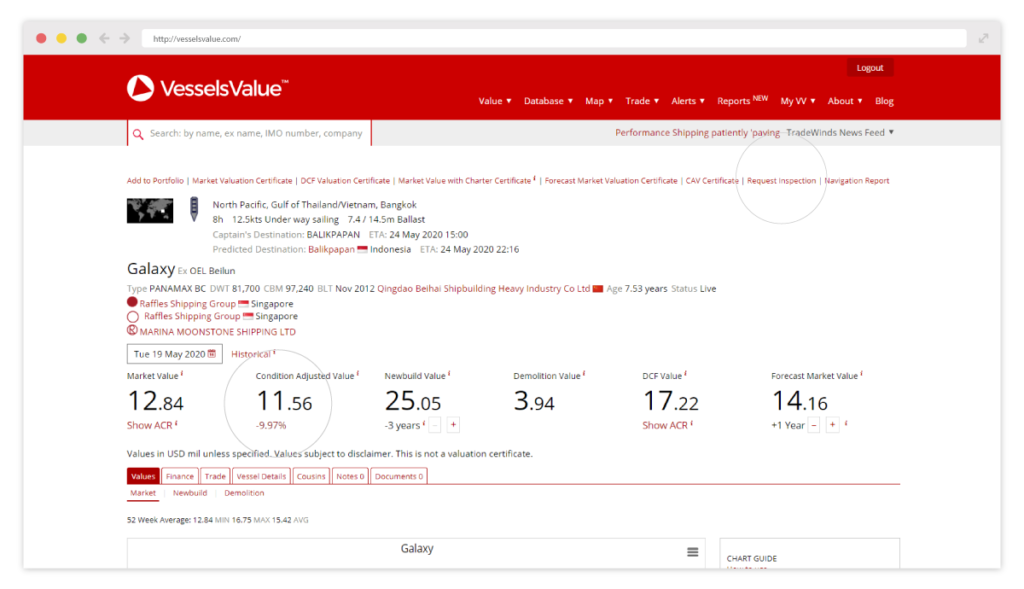

Introducing Condition Adjusted Value

We’re excited to announce the launch of automated Condition Adjusted Values (CAV), the next generation of automated vessel valuations, in partnership with Idwal Marine.

CAV combines a vessel’s actual condition with algorithmically derived market values to now account for a vessel’s physical condition; a first for the maritime industry.

Tom Evans, Director explains that “CAV will assist stakeholders to get value for the additional time, effort and expense of maintaining quality fleets; an effort that we see rewarded in transactions but not in valuations currently”.

Unique Idwal vessel grading data is fed into the VV algorithms to produce daily automated Condition Adjusted Values.

Any method of asset valuation requires assumptions. Desktop valuations commonly assume a vessel is in fair condition with all relevant Class, Flag and certificate requirements in place. This new value enables users to gain greater granularity and move beyond assumptions that all vessels are in a fair condition.

Idwal Managing Director Nick Owens said “We’re thrilled to enter a partnership with VesselsValue to bring Condition Adjusted Values to the industry. Through the combination of Idwal’s latest grading data, users now have greater visibility into a ship’s true value. This is just one of the ways Idwal is bringing inspection data back to the industry to help it make smarter decisions”.

Benefits

- Get ahead of your competitors with the only automated Condition Adjusted Value

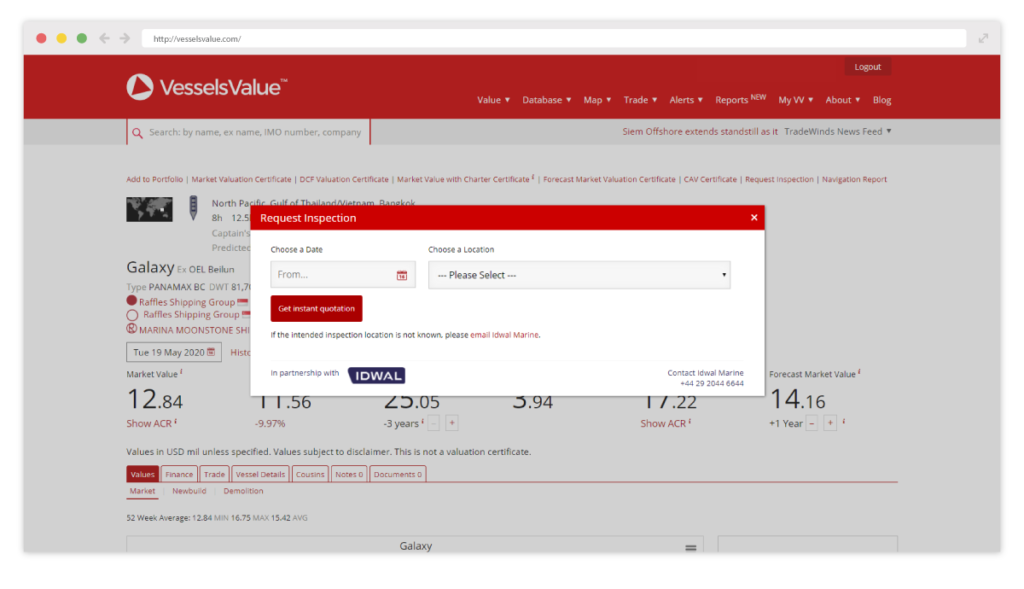

- Request an Idwal Condition Inspection on vessels of interest

- Speed up your decision making processes

Features

- Daily updated automated Condition Adjusted Value

- Compare Condition Adjusted Values and Market Values for specific vessels

- Receive instant quotations for an Idwal Condition Inspection

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?

Comments

Leave a Comment