Half Year Review: Cargo Newbuildings 1H 2023

Introduction

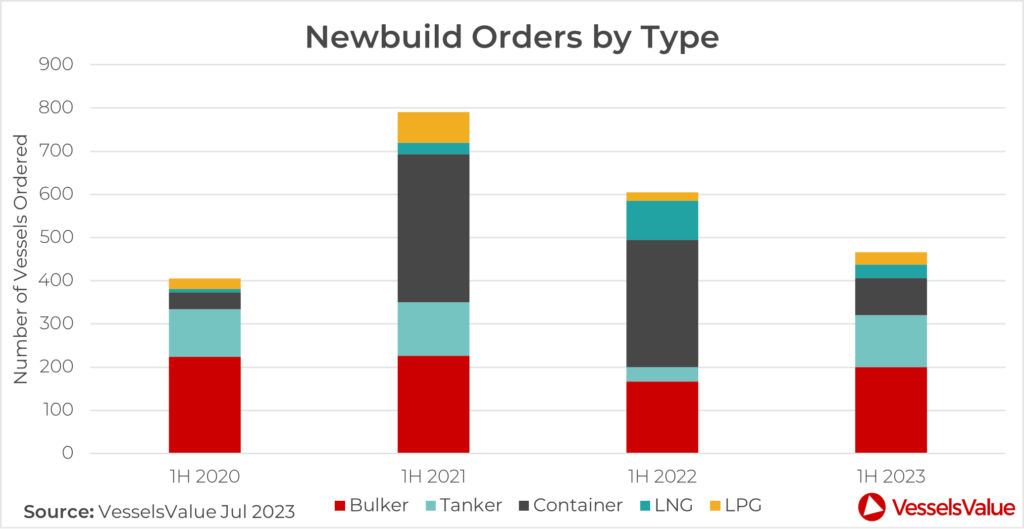

Overall ordering levels have dipped in the first half of 2023 and, in comparison to last year, the number of new orders has fallen short of the record-breaking levels seen over the last two years. So far, 466 Cargo vessels have been added to the orderbook, a decrease of c.23% YoY. The Cargo sector in this report covers Bulkers, Tankers, Containers and Gas (LNG & LPG).

The declining number of newbuilding orders, particularly in the Container sector, reflects a weaker global macroeconomic outlook as the number of Container orders have reached a saturation point and have now started to decline. At the same time, rates for this sector have fallen and are now beginning to stabilise from the all-time highs of 2022. And, despite the push towards greener energy sources resulting in an increased number of LNG orders last year, contracts for Tanker newbuildings have picked up once again.

Bulker orders have been the talk of the town so far this year as an ageing fleet, green requirements and high rates in recent times have sparked interest to build new vessels as yard space becomes available with new Container orders slowing.

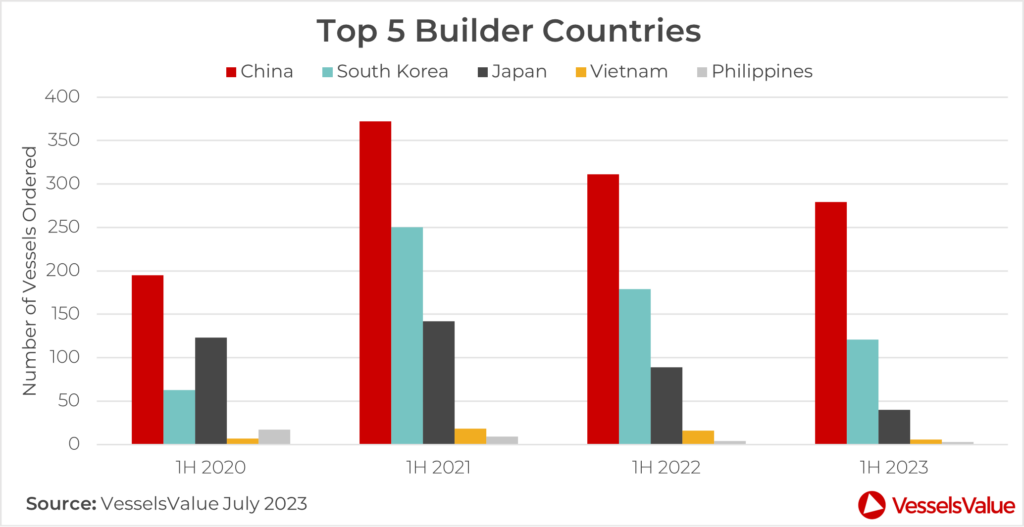

Chinese yards held the top rank as the most popular choice for newbuildings, accounting for 279 orders placed in 1H 2023, around 62.1% of newbuilding orders placed in 1H 2023, with the majority of these orders in the Bulker sector. South Korea ranked second, accounting for 27% of orders with 121 orders placed. Japan was once again in third place with c.8.9% although this share has dropped from c.14.8% last year as yard slots are set to remain busy with Container orders for the next few years. Vietnamese yards represented c.1.3% of orders and the Philippines c.0.6%.

Overall vessel orders have cooled this year as the amount of Container and LNG orders has reached a saturation point. Container contracts have declined from 295 in the first half of 2022 to 86 so far this year and LNG contracts have fallen from 91 to 32. Instead, Bulkers have taken the top spot with orders increasing by c.20% year on year from 167 in 1H 2022 to 200 in the 1H 2023. Tanker orders have seen the most growth year on year, increasing by c.263.6%. LPG orders have grown by c. 47% year on year, from 19 to 28.

Bulkers

Bulker orders have had a great start to the year, which has boosted newbuilding values across the board. Panamaxes of 82,000 DWT climbed by approximately 10.3% in the first half of 2023, from USD 34.1 mil to USD 37.61 mil.

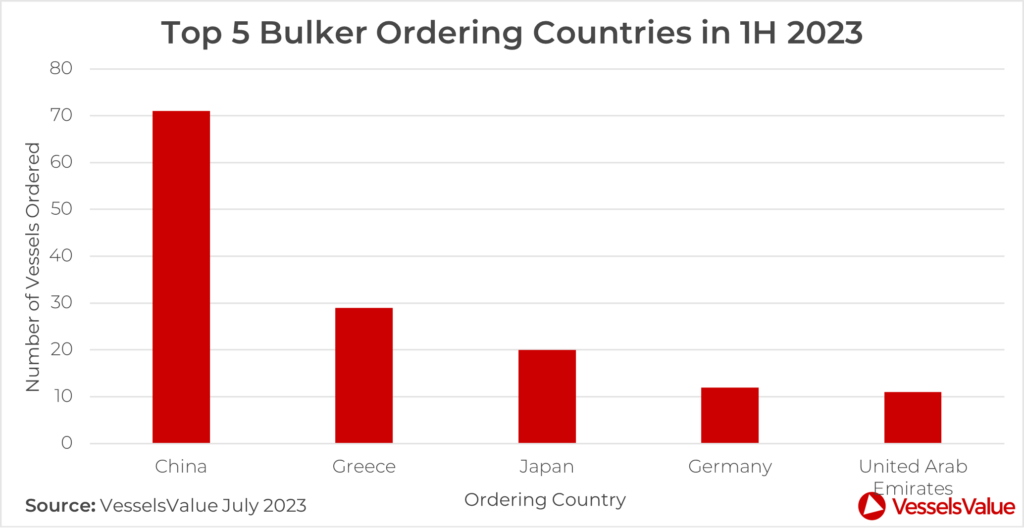

Overall orderbook levels increased by approximately 19.7%, from 167 Bulker contracts in the first half of 2022 to 200 in the first half of 2023. Chinese owners dominated bulker orders this year. Over 70 contracts were signed in the first half of the year, accounting for over half of all orders. Greece came in second with around 20%, and Japan came in third with around 14%.

Headline orders include 12 x 82,000 DWT Panamax Bulk Carriers by Shandong Shipping set to be built at Jiangsu New Hantong and delivered between 2024-2025 and contracted for USD 33 mil en bloc, VV value USD 32.15 mil.

Tankers

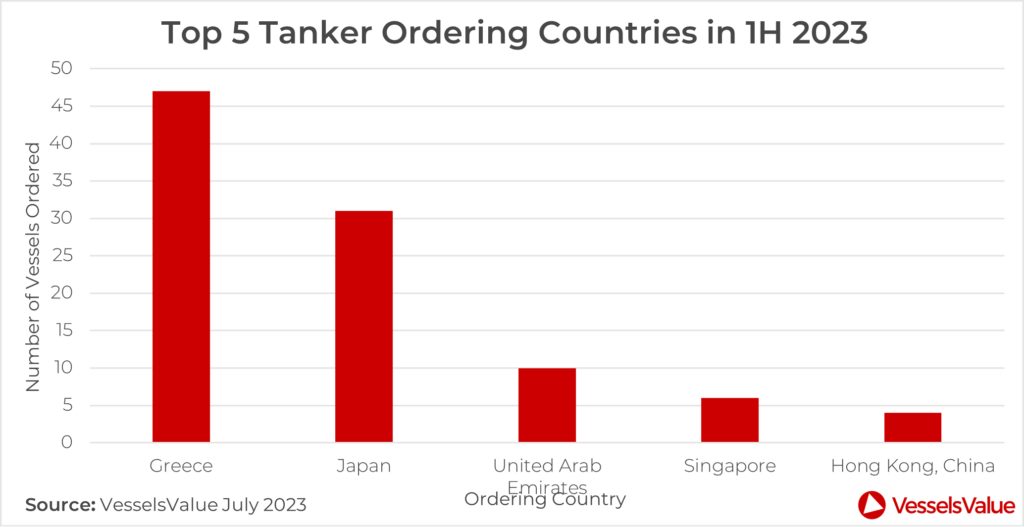

Greece has been the top nation for ordering Tankers once again, placing almost half of the orders in 1H 2023 at 47.9%. Japan ranked second with c.31.6% and in third place is the UAE with c.6.9%.

After a quieter period in the 1H 2022, there has been a resurgence in demand for Tankers, and earnings have strengthened as a result of changing trade maps and increased tonne mile demand surrounding the Ukraine/Russia conflict. New Tanker orders were up by c.263.6% YoY with 120 contracts signed in the 1H 2023.

Headline orders include 10 x LR2 Tankers of 115,000 DWT by Dynacom Tankers, scheduled to be built at Dalian Shipbuilding and delivered between 2025-2026 and contracted for USD 62 mil en bloc, VV value USD 65.61 mil.

Containers

Total Container orders have fallen by c. 70.8% YoY from 295 in 1H 2022 to just 86 in 1H 2023. The momentum of this sector, which saw rates reach record highs in 2022, has slowed down as the world begins to return to normal following the pandemic and concerns over the global economy have put the breaks on consumer spending.

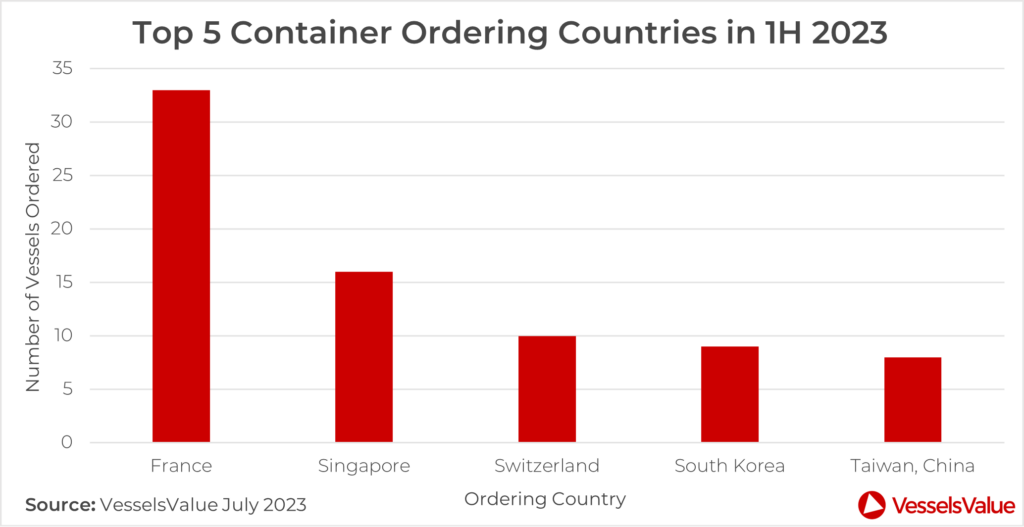

In 2023 to date, France has been the most active nation in ordering 10 new Container vessels, accounting for 38.3%, Singapore ranked second with 16 new orders, equating to c.18.6% and in third place was Switzerland with ten new orders or c.11.6%.

Headline new orders include 10 x ULCVs of 24,000 TEU ordered by CMA CGM scheduled to be delivered in 2026 and built at Jiangsu Yangzi Xinfu, contracted for USD 240 mil en bloc, VV value USD 232.49 mil.

Gas

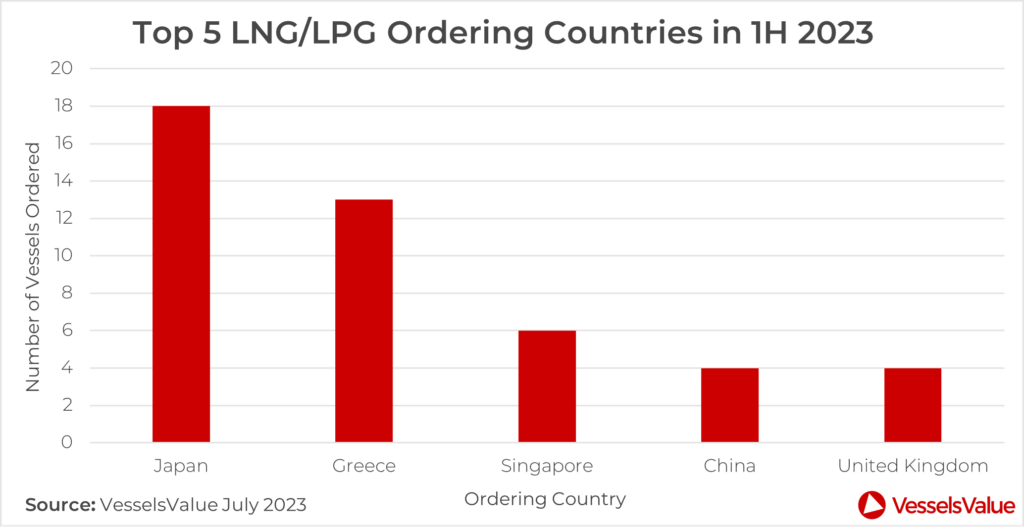

Japan has led the way this year for orders in the Gas sector, with 18 orders confirmed or a share of c.30%. The majority of these orders were for Large LNG carriers of 174,000 CBM.Over the course of the year, to date, NYK Line have ordered 10 Large LNG vessels at various yards in both South Korea and Japan. Second place is Greece with 13 new orders, equating to c.16.6% and in third place was Singapore with six new orders, accounting for 6%.

In January, Values for Large LNG carrier newbuildings hit an all-time high of USD 257.38 mil and then remained above USD 250 mil for the remainder of the first half of the year.

At the end of June, a headline sale was confirmed that set the benchmark even higher with NYK Line’s order of two Large LNG Carriers of 174,000 CBM, scheduled to be built at Hyundai Mipo and delivered between 2026 and 2027, sold in an en bloc deal for USD 261.31 mil, VV value 254.15 mil.

In the LPG sector, MGC values strengthened by c. 3.1% from USD 61.07 mil to reach a seven year high of USD 62.99 mil. Headline sales include 2 x MGC LPG carriers of 40,000 CBM, ordered by Sahara Group and scheduled to be built at Hyundai Mipo and delivered in 2026, for an en bloc price of USD 70.5 mil, VV value 64.45 mil.

Conclusion

The ordering spree of Containers and LNG carriers in recent years has now settled and this has paved the way for a resurgence Bulker and Tanker orders over the past six months. Tanker orders have been supported by an increase in interest in this sector as a result of rocketing freight rates over the last year, combined with the new policies from the International Maritime Organisation (IMO) which has led to owners deciding to build greener and more efficient tonnage in order to comply with the new EEXI and CII regulations. With an ageing fleet, these new regulations have also encouraged Bulker owners to consider building new vessels now that yard spaces are becoming available.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?