Half year review: S&P and Values

Introduction

2021 to date has been one of the best years in recent memory for sale and purchase, with a rise in asset values experienced across most sectors.

A combination of pent up demand following the easing of global Covid-19 restrictions and low asset values at the beginning of the year has led to a dramatic increase in both the number of transactions seen and asset values across the board.

It is not just the secondhand market that has flourished, but also scrap values and newbuilding values that have also experienced strong improvements and show no signs of slowing down.

This half year review will analyse each asset class and attempt to add some further colour to the different factors that impacted changes seen during the first half of 2021.

Bulkers

At the beginning of 2021, 2007 blt Capesize Unique Carrier was sold for USD 11.5 mil. The same vessel is worth USD 20.4 mil today. It is a benchmark transaction as it was the last “cheap” Capesize to have been sold before both rates and buying sentiment took off, largely driven by increased demand from China as Covid-19 lockdowns eased.

In January 2021, Capesize rates (per day) were in the low teens and have risen over 50% reaching a peak of USD 44,000 in May before settling around USD 30,000 where they remain today. By contrast, in January 2020 during the first peak of Covid-19, they stood around USD 4,000.

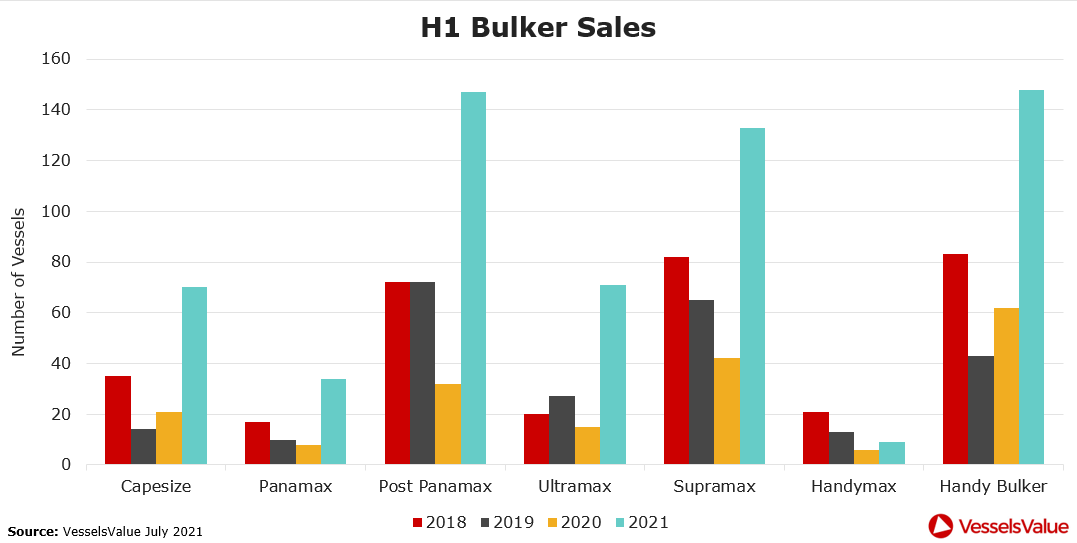

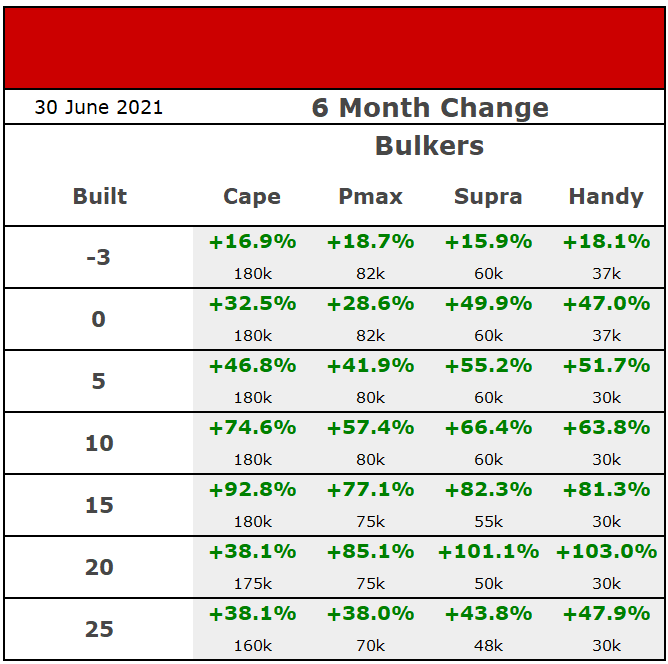

Year on year Capesize S&P transactions have increased by nearly 700% and the value of a 10 year old vessel has risen by 75%.

Demand from China remains strong with Chinese steel production continuing to increase this spring reaching a record high 99.5Mt in May 2021, (a ~14% growth over January to May compared to the same period in 2020).

Increased Chinese demand for other goods such as grain and soya beans has filtered down into the smaller sizes resulting in asset values increasing across the board. Since January 2021, 10 year old Panamax and Supramax values have increased over 60%.

In January 2021, 2006 blt Panamax CMB Sakura was sold to China for USD 7.8 mil. The same vessel is worth USD 15.8 mil today and is capable of earning USD 35,000 per day on the spot market.

January 2021 also saw 2017 blt Ultramax SBI Libra sold to Greek buyers Kassian for USD 18.65 mil. She is now worth USD 26.8 mil, an increase of almost 45%.

Newbuilding prices rose as shipyard demand increased, but also due to continuing increase in steel plate prices and sentiment as we hopefully reach the last stages of the pandemic.

Tankers

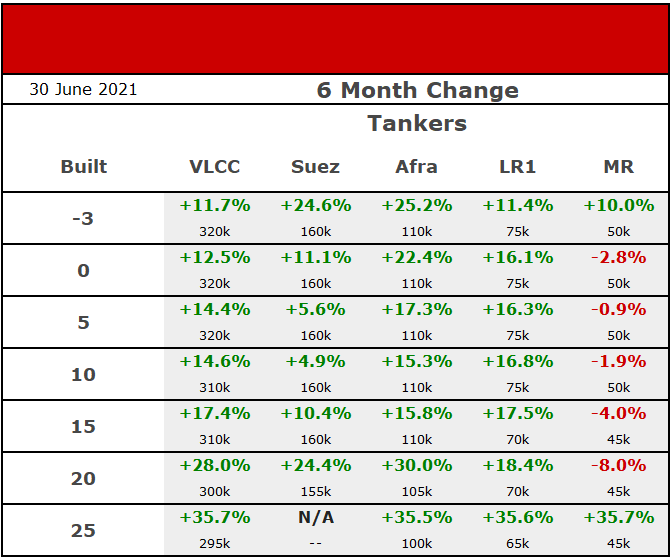

Tanker values have risen across the board since January however rates remain near record lows largely due to tonnage oversupply. Older vessels have seen the biggest increase with values of 20 year old VLCCs having risen just under 30%.

This is partly due to a large increase in scrap metal prices that have increased from USD 400 per ldt to USD 600 per ldt since January, their highest level in over 10 years.

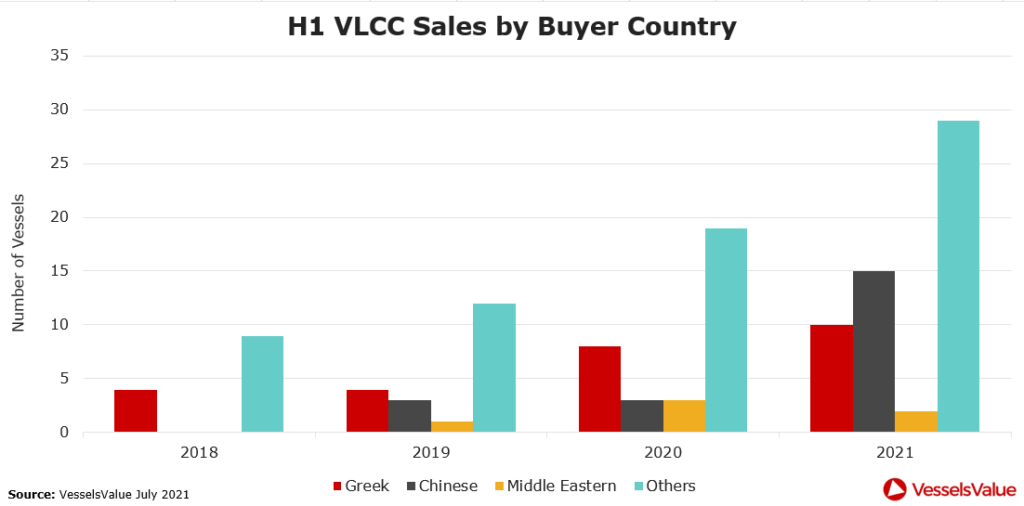

1999 blt VLCC Sino Macro was sold for further trading in early January for USD 20.5 mil. Her scrap value today has risen to USD 24.3 mil. Another major contributing factor for the increase in asset values has been the introduction of Middle Eastern and Chinese buyers who have been acquiring tonnage to use on trade routes that are otherwise sanctioned for most other market participants.

32% of all VLCC transactions this year have been purchased by Chinese or Middle Eastern counterparties.

Modern vessels have enjoyed an uplift in value due in part to rising replacement costs but also due to anticipation that the market will recover and the desire by owners and public companies to be positioned with fuel efficient modern ships if, or when, it does.

In May 2021, ADNOC paid USD 85 mil for Chinese blt resale VLCC CS Venture. 4 months later the vessel is worth USD 91 mil.

Aframax values have fared well, again largely driven by sentiment and the hope of a speedy recovery on the back of a sustained higher oil price.

In January 2021, 14 year old Esteem Brilliance was sold at USD 12.8 mil to Avin International of Greece. She is worth an excess of USD 16 mil today.

Resale tonnage however has fared the best with asset prices having firmed c. 22% from USD 42 mil in January 2021 to USD 52 mil today.

Containers

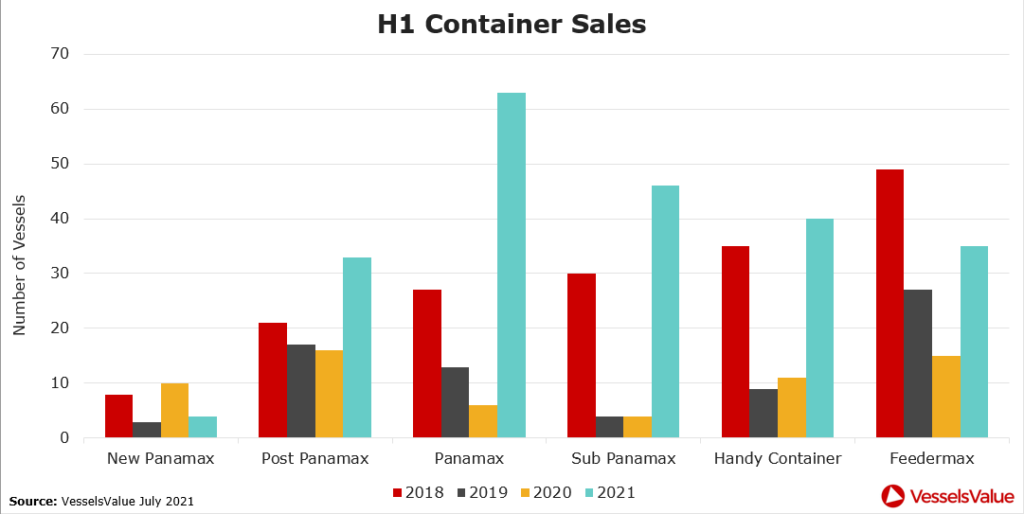

On the contrary to the newbuild orders, we’ve seen a significant increase in activity in the Panamax Container market. The number of sales are up 780% for year to date 2021 compared to year to date 2020.

Recent acquisitions where new entrants are paying more than USD 100,000 pd for a short term fixture of between 65-80 days has meant Owners like MSC have been buying vessels instead of entering the charter market as it works out more cost effective. For example, the Mexico (4,839 TEU, Feb 2002, Hyundai HI) sold for USD 50.5 mil to MSC at the end of June. The alternative would be to take a vessel on a five year charter which could cost up to USD 70 mil.

Another benchmark sale confirmed earlier in June was the Kowloon Bay (4,992 TEU, Jul 2004, Hyundai HI) also bought by MSC for USD 42.5 mil. She was bought 2 weeks earlier than the Mexico for USD 8 mil less.

These sales have shown how the Panamax Container market is setting new benchmarks each week.

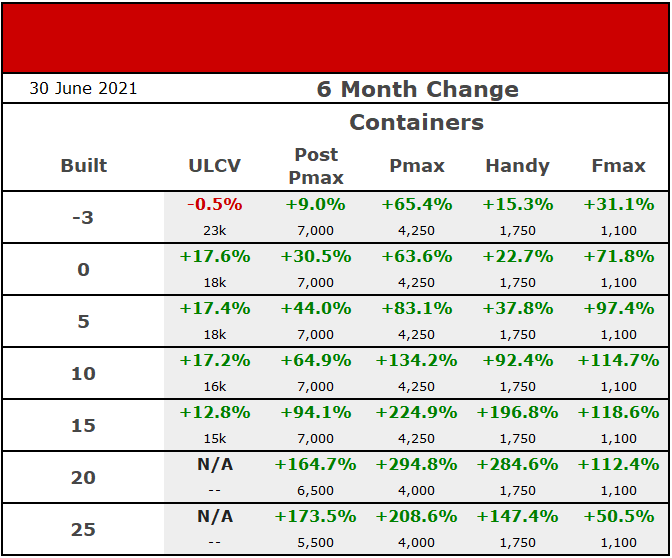

With the ever firming rates across the Container sector, we have seen a surge in values. Increased US imports, port congestions and a shortage of capacity is pushing freight rates to record levels on key routes from China to the US and Europe. A secondary outbreak of Covid-19 in Southern China has prompted even more delays and congestion across ports which has tightened supply.

As a result of the increased S&P market and rates, the Panamaxes (4,250 TEU) have benefitted the most from increased values. For example, 15 YO 4,250 TEU tonnage has doubled in value in just 3 months. At the end of March a generic 15 YO Panamax was worth USD 20 mil, today she would be worth USD 40 mil.

Vehicle Carriers

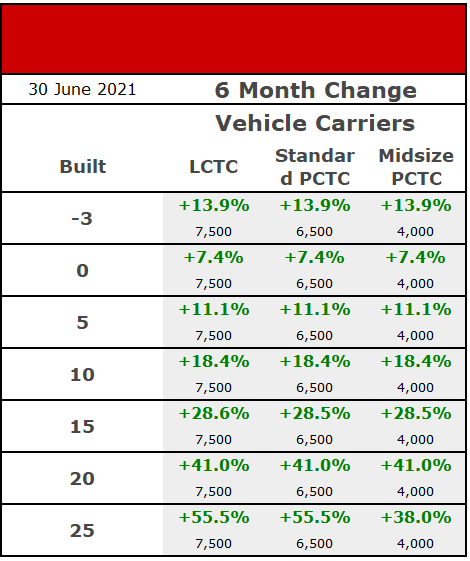

Interest in second hand PCTC tonnage came to the boil in the second quarter as operators planned for a strong demand market underserved by supply. A low orderbook and near record high scrapping activity in 2020 laid solid foundations, driven by underlying demand for cars from consumers with pent up savings.

Sellers became more selective holding out for increased counteroffers. 22 year old Perseus Liberty (6,400 CEU, Jan 1999, Imabari) was purchased by Doriko for USD 13.8 mil after an initial USD 12 mil offer was rejected. The Glovis Companion (6340 CEU, Feb 2010, Mitsubishi HI) was sold by its Norwegian owners to Korean buyers in the low USD 30 mil range (VV at USD 29.53 mil). Total straight sales grossed USD 129 mil based on 7 vessels, up 34% vs 2019.

Earnings firmed from a lack of available tonnage, increasing 14% from April based on a PCTC 6,500 CEU 1 year time charter. A midsize 4000 CEU unit was fixed between USD 16-17,000 per day in early May, up USD 2,000 per day versus the April average. Newbuild yard tariffs increased adjusting to rising steel prices, and increased competition for yard slots feeding into values. Dual fuel 6090/7050 CEU orders placed by NYK, SFL Corporation and Eastern Pacific suggest a USD 5-10 mil premium (vs 2020), subject to shipyard and order dates.

Values for hotly contested 10 to 15 year old 4000 – 6500 PCTCs increased by 18% and 29%. Mid term fundamentals for the Car Carrier market look rosy with auto analysts forecasting stronger demand from EVs (Electric Vehicles). Further upside for asset values is likely.

RoRo

Freight demand for shortsea RoRos was stronger than expected in the first three months of 2021, partly due to a fast recovery from the Brexit transition, higher than expected earnings in the Med, and increased cargo volumes in the Baltic supporting a recovery in values. Heavyweight’s Cobelfret and DFDS concluded a swap plus cash deal for the Meleq (4076 LM, Apr 2017, FSG) and Gothia Seaways (2475 LM, Oct 2000, Flender Werft) in April.

The Meleq was purchased by Cobelfret in January 2020 for USD 50 mil and had a VV value of USD 43 mil at the time of sale, now trading as the Acacia Seaways. The Gothica Seaways valued at EUR 9 mil, renamed the Maxine by new owners Cobelfret. In March, the Undine (1604 LM, Dec 1991, Dalian) was sold in the mid to low EUR 2 mil range (VV at EUR 2.17 mil day before sale). Sales activity kept low and was generally limited to smaller vintage RoRos. A total of 7 sales were concluded for USD 80 mil (EUR 68 mil). Values appreciated moderately across the board, with 5 year olds and 10 year olds increasing by 6.6% and 7% respectively.

On the earnings side, the Alf Pollak (4076 LM, Oct 2018, FSG) was fixed in the range of EUR 17,000 – 20,000 per day in late April, a EUR 4,000 per day premium versus her sister of similar age extended only four months previous. Time charter rates for midsize 3500-4000 LM RoRos increased by 23% from April to June, as interest in secondhand tonnage firmed in preparation for a stronger second half to the year.

Further support for values came from a higher steel price, increasing newbuild tariffs. Grimaldi ordered 6 x 4700 LM ConRos from Hyundai Mipo in February for USD 86 mil per vessel. This now looks like a good bit of business for the Neapolitan group.

Offshore

Platform Supply Vessels

During the first half of 2021 we saw a large proportion of non-core/non-competitive PSV tonnage transacted. Prior to 2021 the top seller of this type of tonnage was Tidewater Marine, selling 11 vessels on the secondhand market and 33 for demolition since 2018. However, Covid-19 forced significant financial pressure on already struggling European owners, particularly Norwegians.

As a result, banks and financiers had no choice but to intervene. In May 2020 Solstad Offshore was the largest of the Norwegian owners to undergo financial restructuring and as part of the agreement, the OSV owner earmarked 37 vessels (across all OSV types) to be sold. So far, they have made good progress, Figure 8 outlines the Solstad PSVs sold over the last 6 months.

Older PSV values remained stable over the last 6 months, the sales in figure 8 had little effect on asset values as all were sold laid up and SS/DD overdue and the VV value was at a level to take this extra expenditure into account.

At the other end of the age spectrum, only four modern vessels (0-6 years old) have sold over the last six months. The most notable was the Standard Olympus 4,000 dwt blt 2014 Havyard Leirvik which sold for USD 7.50 mil. VV value USD 11.48 mil. Standard Drilling originally purchased the vessel in 2019 at a court admiralty auction for USD 8.1 mil. Market rumours suggested that Standard Drilling sold the vessel out of the oil and gas market and were looking to exit their investment quickly, as they had a renewables project that needed urgent funding. The sale of the Standard Olympus caused a softening in modern PSV values.

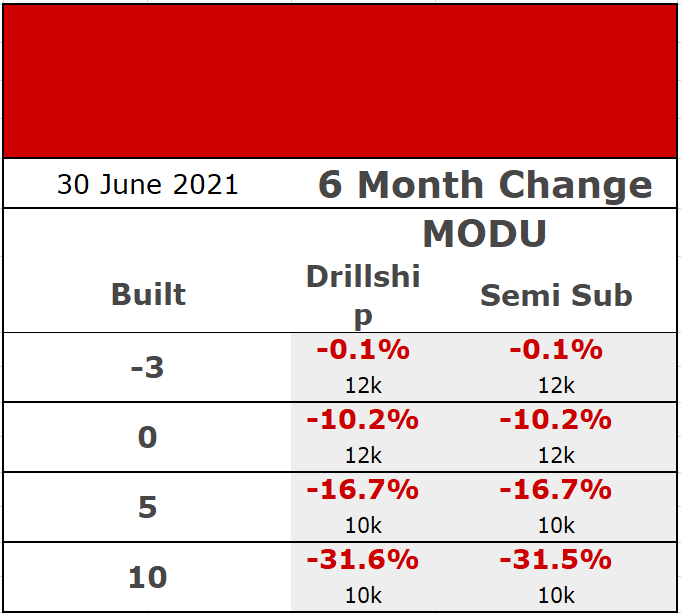

Mobile Offshore Drilling Unites: Drillships and semisubmersibles (Floaters)

The floater sector, in general, has been under significant pressure due to Covid-19. Asset values have been hit hard by the large number of modern floaters (2009-2015) sold for demolition levels (discussed in ‘offshore demolition’ post).

The sale of modern assets for demolition levels has inevitably filtered through to the secondhand market and subsequently secondhand values. This was illustrated by the only transaction during the period, the ultra deep water Drillship Bolette Dolphin 10,000 ft blt 2014 Hyundai Heavy Ind.

The Bolette Dolphin sold for USD 65 mil to Deep Value Driller (Norway) SS/DD due, VV value day before sale USD 88.2 mil. This sale caused further softening across all ages of floaters. Figure 9 shows the value decrease for modern Drillships and Semisubmersibles between Jan 2021 and June 2021. The Bolette Dolphins value today is USD 65.83 mil.

Conclusion

A stark contrast to what was seen in 2020, the shipping market in 2021 seems to be very much in comeback mode with both private owners and public companies either capitalising by selling their previous well timed acquisitions or using positive market momentum to rapidly expand their fleets.

As we entered 2021, the Bulker market led the way with strong demand for Dry Bulk materials predominantly being driven by China. This seemingly insatiable appetite resulted in demand outweighing the supply of tonnage and caused a mini boom in dry rates the likes of which for the sub Capesize asset classes we have not seen in over 10 years.

It is the Container market however that emerged as the biggest success story for 2021 so far with asset values and rates for all sectors now at record highs and still going.

VesselsValue data as of July 2021

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?