Market Chat: Week 12

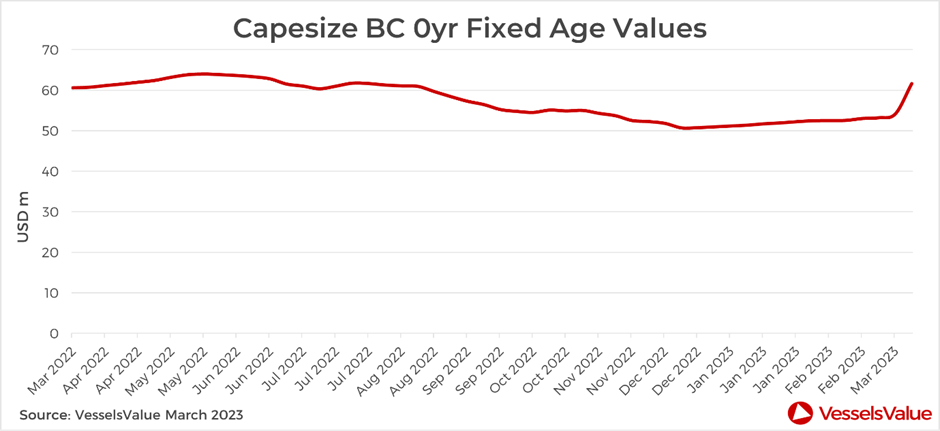

Capesizes values jump by 16%

Since the start of March, Capesize values have surged across all age categories, but modern tonnage has seen the largest increase. These include values for 180,000 DWT vessels rising by c. 16.38% from USD 53.05 mil to USD 61.74 mil, the highest levels since August 2022. Tomini’s purchase from Mangrove Partners of two modern Newcastlemax’s set new benchmark prices with MP The Vrabel (208,300 DWT, Jan 2021, Jiangsu Yangzi) and MP The Bruschi (208,200 DWT, Aug 2020, Jiangsu Yangzi) selling for just over USD 60 mil each. Both were sold with a TC attached to Oldendorff.

Furthermore, as we enter the traditionally stronger second quarter, sentiment for Capesize vessels has soared, strengthening values further. China has lifted restrictions on Australian coal imposed owing to political tensions between the two countries in 2020. After initially allowing four major importers to resume trade earlier this year, China, the world’s largest producer and consumer of coal, has now lifted all the remaining restrictions on Australian coal. Therefore, demand is expected to surge in the coming weeks, which will be favourable for Capesize earnings as Chinese importers seek to resume imports of high quality Australian ore. Rates for the Brazil to China route have also firmed, boosting Capesize rates overall. Freight rates have jumped up by 109% since the 1st of March from 7,703 USD/Day to 16,134 USD/Day, and there is optimism that rates will continue to rise in the coming weeks.

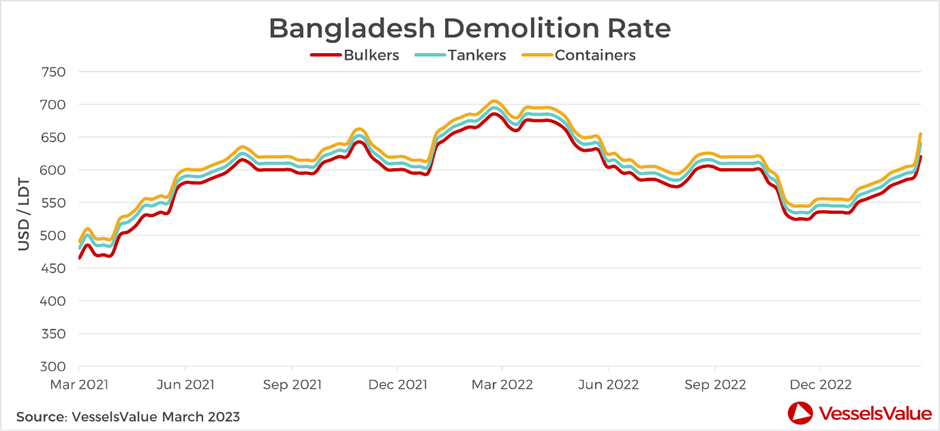

Demolition prices in Bangladesh shoot up

Prices for recycling ships in Bangladesh have increased week on week for Tankers, Bulkers and Containers as cash buyers sought to secure tonnage. This is following the persistent issues with letters of credit that have starved the Bangladeshi market of tonnage in recent months.

Bulker prices have increased by 30 USD/LDT to 620 USD/LDT WoW. Tankers have increased by 40 USD/LDT to 640 USD/LDT WoW. Containers have increased by 50 USD/LDT to 660 USD/LDT WoW.

Last week, three sales were reported to Bangladeshi recyclers, including the Capesize BC Sunny Voyager (171,500 DWT, Jun 2001, Hyundai HI) sold for 610 USD/LDT, (22,686 MT), USD 13.8 mil. MR2 Tanker Salamis (47,000 DWT, Mar 1998, Onomichi Dockyard) sold for 660 USD/LDT, (9,238 MT), USD 6.1 mil and Handy Container Vasi Star (1,728 TEU, Sep 1996, Stocznia Szcecin Nowa) sold for 675 USD/LDT, (7,821 MT), USD 5.3 mil. No deals were reported for any other countries.

for the last 2 years.

VesselsValue data as of March 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?