Market Chat: Tanker Buyers Opt for Youth as Older Vessel Values Decline

Author: Rebecca Galanopoulos Jones

The landscape for Tankers is now changing as older vessels, which have been the focal point for sale and purchase over the last year, have now become less attractive. Instead, buyers are seeking younger tonnage both from an investment point of view and in order to mitigate risk.

Age of unknown Tankers falls

Crude sales to unknown or undisclosed buyers have continued to rise in the first half of 2023, accounting for around 53.6% of sales. Since the start of the conflict between the Ukraine and Russia, a new breed of Tanker owner has been enticed into the market, often the company or owner is unknown and is purchasing older tonnage. What we have noticed recently is average age of second-hand Tankers sold to unknown buyers has decreased to 15.1 years today from 18 years in February. One of the reasons purchasers are opting for newer vessels could be due to concerns around safety issues surrounding older vessels, following the incident in May when the 1997 built Aframax Pablo caught fire, the vessel had changed hands to undisclosed buyers earlier this year.

Furthermore, with Tanker values still at 15-year highs there are plenty of sales candidates available, particularly in the VLCC and Aframax sectors. Buyers’ sentiment is that if they are to invest at such high prices, they would rather spend a few million more on more modern tonnage, especially if they are scrubber fitted and fuel efficient.

Values for 15YO Aframaxes have increased by c.5.38% since the start of June from USD 39.35 mil to USD 41.3 mil, the highest levels since October 2008. The number of Aframax sale and purchase transactions in the first half of 2023 rose by c.5% YoY with over 90 reported. Notable sales include the Aframax Minerva Zoe (105,300 DWT, Mar 2004, Hyundai Samho HI) sold to Unknown Chinese buyers for USD 31 mil, VV Value USD 30.56 mil.

Although crude earnings are lower than this time last year, they remain firm overall as a result of changing trade flow patterns due to the conflict in Ukraine and the EU sanctions on the import of crude and oil products from Russia, which has increased tonne mile demand. The Aframax sector is currently outperforming Suezmaxes by c.9.2% and VLCCs by c.5.5%.

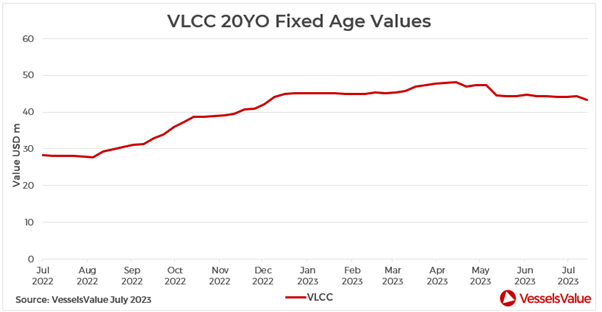

Prices for older VLCCs take a hit

On the other hand, along with the fall in demand for much older vessels, prices for vintage VLCCs have taken a hit recently and since the start of Q3 2023 values for 20 year old VLCCs have fallen by c.6.89 % from USD 44.10 mil to USD 41.06 mil. Sales for this sector have also fallen quarter on quarter and in Q1 2023 there were 32 VLCC sales reported compared to just seven in Q2 2023, a fall of c. 78%. Year on year sales have also dropped, in the first half of 2022 there were 61 sales reported but in same period of 2023 this figure had fallen by c.36% to 39.

According to reports, the Chinese government is seeking to implement stricter regulations for larger older Tankers of 20 years and over. In an article by Lloyds List, this is said to include:

- The requirement for cargo owners operating local Tanker terminals not to charter in vessels that have not been inspected by internationally recognised petroleum organisations or companies in the oil industry within the past two years.

- Vessels that have undergone repeated changes in ship name, shipping company, ship certificate, crew or other situations that suggest frequent ownership changes within the past two years and vessels that have been detained two or more times within the past two years.

- Vessels registered under flag states that are on the grey or blacklist of the Port State Control authorities, whose classification societies are not part of the International Association of Classification Societies, whose P&I clubs are not members of the International Group of P&I Clubs, or those older than 20 years are all categorised as “not recommended for chartering”.

Recent sales have set the benchmark lower. Notable sales include the Lulu (316,500 DWT, Jul 2003, Hyundai Heavy Ind) that sold to unknown Chinese buyers for USD 42.5 mil, which included USD 1 mil for bunkers. VV Value USD 44.68 mil. Also the C Champion (314,000 DWT, Nov 2003, Samsung) sold to undisclosed buyers for USD 37.80 mil (DD Due, BWTS Due), VV Value USD 44.59 mil.

VesselsValue data as of June 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?