Half Year Review: Cargo Demolition 1H 2023

Introduction

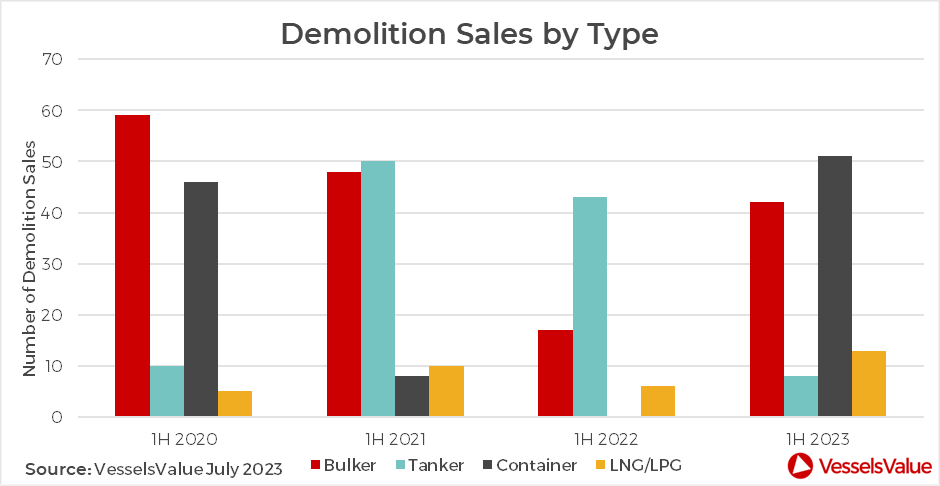

In the first half of 2023, 114 vessels were sold for scrap, a 73% increase over the same period in 2022. 51 tankers were scrapped, accounting for approximately 44.7% of all cargo vessel demolition in the first half of 2023.

The rising scrapping numbers are a direct result of historically high scrapping rates, which reached historic highs in 2022. Despite some volatility, container scrapping prices remained at very high levels in the first six months of 2023, peaking at 655 USD/LDT in April.

Unprecedented earnings in the Tanker market saw owners capitalise in both the charter and S&P markets, turning their backs on the demolition sector despite the lucrative scrapping prices. On the other hand, Bulker owners were more enticed by the high scrapping values, however, the majority are still holding onto older assets in the hope of a market recovery.

Scrap price summary

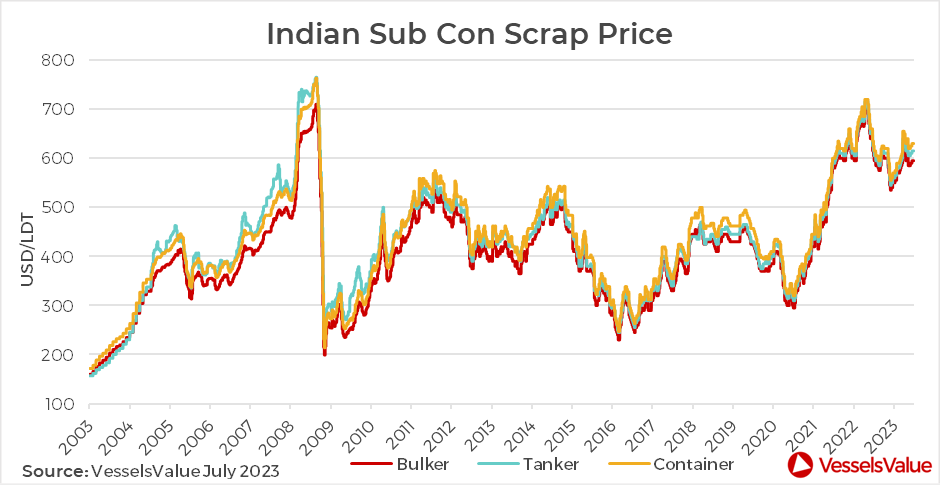

Figure 1 shows the average scrap price in the Indian sub-continent, this represents the highest scrap price available between Bangladesh, India and Pakistan recycling yards.

In May of 2022 scrap prices hit a 14- year high of 720 USD/LDT and although this has since fallen, the prices have remained high and above the 545 USD/LDT mark. This year scrap prices peaked at 650 USD/LDT for Containers.

Below are some examples of vessels achieving high scrap prices on the demolition market:

- 17th February 2023 – Handy Container Xiumei Shanghai ( 1,608 TEU, Sep 1997, Wadan Yards MTW) sold for 640 USD/LDT to Bangladesh.

- 16th June 2023 – Feedermax Container Sco Qingdao (614 TEU, May 1997, Qiuxin) sold for 610 USD/LDT toBangladesh.

- 29th May 2023 – Handymax Bulker Hong Hao (44,600 DWT, Jun 1998, Stocznia Szcecin Nowa) sold for 620 USD/LDT toBangladesh

- 17th March – MR Tanker Salamis (47,200 DWT, Mar 1998, Onomichi Dockyard) sold for 660 USD/LDT to Bangladesh.

Demolition sales by type

Container

The number of Containers scrapped in the 1H of 2023 has risen to 51 from 0 last year. With Container rates now having stabilised from the record highs last year and the large numbers of new deliveries scheduled to hit the water over the next few years, it would not be a surprise if Container scrapping continues to grow, should earnings remain at current levels or even fall further.

Tanker

Despite the high scrap prices, Tanker owners are reticent to scrap any older tonnage due to the high earnings over the past year and second-hand values which are hovering around 15- year highs. Continued interest in older tonnage sold to the so called dark or shadow fleet in order to take advantage of the premiums available for sanctioned trades, has kept values high. Therefore, scrapping numbers have been low in the first half of the year, down by 81% YoY from 43 in 1H 2022 to just eight in 1H 2023, with only the oldest and least efficient tonnage being sent for scrap.

Bulker

With lacklustre earnings for Bulkers over the past 12 months, unsurprisingly we have seen an increase in Bulker scrapping this year which has more than doubled, from 17 vessels sent to the breakers yard in 1H 2022 to 42 so far this year. An ageing fleet and the introduction of the new CII regulations from the IMO has been an extra incentive to scrap older tonnage.

Gas

In the Gas sector, scrapping rose from six vessels in 1H 2022 to 13 in 1H 2023, with all vessel sales in the LPG sector. The average age of vessels sold for scrap this year is 34 as very high rates ensure that only the oldest vessels are being sent to the breakers yard.

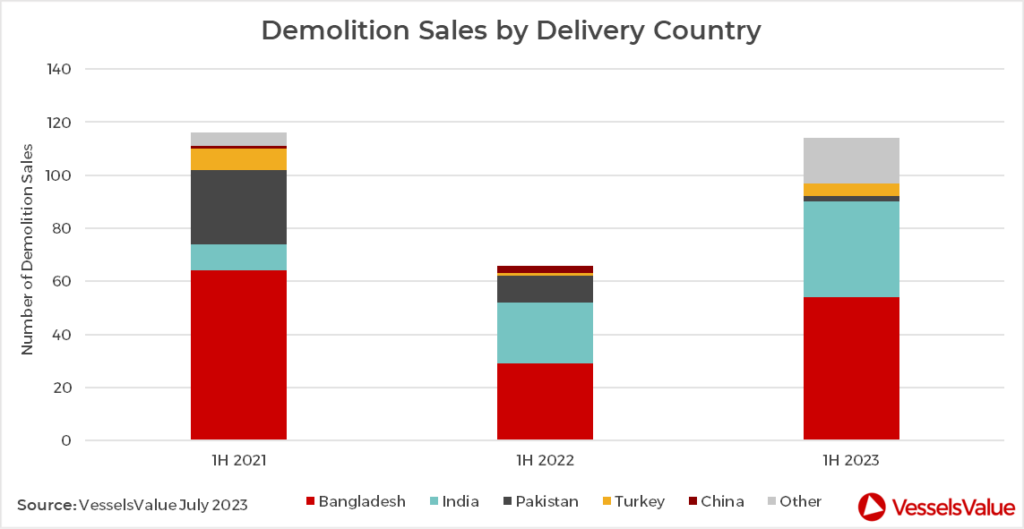

Demolition sales by country

Bangladesh has accounted for approximately 47.3% of demolitions in 2023 to date, India followed with a share of c.31.6%. Turkey ranked third, with a share of c. 4.4%, overtaking Pakistan where only two vessels has been scrapped so far this year, compared to 10 in 1H 2022.

Despite the ongoing issues with letters of credit in Bangladesh, inventories at Bangladeshi yards remain at healthy levels, ensuring that they will remain busy over the coming months. However, as banks impose stricter regulations, making it more difficult to obtain letters of credit, this has left many cash buyers and recyclers in a difficult situation. Demolition in India has increased from 10 vessels in 1H 2021 to 23 in 1H 2022 and then to 36 in 1H 2023, should the situation in Bangladesh continue and it is possible that this number may grow in the second half of the year, should ships be diverted to Alang, India for demolition.

Conclusion

Containers have been the most popular vessel for demolition this year and as earnings settle from the extreme highs of the last few years, it is likely that we will see a continuation in this trend over the coming months. The introduction of the CII regulations from the IMO is yet another incentive to scrap old and less environmentally friendly tonnage and with weaker earnings for Bulkers, there has been an increase in demolition for this sector too. However, scrapping for Tankers and Gas has remained low, due to elevated earnings that have come as a result of increased tonne mile demand.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?