Half year review – vessel values and S&P activity

Bulkers

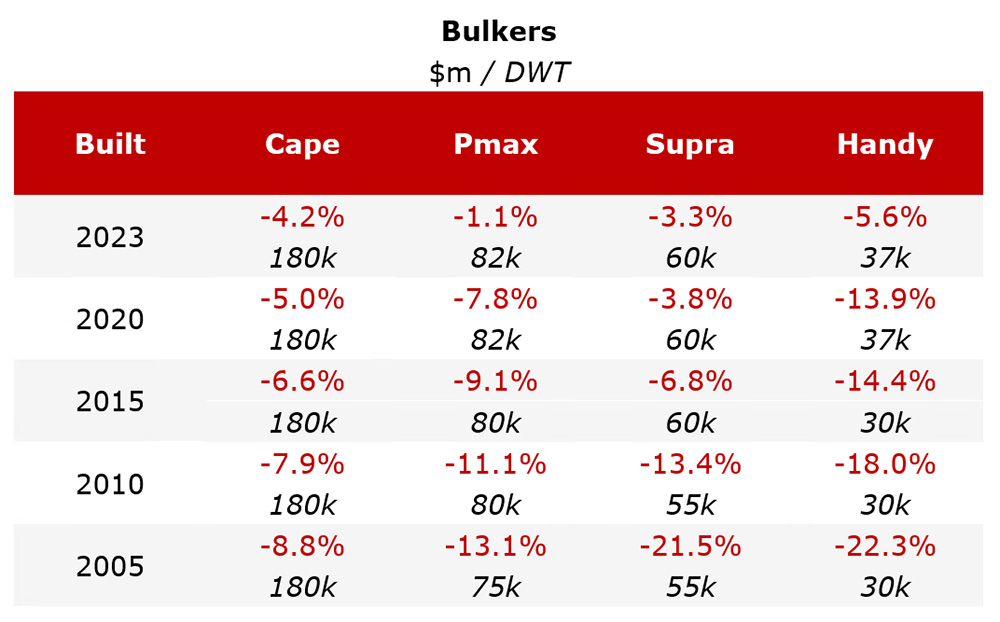

Value Analysis

The COVID-19 pandemic has had a dramatic effect on the Bulker sector causing a deterioration in rates, values and number of second-hand transactions.

Capesize Bulkers have been the worst affected, primarily as China is the major epicentre of Capesize trade. In the early part of the year, imports into China were near historical lows and Capesize rates were at c. USD 2,000/ 3,000 a day, well below OPEX.

In terms of values, at the start of 2020 a VesselsValue generic 10-year-old Capesize was valued at USD 20.5 mil, by March this had fallen to USD 17.5 mil.

In the second-hand transaction market, we saw Capesize vessels Lancelot (177,000 DWT, 2010, New Times) and Percival (178,100 DWT, 2010, New Times) sold for USD 16.5 mil each to Chinese buyers. 3 months previous these vessels were valued at USD 18.9 and USD 19.4, respectively.

However, as we progressed into May, many global restrictions began to ease and the main Capesize trade route of Brazil to China reopened. This led to a surge in demand, and rates increased over 140% percent from May to June. This increase had a recent positive effect on values.

We have also seen this positivity filter down into smaller sizes, for example, to Panamaxes

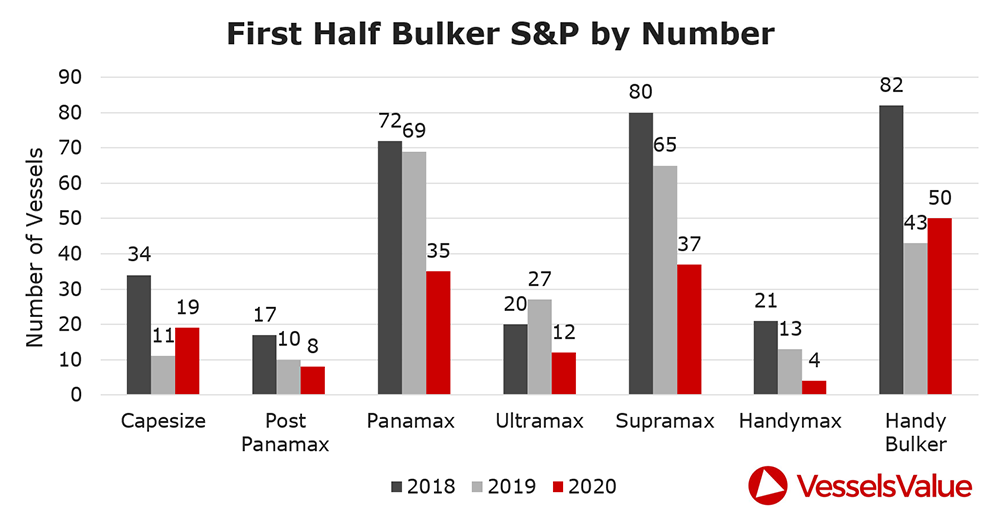

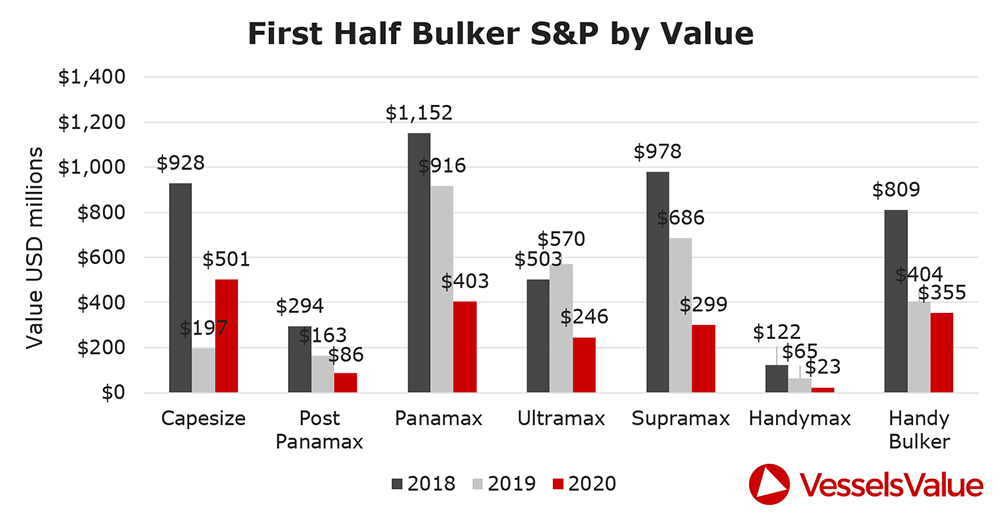

S&P Activity

Total Bulker sales are down 31% and 49% compared to the first half of 2019 and 2018, respectively.

Total spending for the first half of 2020 was USD 1.9bn, down 60% compared to the USD 4.8bn spent in the first half of 2018.

Capesize sales were up by number and by spending compared to 2019 with most of the deals occurring in June, after the surge in rates due to the Brazil/China trade route.

The largest Bulker deal of the half year goes to Oldendorff Carriers, spending a reported USD 212.76m on three Capesize Bulkers in June. The Trust Integrity, Agility (180,600 DWT, 2011, STX) and Amity (209,300 DWT, 2016, Jiangsu Yangzi). The deal includes a long term affreightment for the transportation of coal to India.

Tankers

Value Analysis

In contrast to Bulkers, the Tanker sector had a strong first half of 2020 with the major publicly listed Tanker companies all posting record results.

COVID-19 caused a global decrease in oil demand, while geopolitical tensions between major oil producing countries kept production high. With supply heavily outstripping demand, land-based oil storage began to reach maximum capacity.

This caused a surge in requirement for floating storage, which consequently caused spot rates of Tankers to increase to levels not seen since before 2008.

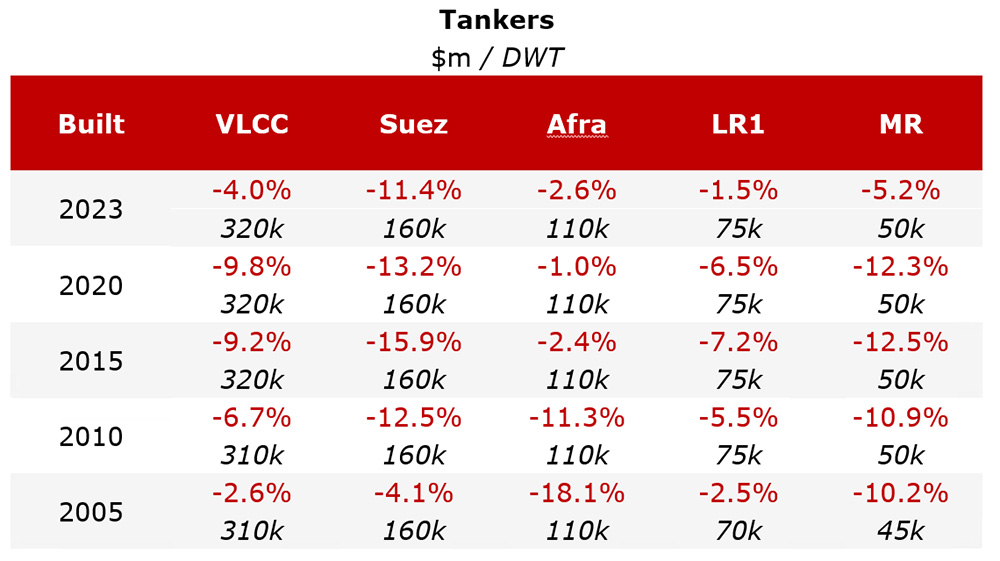

In terms of values, Tankers benefitted heavily from COVID-19. At the start of January, a VesselsValue generic 15-year-old VLCC was valued at USD 34 mil and by the end of April this figure had increased to USD 40 mil.

Even during the global pandemic, a high number of second-hand transactions took place, and sellers with prompt tonnage were able to take advantage of firming market values. An example of this occurred in April, the TI Hellas (319,300 DWT, 2005, Hyundai Samho) sold for USD 38.1 mil from Euronav to Altomare Greece. At the start of January, it was valued at USD 33.9 mil.

However, as COVID-19 began to loosen its grip on the world, oil demand and oil price began to increase. The number of vessels required for floating storage decreased and as a result, rates and asset values decreased significantly.

The TI Hellas is today valued at USD 34 mil, similar to its pre COVID-19 value.

S&P Activity

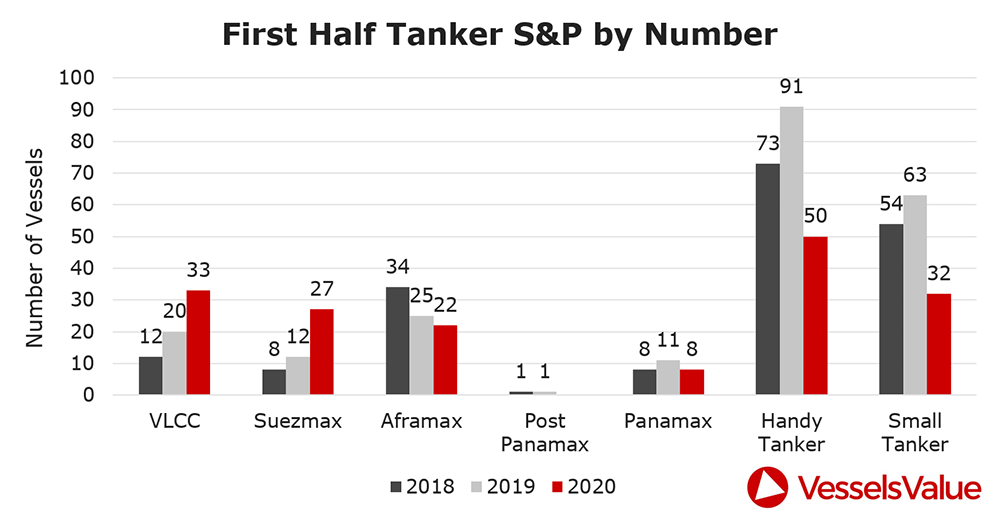

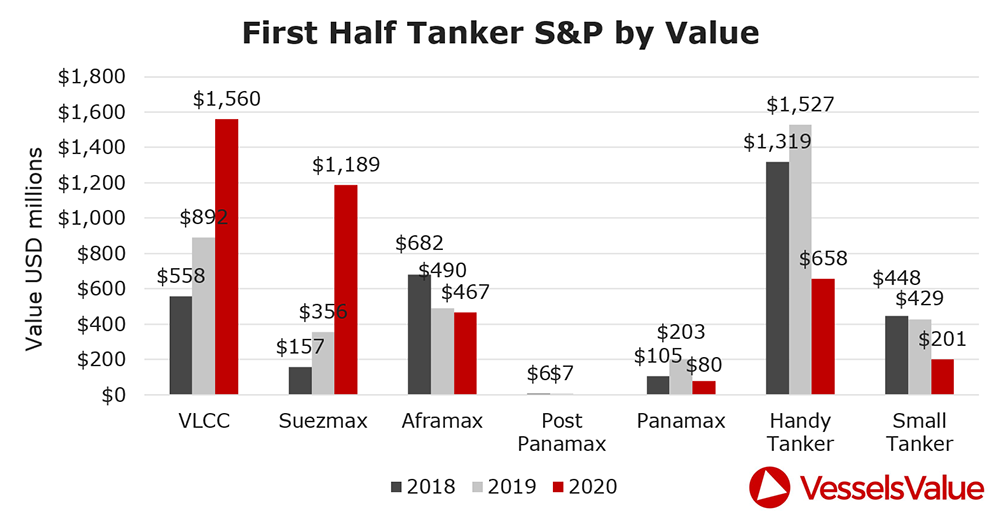

Sales of large Tankers are up, with VLCC and Suezmax sales up 50% and 125% respectively compared to the first half of 2019. Smaller tankers have seen a quiet first half of the year, with sales of Small and Handy Tankers down 47% vs 2019 and 35% vs 2018.

Total spending for the first half of 2020 was USD 4.1bn, up 5% compared to the USD 3.9bn spent in the first half of 2018. VLCC sales saw the biggest spend due to need for floating storage, the majority of tonnage sold so far this year has been ages between 15-20 years old.

In February, Euronav reported spending USD 187m on two VLCC resales from Sinokor, Hull 5474 and 5475 (300,200 DWT, 2020/1, Daewoo). They followed this up buying a third VLCC resale Hull 5476 (300,200 DWT, 2021, Daewoo) as part of a separate deal, again from Sinokor for USD 92.25m in March.

Containers

Value Analysis

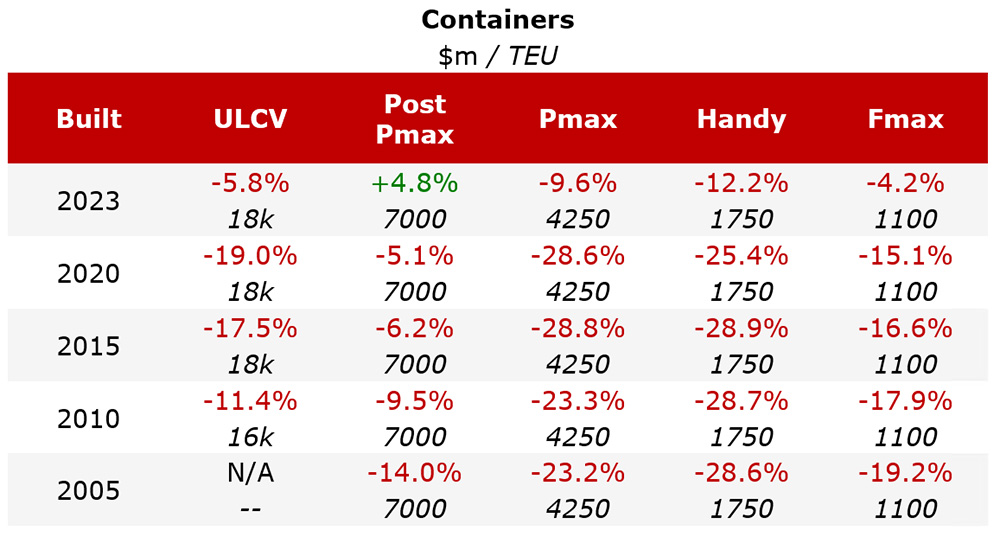

The Container sector has been hit hard by the COVID-19 pandemic.

On the demand side – with the world in a state of imposed quarantine, all consumer driven businesses ceased, consumer confidence reduced to an all-time low and household spending declined significantly.

On the supply side – a collapse in box cargo volumes and a large amount of blanked sailings decreased rates. Larger Containers rates fell c.60% from midFebruary through to June. Smaller Panamax rates fell c.40% and the Handysize vessels fell c.30%.

In terms of asset values, smaller/older Handysize sector were the worst effected with a decrease of c.25%.

Looking forward to the second half of 2020, as more and more countries come out of lockdown and demand for consumer goods increase, we expect to see an increase in both rates and values.

S&P Activity

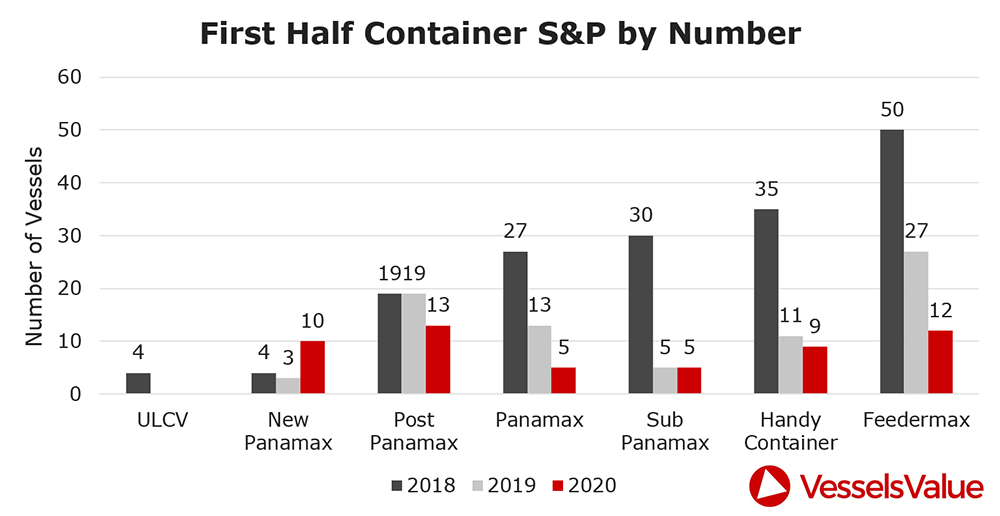

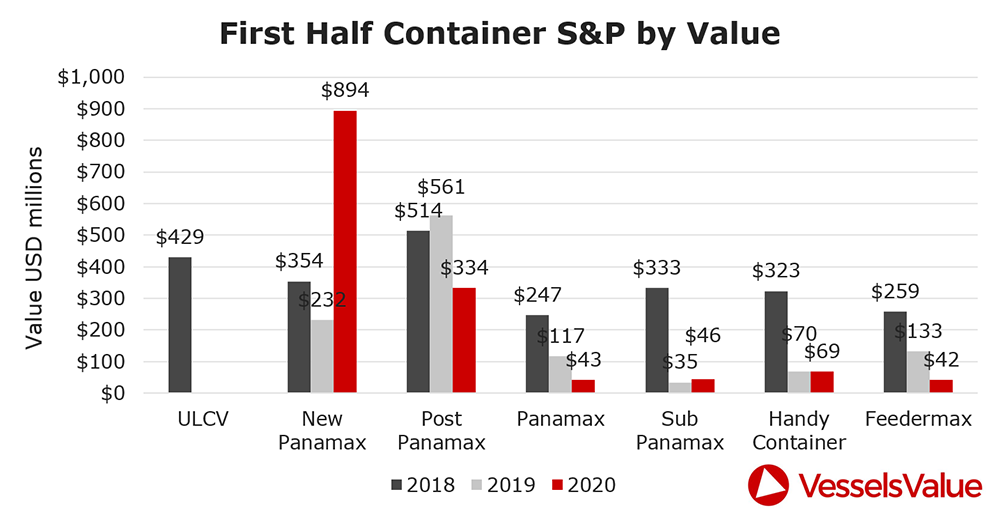

As a result of the uncertain market activity, deals have also been low in the smaller tonnage compared to 2019 YTD and 2018 YTD.

Although the total number of sales for the first half of 2020 is down by 30%, due to transactions of larger more expensive tonnage, total USD is up c.24% with USD 1.4 bn being spent.

Early in February, PIL sold 4 x 11,923 TEU vessels built between 2017-2018 at Jiangsu Yangzi to Seaspan for an en bloc price of USD 367 mil, the deal included a long term charter but with no price disclosed.

Later in March, Seaspan then bare boat backed (BBB) the same vessels to BoComm in a sale and leaseback deal, which included a purchase obligation with back to back delivery.

As rates began to fall, sales slowed down. A total of 6 vessels were sold in April, May and June, 3 of which were auction/bank driven sales.

LPG

Value Analysis

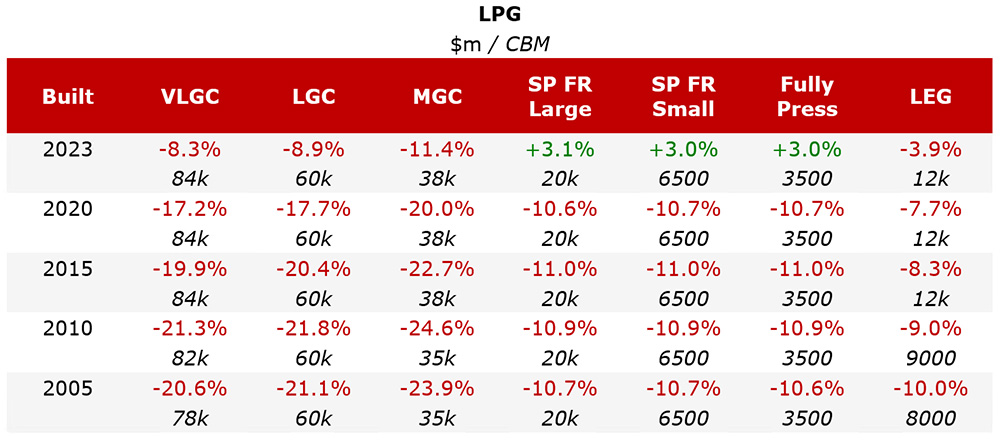

Rates tumbled throughout June as we saw lower US LPG export volumes driven by cutbacks in oil production. 1-year time charter rates for large LPG carriers fell over 50% through the first half of this year, in the wake of the COVID-19 pandemic.

When oil prices collapsed in March, the price of naphtha decreased. This led to a reduction in demand for LPG in ethylene production because crackers switched to the low-priced naphtha.

This put a lot of pressure on spot rates, which dropped by c.60% between the beginning of May and end of June 2020.

Values have fallen as a result, with the older fully refrigerated vessels dropping by c.20% in value from USD 28 mil in January to USD 22 mil today.

S&P Activity

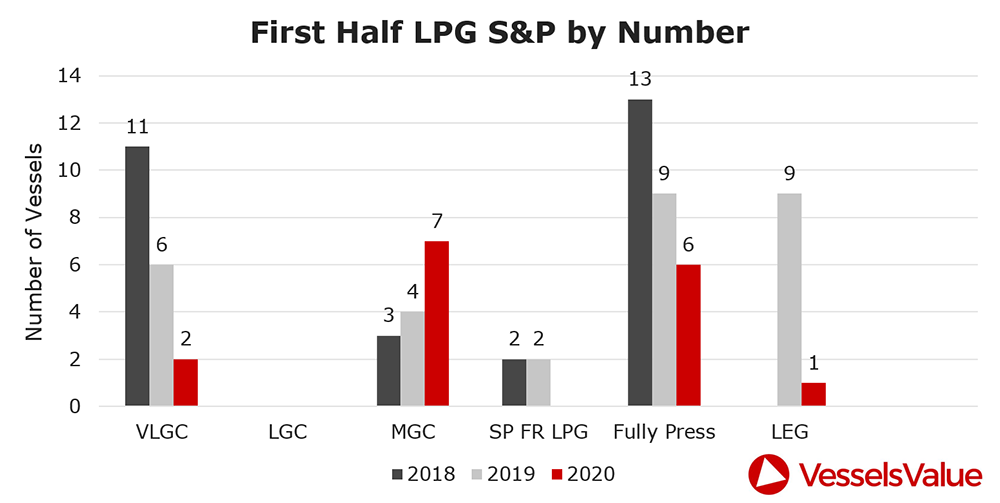

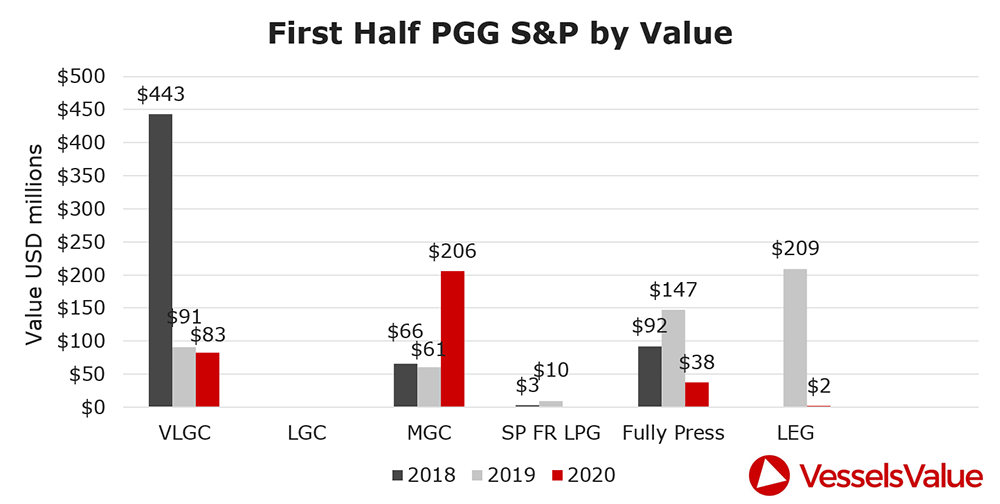

Due to the uncertainty in the market, the total number of deals that have taken place in the first half of 2020 are down 50% compared to the first half of 2019.

Total spending is only down c.36% due to the en bloc deal of the 3 MGC carriers from Hartmann to StealthGas earlier in January.

The vessels included the Gaschem Stade, Hamburg and Bremen (35,193 CBM, 2010, Hyundai Mipo) which were sold in a bank sale for USD 27 mil each, VV value day before sale USD 31.54, 31.77 and 31.25 mil respectively. June only saw one deal with BW selling its oldest vessel in its fleet, the Berge Summit (78,488 CBM, 1990, Mitsubishi) to an undisclosed buyer for USD 11 mil but the vessel is SS due.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?