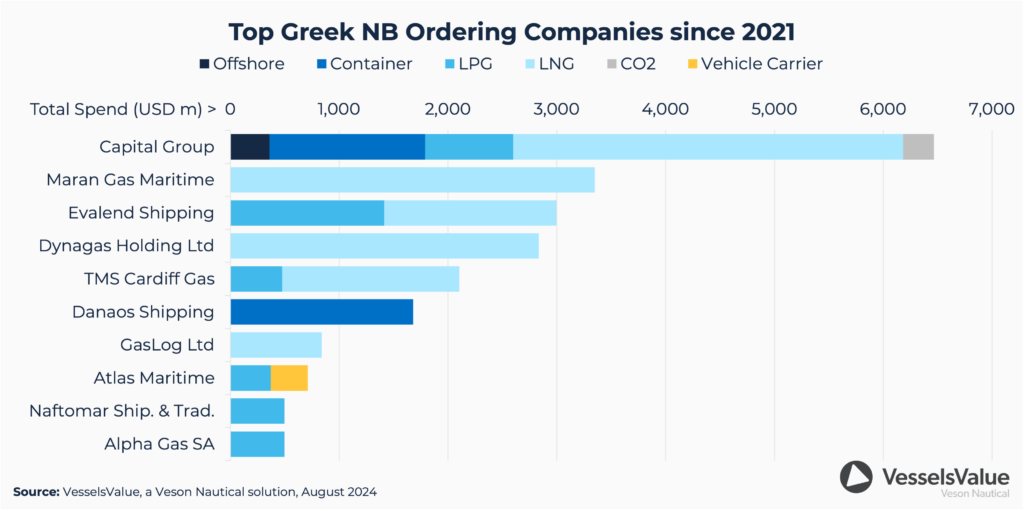

An analysis of newbuild order spend by top Greek companies since 2021 shows that c.USD 18 bn has been spent on gas, including c.USD 13.8 bn on LNG (59 vessels) and c.USD 4 bn on LPG (41 vessels). To put this into perspective, this exceeds the newbuilding spend on tanker, bulker, and container sectors by Greek companies over the same period based on c.USD 12.2 bn (167 Tankers), c.USD 4.1 bn (109 Bulkers), and c.USD 3.1 bn (39 Container ships).

Capital Group have been the most speculative, opting for large LNG (15 vessels), VLAC (2 vessels), MGC (8 vessels), and CO2 (4 vessels) for a combined total spend of c.USD 4.7 bn, followed by Maran Gas at c.USD 3.3 bn (15 x large LNG), and Evalend Shipping at c.USD 3 bn (12 x VLGC, 2 x MGC, 2 x VLAC, 6 x large LNG).

Moving further down the list, Atlas Maritime took a speculative punt into vehicle carriers investing c.USD 340 mil (4 x LCTCs) in 2022/23 which may prove to be a shrewd investment based on a general lack of car carrying capacity into next year. Focusing on offshore, in addition to Capital Group’s orders in China already referenced, Singapore’s Pax Ocean Group have revealed that up to 10 x MPSVs (5,500 DWT) have been ordered by an undisclosed Greek shipowner, price undisclosed, supporting a growing trend.

Newbuilding prices to remain in high territory

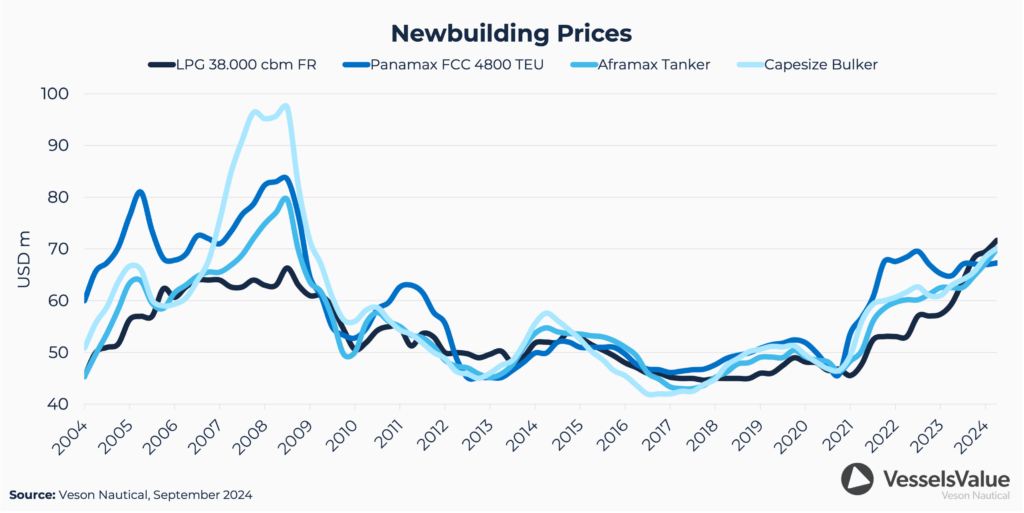

Newbuilding prices across sectors have reached their highest level since the 2008 financial crisis with the most recent upward pressure commencing in 2021. The price surge was initiated by the COVID-19 pandemic and the sharp rise in demand for building Container vessels. Over time, newbuilding prices across sectors have proven to correlate, and when you have very high ordering activity in one sector prices will typically move for all sectors irrespective of earnings. Using Aframax Tankers as an example, its newbuilding price increased more than c.20% in 2021 despite earnings remaining well below OPEX through the year.

Following high ordering activity for Container and LNG vessels in 2021/22, the total orderbook for all vessels continued to rise exerting even more pressure on shipyard capacity and building periods. As a result, shipyards have held the upper hand in price negotiations and prices have climbed. Furthermore, earnings for Container vessels have pushed up again this year based on longer sailing distances around the Cape of Good Hope owing to a persistent Red Sea crisis. Isolated from incentives to reduce CO2 emissions and slot costs for liner companies, this development has brought renewed interest for Container vessel ordering and newbuilding prices are subsequently rising again across sectors. Whilst we do not foresee a repeat of the ordering volumes from the pandemic years, we expect to see newbuilding prices for Container vessels rising above the upward trendline of other segments. As such, our expectations are for Container newbuilding prices to continue to rise in 2024 and into 2025 at a higher pace than that of the other sectors.

Looking further ahead, and unless Container earnings continue to increase, we expect Container ordering demand to slow and the total orderbook to slowly subside. This development is expected despite solid sentiment and replacement needs in the other major sectors primarily Bulkers and Tankers, where ordering activity is likely to increase but not replace the reduction from ordering in the Container sector. In turn, this will result in more vessels being delivered than new orders being placed and consequently, the total orderbook will decline. If sustained over some time, a declining total orderbook will remove capacity pressure from shipyards which typically leads to lower newbuilding prices. However, this decline will be gradual and is probably 12-24 months out in time, therefore vessel prices are expected to remain in historically high territory.

Capital Group’s asset play

As we have seen, it’s an expensive time to buy large ships across sectors, and it’s a good time to sell based on historical prices. Capital Group must have felt the timing was right to sell nine modern VLCCs to Bahri in August pocketing c.USD 1 bn. Similarly, a trio of 12-year-old Post Panamax container ships were offloaded to Peter Doehle back in March for USD 51 mil each including time charters, followed by a further five 11-year-old Post Panamax box ships sold to undisclosed buyers last month. These deals combined have generated revenues more than c.USD 1.4 bn that will be used to finance Capital’s expansive Gas newbuilding programme. However, more container and tanker sales may be necessary to make up the shortfall.

Whilst on the buying side, Capital Group have acquired seven PSVs from the second-hand market since the end of last year spending c.USD 108 mil in total including Standard Supplier (5,200 DWT, Oct 2007, Vard Brattvaag) purchased for USD 22.7 mil in March, VV value USD 21.9 mil the day before sale. So, from a total cost to invest in a new sector perspective, Capital Group have spent c.USD 340 mil on Offshore to date in return for seven second-hand units and six firm newbuild orders excluding options. That’s comparatively cheap compared to other sectors and may attract further interest based on a favourable supply-demand market balance.

Dry Bulk & Tanker Trades: Year-End Review

Register for our upcoming webinar to learn about the key market drivers and evolving geopolitical, regulatory shifts in maritime.

February 4 @ 4:00 PM SGT / 8:00 AM GMT

February 5 @ 2:00 PM GMT / 9:00 AM EST