Half year review – demolition

Overview

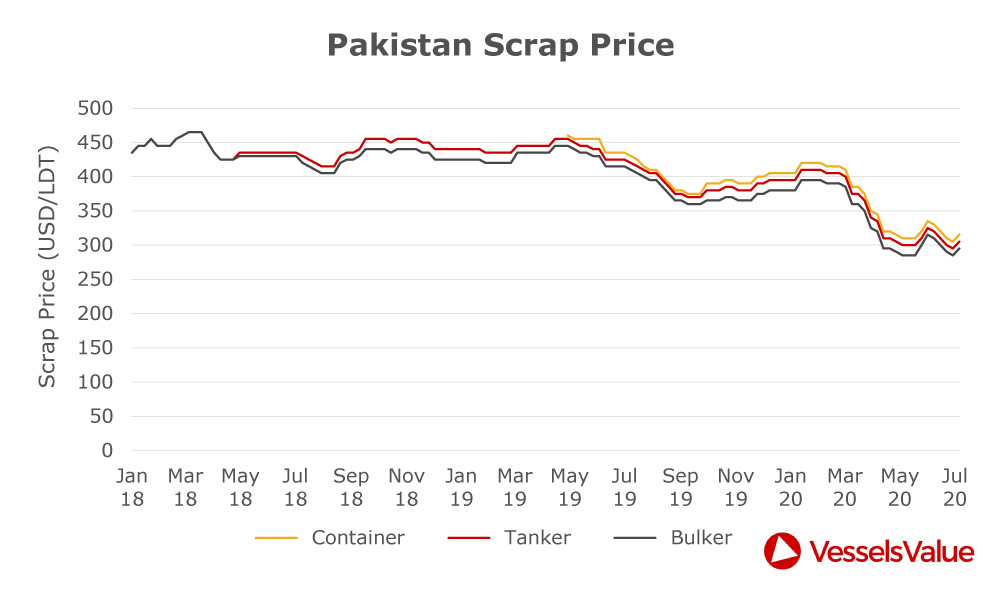

Heading into March 2020 the recycling market had made significant ground and was looking strong. However, the COVID-19 pandemic hit hard and fast, crashing local steel plate prices and forcing tight restrictions, which in turn, for the first time led to yard lockdowns.

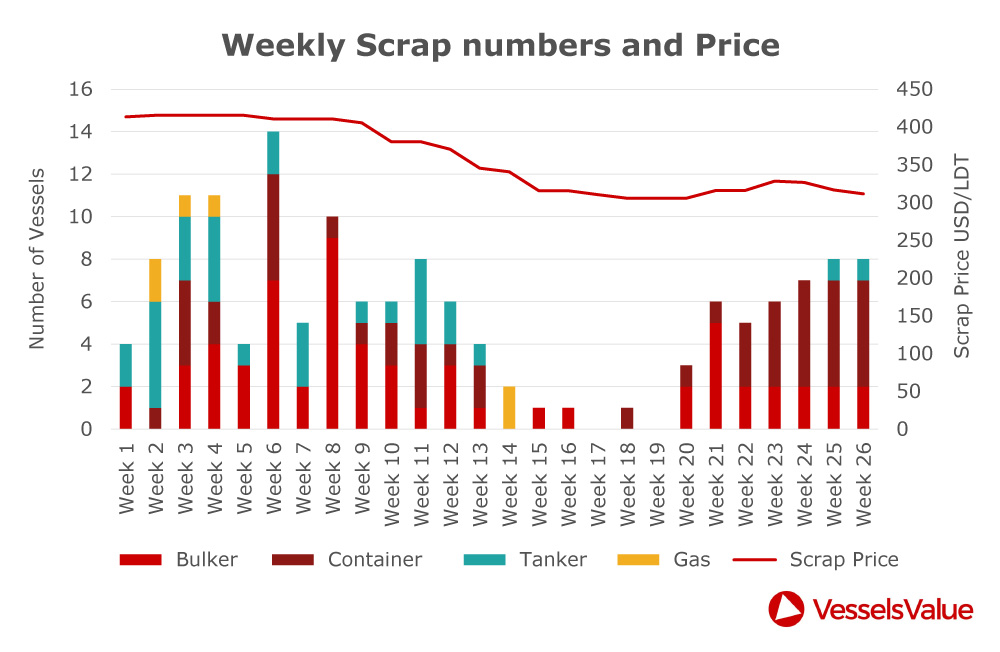

The first 8 weeks of 2020 saw 67 vessels scrapped, this slowly reduced over the next 6 weeks as COVID-19 restrictions were introduced. The lockdown effect on yards can really be seen during weeks 15-19. During this time average scrap price bottomed out at c.305 $/LDT. However, as lockdown restrictions eased, owner’s confidence and interest returned to the market. More tonnage headed to beakers yards and the scrap price experienced a slight recovery.

Scrappage by Type

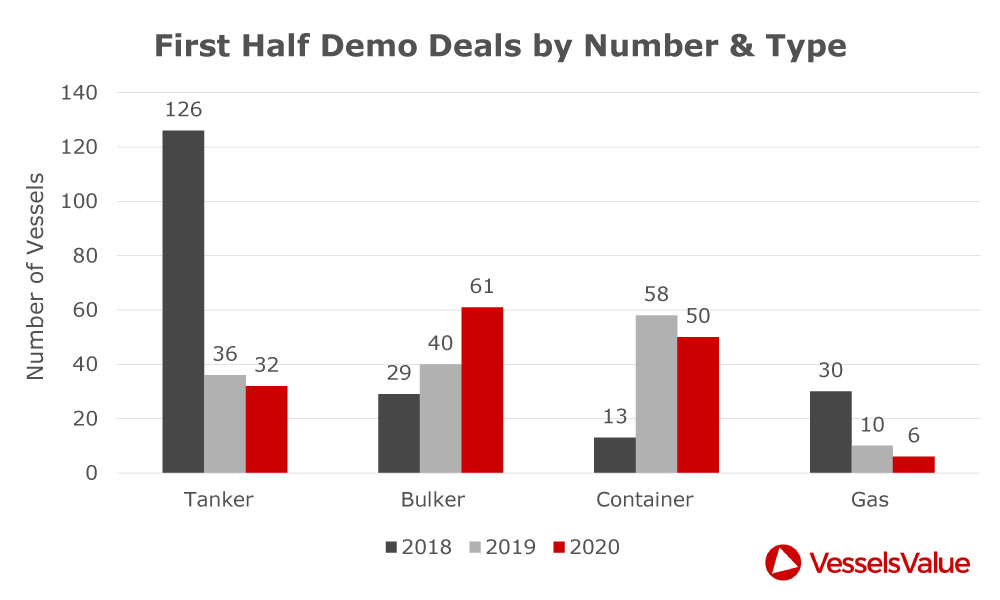

Figure 2 below shows that Bulkers were the most frequently scrapped vessel type during the 1st half of 2020. It was also the only sector to see growth from previous years, up c.50% from 2019 and up c.110% from 2018.

Container scrappage was down 8 units compared to 2019 but was up nearly 4 times compared to 2018.

Tanker scrapping figures remained fairly consistent with 2019, but still considerably less than the first half of 2018. The high volume of scrappage in 2018 was a direct result of low earnings and a high Tanker scrap price.

6 Gas vessels were scrapped in the first half of 2020, 4 less than last year.

Scrappage by Country

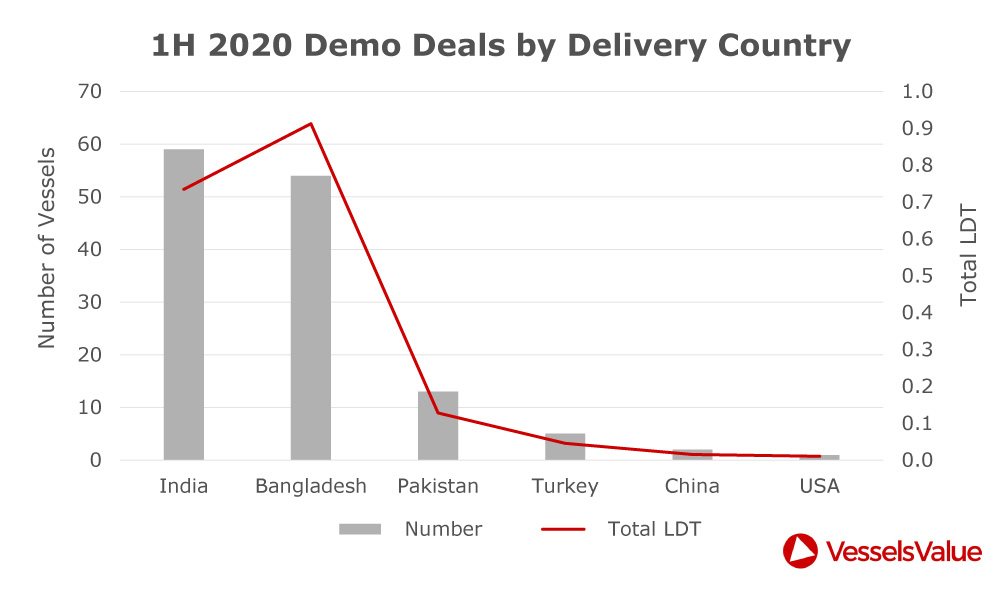

India takes the top spot by number of vessels, however, interestingly Bangladesh by total LDT. Figure 3 shows 59 vessels totalling an LDT of 735,000 were scrapped in India, compared to the 54 vessels totalling an LDT of 912,000 in Bangladesh.

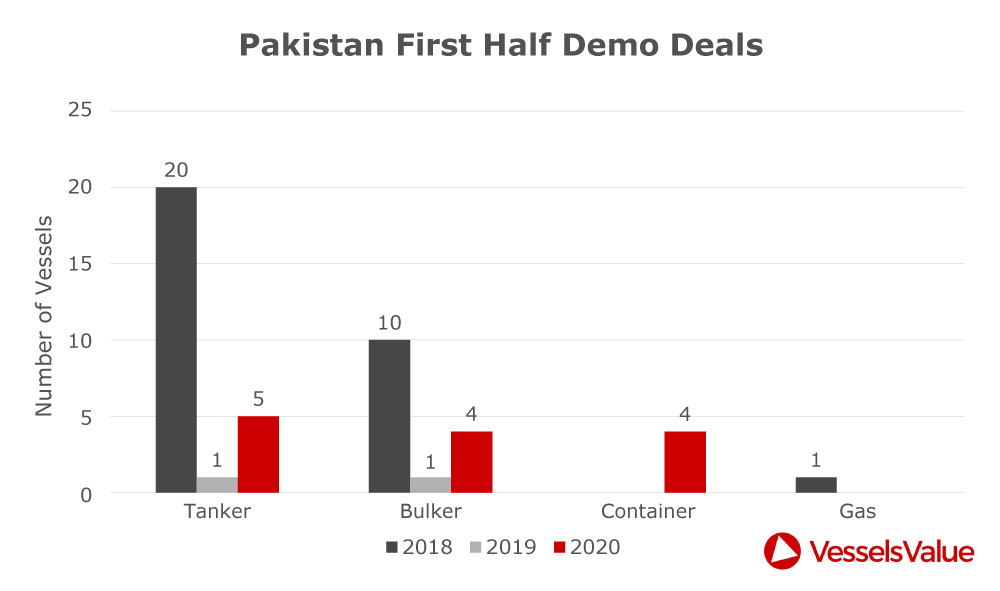

Pakistan saw 13 vessels sold for scrap, 5 from Greek ship owners and 4 from UAE owners.

Turkey only scrapped 5 vessels. A notable deal was the German built, Post Panamax Container, owned by APL which sold for a low 170 $/LDT, with an LDT of 24,098 the deal was worth just over 4 million US dollars.

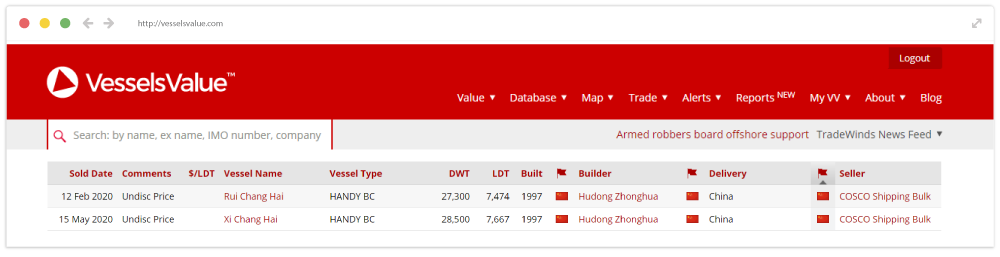

China took delivery of two COSCO owned Handy Bulkers, these are shown below.

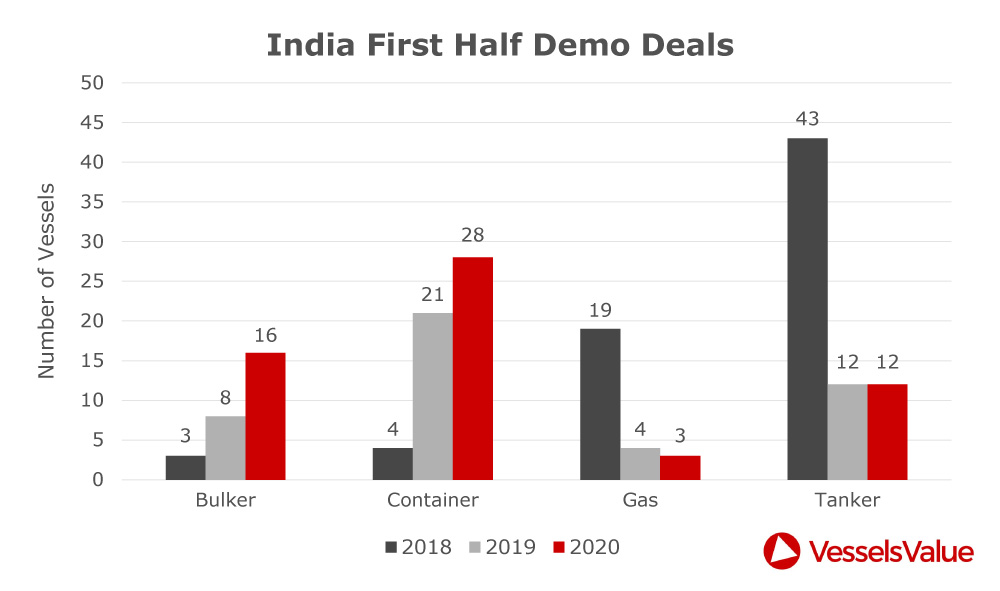

India

Alang breaking yards experienced an increase in number of Bulkers and Containers scrapped, compared to the same period of 2018 and 2019. Tanker numbers matched last year but were down significantly compared to 2018. Total LDT scrapped in India was up 34% from 547,795 to 734,878.

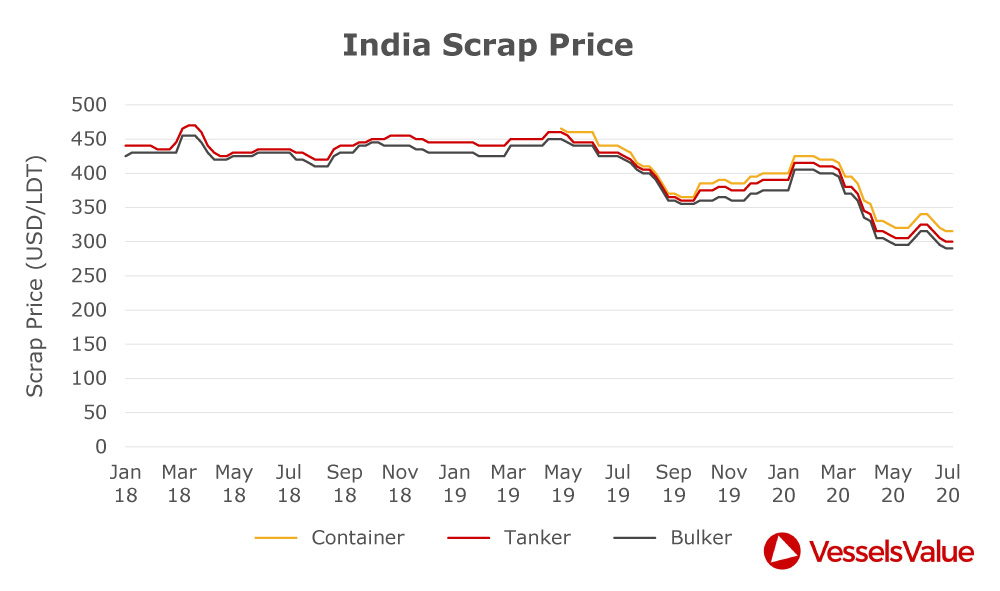

The Indian scrap price, like all sub-continent regions was affected heavily by the lockdown caused by COVID-19. Scrap price for Bulkers fell 27% to 295 $/LDT.

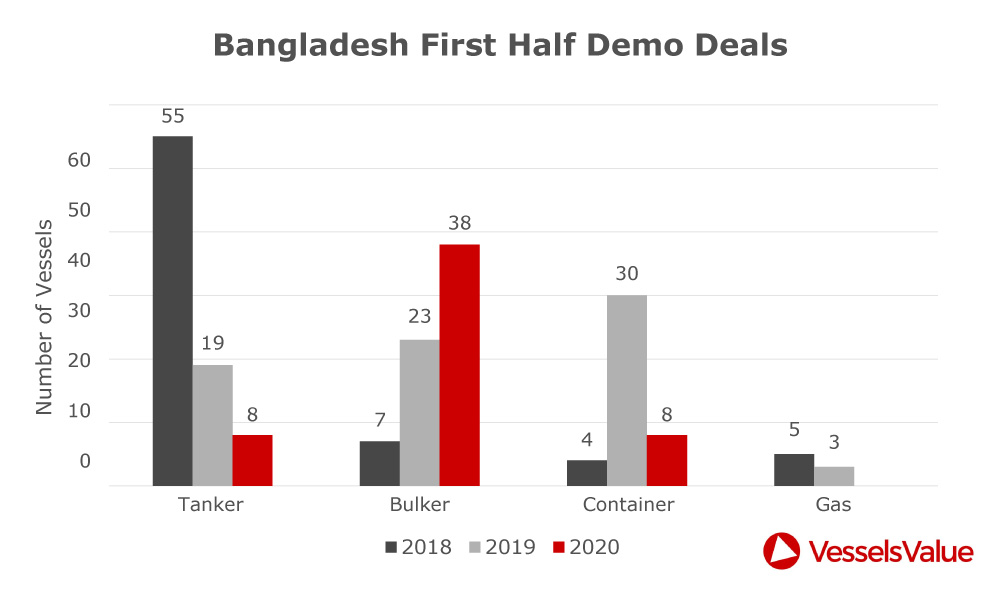

Bangladesh

Scrapping numbers were down across the board for Bangladesh, excluding Bulkers, which saw a 65% increase from the previous year. This rise in Bulker scrapping is a result of three owners offloading a large number of Capesize vessels pre COVID-19.

- Polaris Shipping scrapped 5x Capes (1,354,200 DWT) for a combined USD 55.4 million.

- Berge Bulk scrapped 4x Capes (939,500 DWT) for a combined USD 49.5 million.

- Cido Shipping scrapped 3x Capes (816,300 DWT) for a combined USD 37.4 million.

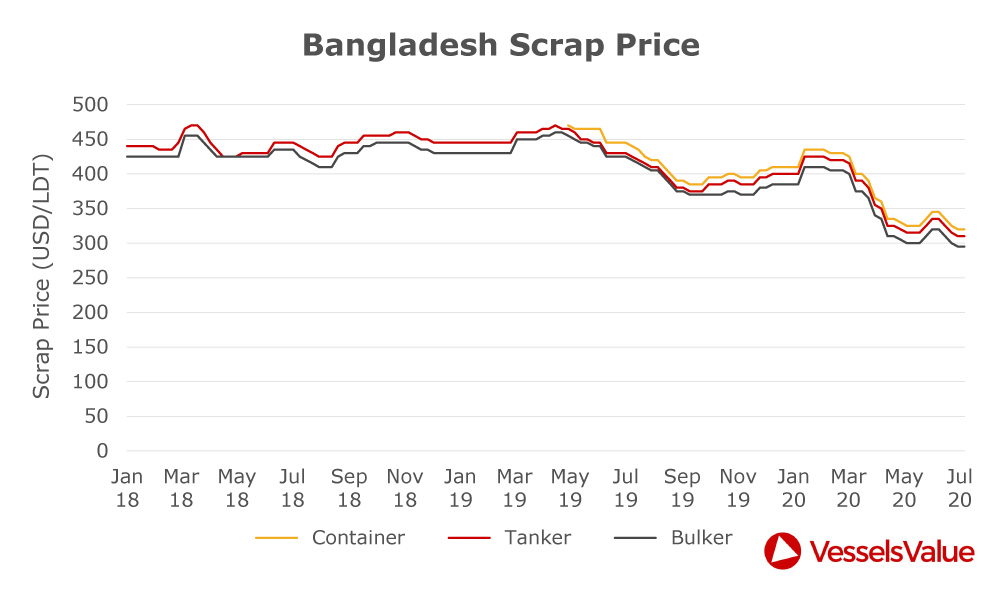

The first 3 weeks in May, saw the Bulker scrap price bottom out at 300 USD/LDT, Tankers at 315 USD/LDT and Containers 325 USD/LDT. Down significantly compared to prices in January.

Pakistan

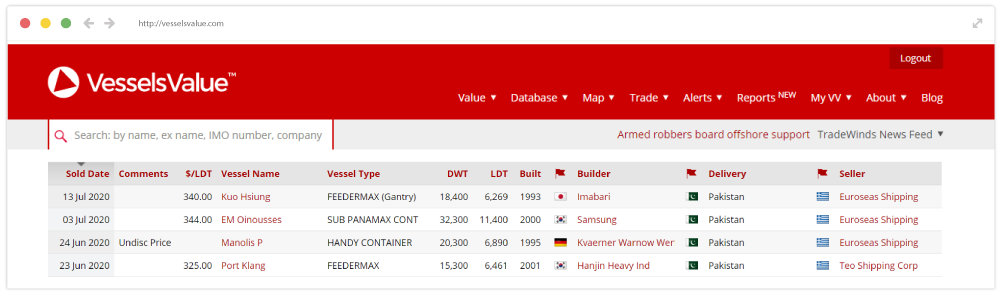

Pakistan scrapping numbers remained fairly consistent across all vessel types, excluding Gas. Most notably Pakistan broke its two year Container dry streak, receiving 4 containers for the first half of 2020. These are outlined below.

Pakistan also experienced the lowest scrap prices during the hight of the COVID-19 lockdown. Bulker scrap price fell to 285 USD/LDT and Tankers fell to 300 $/LDT levels.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment