Bulker Market Resilient After Lunar New Year

As stakeholders navigated numerous variables over the start to 2024, including global economics and shipping route disruptions, the Bulker market remains dynamic and responsive to evolving trends and challenges.

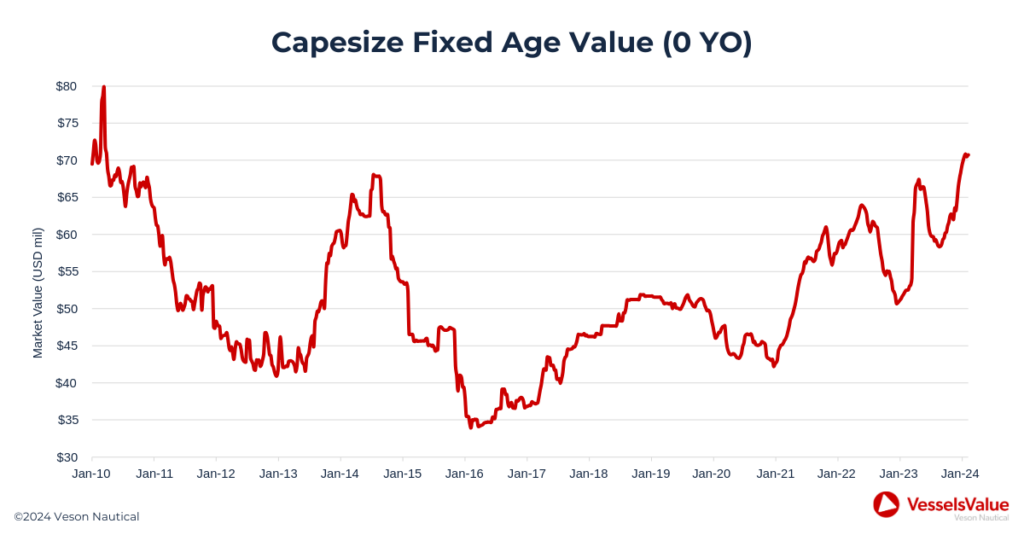

Bulker earnings reached their zenith in December but have since experienced a customary seasonal dip. However, despite the current decline, earnings continue to stand at historically elevated levels for this time of the year. While there has been considerable discussion surrounding a potential resurgence in demand for larger Bulkers, the sale and purchase transactions occurring this year have yet to align with this anticipated trend. On the flip side, values present a contrasting narrative, with Capesizes demonstrating robust year-on-year strength, driven by elevated commodity prices fostering a sturdy underlying demand for larger Bulkers.

Values

Bulker values remained stable in January, with older Capesizes experiencing the most gains. Values for 20YO Capes of 180,000 DWT increased by c.2.81 % month-on-month from USD 13.86mil to USD 14.25 mil at the end of January.

However, it is the year-on-year values for modern Bulkers that show the most dramatic improvements increasing across all categories for vessels under 10 years of age. Values for 0YO Capesizes of 180,000 DWT are currently at the highest levels since March 2010, up c.34.93% year-on-year to USD 70.57 mil.

Notable sales

Secondhand sales in January continued to revolve around the smaller vessels and the majority of sales were in the Supramax sector, accounting for c.32% of all sales, followed by Handy Bulkers with c.24%. Notable sales include the Supramax BC Isabella M (56,100 DWT, Jul 2006, Zhoushan) sold to unknown Chinese buyers for USD 12.00 mil, VV Value USD 11.84 mil. Additionally, the Handymax BC Rui Fu Xing (36,700 DWT, Jul 2012, Hyundai Mipo) sold to unknown Turkish buyers for USD 16.50 mil, VV value USD 16.50 mil.

In the newbuilding sector, Panamaxes dominated orders in the first month of the year, accounting for c.33%; Capesizes and Ultramaxes were in second place, each with a share of c.19%. Notable orders include an en bloc order of 4x Newcastlemax of 210,000 DWT, ordered by Eastern Pacific Shipping and scheduled to be built at Qingdao Beihai Shipbuilding and delivered in 2027, VV value USD 65.6 mil each.

Earnings

Improved demand fundamentals for commodities such as iron ore and bauxite, combined with the additional tonne mile demand that has arisen as a result of disruption around both the Panama and Suez canals, have led to year-on-year increases for Bulker earnings across the board. Traditionally, the first few months of the year represent a quieter period for the Bulker markets as the Far East winds down for the Lunar New Year celebrations. Although rates have dipped from the highs of December, they still remain at historical highs. For example, Capesize earnings are up by c.357% year-on-year from around 3,600 USD/Day at the start of February 2023 to around 16,500 USD/Day today. On the smaller end of the scale, Handysize earnings are up by c.35% from around 7,800 USD/Day at this point last year to 10,578 USD/Day today.

In conclusion, the Bulker market has witnessed a fluctuation in earnings, with a peak in December followed by a customary seasonal decline. Notably, current earnings, despite the decline, remain historically elevated for this time of the year. Despite impressive year-on-year improvements in values for modern Bulkers, notable sales in January centered around smaller vessels, with Supramax and Handy Bulkers leading the way. Newbuilding orders, dominated by Panamaxes, showcase continued investment in the industry, with notable en bloc orders indicating confidence in the market’s future.

Market dynamics suggest a resilient Bulker sector, influenced by global economic conditions, commodity prices, and disruptions in major shipping routes. As stakeholders navigate these variables, the Bulker market remains dynamic and responsive to evolving trends and challenges.