Half Year Review: Cargo S&P 1H 2023

Introduction

2023 to date has been one of the best years in recent memory for Tanker sale and purchase as values hover around 15-year highs. For other sectors, the pent-up demand following Covid has now abated but values have yet to correct back to pre pandemic levels.

A combination of changing trade patterns and increased tonne mile demand as a result of conflict between Russia and the Ukraine continues to influence demand for vessels and consequently values.

The half year review will analyse each asset class and aim to shed more light on the different factors that influenced developments seen in the first half of 2023.

Bulkers

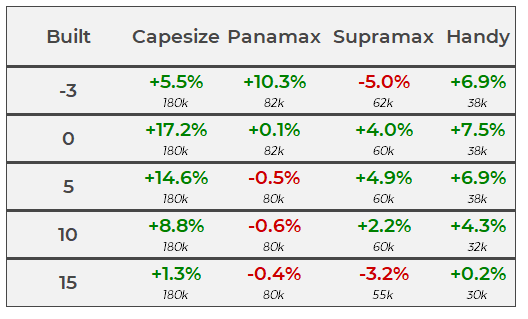

The Bulker sale and purchase market surpassed the Tanker sector by a staggering 17.2% during the first half of 2023.for example, at the beginning of 2023 Capesize the HL Sapphire (208,000 DWT, Jan 2021, New Times Shipbuilding) sold for USD 50.5 mil, that same vessel today is valued at USD 55.51 mil.

In the first half of 2023, Capesize values continued to make considerable gains across all age categories, led by transactions from Japanese sellers that have set the benchmark higher. Newbuild vessels of 180,000 DWT increased by c. 17.2% from USD 51.16 mil to USD 59.94 mil.

In the Panamax sector, although values for newbuildings increased, the remaining age categories were relatively stable.

Supramax values were mixed for example 60,000 DWT 5YO vessels firmed by c. 4.9% from USD 26.76 mil to USD 28.08 mil but values for 55,000 DWT 15YO vessels softened by c. 3.2% from USD 14.68 mil to USD 14.21 mil. Meanwhile Handy values remained firm with values for 0YO vessels of 38,000 DWT rising from USD 27.72 mil to USD 29.80 mil.

Notable sales include:

- Capesize BC Aquaenna (176,000 DWT, Sept 2011, JIM) sold to Costamare for USD 22.20 mil, VV Value USD 21.10 mil.

- Panamax BC Rikke (81,900 DWT, Jul 2016, Tsuneishi Zhoushan) sold to undisclosed buyers for USD 27 mil, VV Value USD 27.10 mil.

- Ultramax BC Kambos (63,700 DWT, Jun 2015, COSCO Zhoushan) sold to undisclosed buyers for USD 24.5 mil (DD passed), VV Value USD 22.60 mil.

- Supramax BC RHL Julia (55,700 DWT, Nov 2009, Mitsui Tamano) sold to undisclosed buyers for USD 15.30 mil, VV Value USD 15.85 mil.

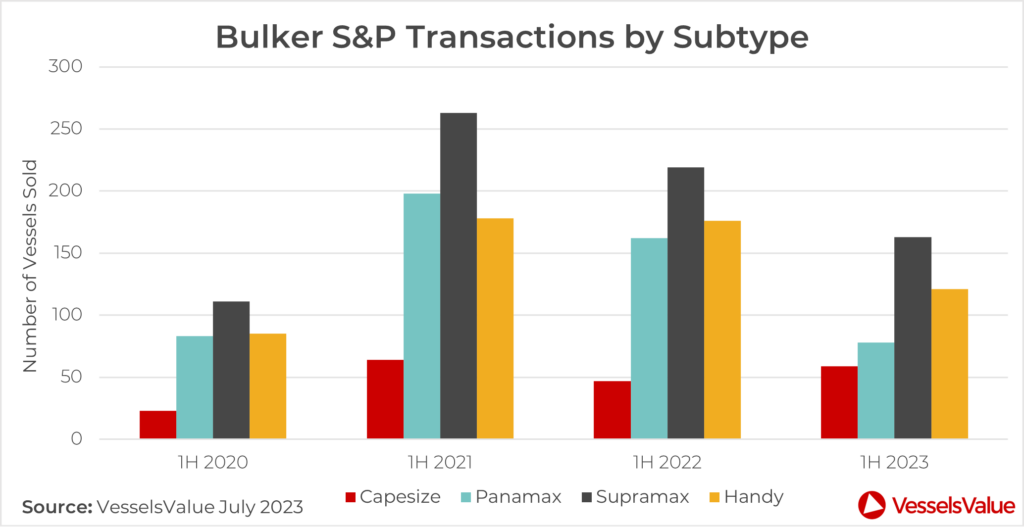

Although Bulker sale and purchase activity was the busiest sector so far this year, year-on-year transactions actually fell by c.30.2%. Supramaxes were the most popular category, accounting for around c. c.38.7%, followed by Handys with c.28.7%, Panamaxes ranked third with c.18.5% with Capes accounting for c.14.1%.

Tankers

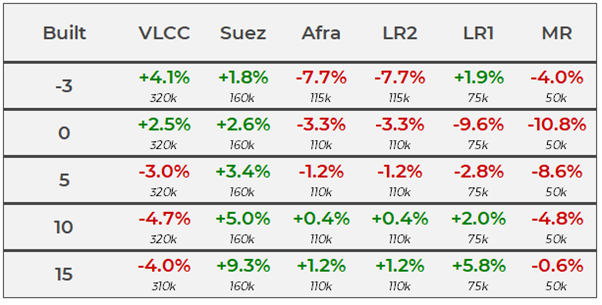

A mixed first half of the year for Tanker values.

In the Suezmax sector, earnings were up c. 119% YoY to around 40,000 USD/Day and this ensured that values for this sector continued to firm, reaching 15-year highs over the course of 1H 2023. 15YO vessels of 160,000 DWT were up by c.9.3% from USD 37.53 mil in January to USD 41.01 mil at the end of June.

On the other hand, values for new MRs of 0YO cooled by c.10.8% from USD 51.97 mil to USD 46.36 mil as values came off from the peaks at the start of the year, that were buoyed by strong earnings in the run up to the introduction of sanctions on Russian crude oil and products.

Notable sales include:

- Suezmax Sonangol Kassanje (158,700 DW, Jun 2005, Daewoo) sold to Infinity Ships FZE for USD 37 mil (BWTS), VV Value USD 34.39 mil.

- Suezmax Elandra Osprey (157,500 DWT, Apr 2018, Hyundai Samho) sold to Eastern Pacific Shipping for USD 75.75 mil (SS/DD Passed), VV Value USD 71.86 mil.

- MR2 (Chem/Product) Ridgebury Galileo (47,900 DWT, May 2006, Hyundai Mipo) sold to undisclosed buyers for USD 19 mil (BWTS), VV Value 20.71 mil.

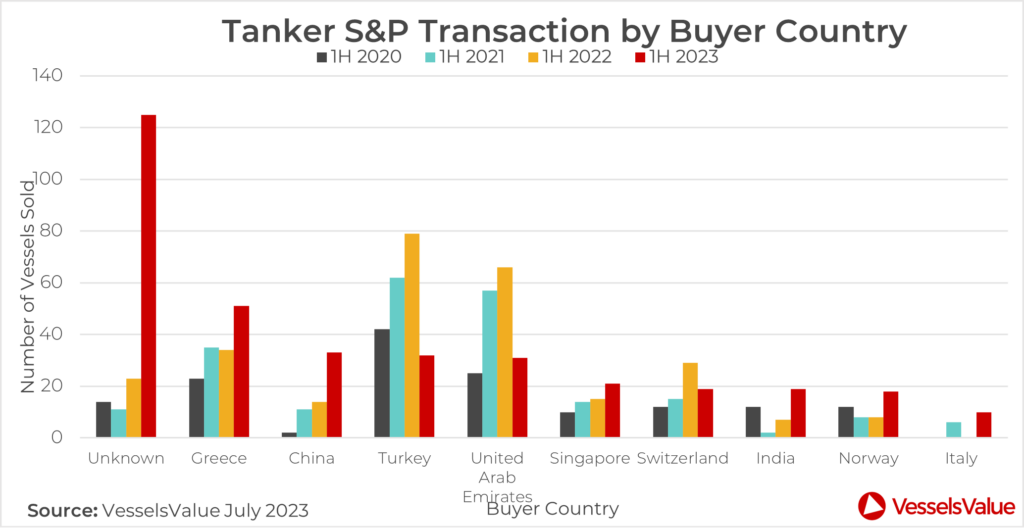

Tanker sales in the 1H 2023 were up by c.34.1% YoY. The majority of these sales were to unknown buyers accounting for c.35%, soaring from just 23 in 1H 2022 to 125 in 1H 2023, an increase of c.443.5%. As sales to unknown buyers have continued to rise since the start of the conflict between the Ukraine and Russia, a new breed of Tanker owner has been enticed into the market where often the company of the owner is unknown and is purchasing older, more cost-effective tonnage.

Greece ranked second, accounting for c.14% followed by China at c.9.1% and Turkey came in fourth with c.8.9%, despite a drop in sales of c.59.5%.

Containers

After declining progressively from historical highs observed in early 2022, box rates eventually found a floor earlier this year and are now beginning to settle but remain above pre-pandemic levels. One year time charter rates took a dip between February and March of this year but have since rebounded to around 45,000 USD/Day for Post Panamax vessels. However, Feedermax and Handy’s are starting to drop again following a tonnage build up in Asia weighing on future values.

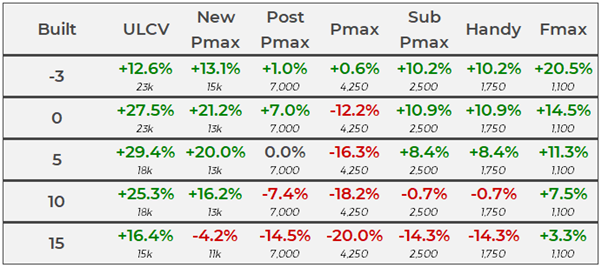

It has been a mixed first half of the year for Container

values. Modern tonnage has risen in value as newbuilding prices stay firm,

however older tonnage has fallen in value as earnings and sentiment across the

sector continue to decline.

For example the price of 18,000 TEU 5YO ULCV has risen by c.29.4% from the

start of the year from USD 124.91 mil to USD 160.7 mil whereas the price of a

4,250 TEU 15YO Panamax has fallen by c.20% from USD 28.7 mil to USD 22.96 mil.

The Panamax Tintin (3,451 TEU, Aug 2007, Hyundai Mipo) was sold earlier this year to undisclosed buyers, the VV value at the start of this year was USD 21.59 mil and today that same vessel is valued at USD 16.29 mil.

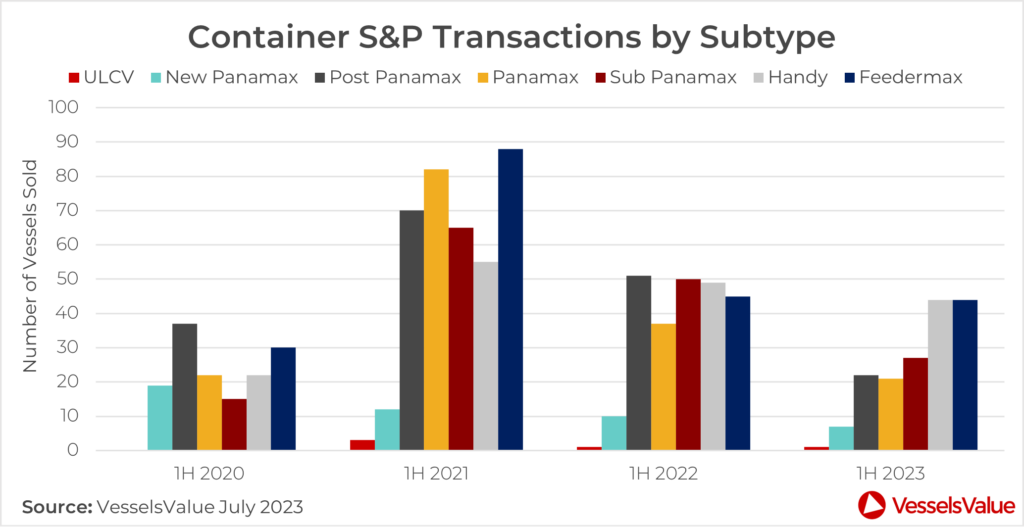

Overall Container sale and purchase transactions have fallen by c.32% YoY with 166 sales reported in the 1H 2023 compared to 243 sales in the 1H 2023. Handymaxes and Feedermaxes have led Container sales so far this year accounting for c.26.5% of sales each, Sub Panamaxes ranked second with a share of c.16.3%, Post Panamaxes c.13.3%, Panamaxes c.12.7%, New Panamaxes c.4.2% and ULCVs 0.6%.

Switzerland retained the top spot as the biggest buyer of second hand tonnage with 24 sales repored, the majority of these were bought by the world’s largest Container operator, MSC totalling 20 vessels.

Notable sales include:

- Post Panamax Amoliani (6,900 TEU, Jan 2013, Hyundai Samho Heavy Ind) sold USD 60 mil SS/DD due VV value 58.21 mil.

- Panamax Northern Promotion (4,586 TEU, Jan 2010, Daewoo) sold USD 27.7 mil BWTS VV value 26.1 mil.

- Panamax Northern Priority (4,586 TEU, Oct 2009, Daewoo) sold USD 27.7 mil BWTS VV value 25.67 mil.

- Sub Panamax Ella (2,450 TEU, Mar 2003, Naikai Setoda) sold USD 14 mil VV value 13.95 mil.

- Sub Panamax Northern Volition (2,750 TEU, Nov 2005, Wadan Yards MTW) sold USD 13 mil DD due VV value 12.02 mil.

- Handy Viking Orca (1,800 TEU, May 2023, Jiangsu Yangzijiang) resale sold USD 28 mil VV value 26.8 day before. Ordered for USD 23 mil en bloc Jan 2021

- Feedermax Tacoma Trader (1,103 TEU, Aug 2015, Jiangsu New Yangzijiang) sold USD 19 mil DD due VV value 17.4 mil.

Gas

LPG

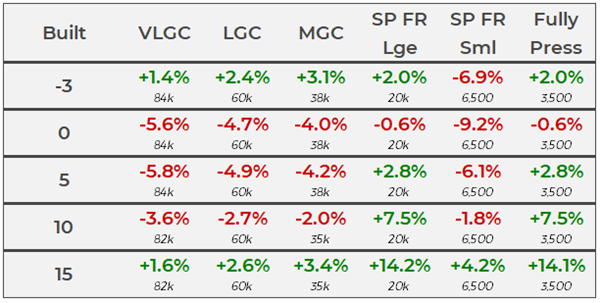

Values for older LPG vessels of 15 years rose across all sub sectors. Fully Pressurised vessels of 3,500 CBM showed the most dramatic increase of c.14.1% from USD 9.9 mil to an all time high of USD 11.3 mil as Stealth Gas offloaded a number of their smaller fully pressurised fleet to release capital to invest in larger tonnage 15YO and older VLGC and MGC values were supported by a number of transactions from Greek and Japanese sellers such as Naftomar and Nissen Kaiun to Chinese buyers such as Bocomm.

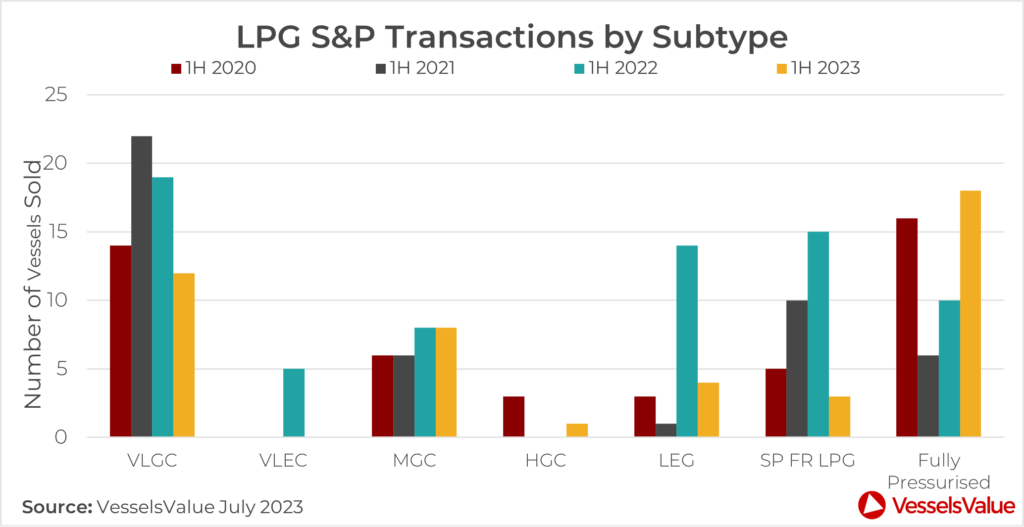

In the LPG sector, sale and purchase transactions focussed heavily on the Fully Pressurised category of 3,500 CBM with 18 sales reported, seven of which were StealthGas alone. At the other end of the LPG sector, VLGCs accounted for 12 of the sales c.26% during the first half of 2023. MCGS ranked third with c.17.4% and LEG’s came in fourth with c. 8.77%. Overall sales have fallen by c. 35% YoY from 71 sales in the 1H 2022 to 46 in 1H 2023.

Notable sales include:

- VLGC LPG Global Scorpio (80,529 CBM, Jul 2003, Hyundai Heavy Ind) sold SS/DD Due to an undisclosed buyer for USD 47.0 mil, VV Value USD 46.2 mil.

- FULLY PRESS LPG 719 (Hull) Sasaki (7,500 CBM, Jun 2023, Sasaki) sold to Global One Energy for USD 26 mil, VV Value 27.02 mil.

LNG

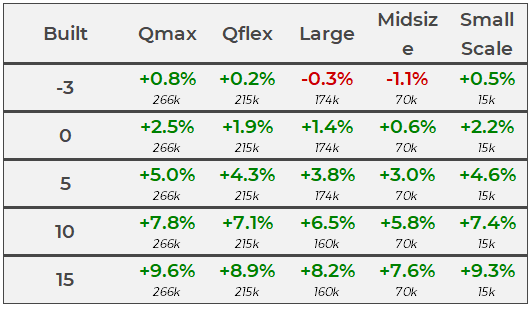

LNG earnings have remained above average and this has pushed up values for LNG vessels. Values have risen across all size ranges particularly modern tonnage where the percentages seem small, but relative increase is substantial. For example, 0YO 174,000 DWT Large LNG carriers have increased by c.1.4% and 5YO 174,000 DWT by c.3.8%. Older tonnage has also firmed for example 15YO Large LNG carriers of 160,000 CBM have increased from USD 104.39 mil to USD 112.99 mil. However, since the sale of the BW Everett (138,028 CBM, Jun 2003, Daewoo) values have softened as the market readjusts.

Notable sales include:

- LARGE LNG Gaslog Sydney and Gaslog Sarah (155,000 CBM, May 2013 & Dec 2014, Samsung) sold to China Development Bank for USD 248 mil in an en bloc deal with 5 years BBCB profit share. VV Value USD 347 mil.

- Large LNG Fuji LNG (147,895 CBM, Apr 2004, Kawasaki) sold for USD 78 mil to Golar LNG with a deductible 5 mil deposit. The unit has been reportedly acquired for conversion to Mk II FLNG and will be delivered in Q2 2023.

Conclusion

Bulkers have led the way for sale and purchase in the first half of this year with a focus smaller, versatile bulkers in the Supramax sector.

Demand for second hand Tankers has remained firm due to the continued popularity of older tonnage, values remained high overall with most categories around 15-year highs.

In the Gas sector, values for older LPG vessels have remained firm and values remained very firm overall despite some corrections in other sectors. In the LNG values continue to strengthen, having reached record peaks earlier this year.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment