Market Chat: Week 47

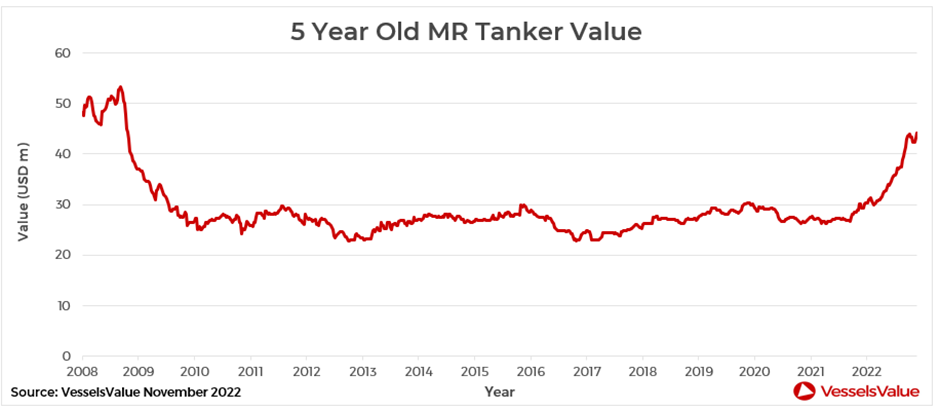

MR values hit 14 year high

MR values have hit the highest levels since Oct 2008. The current value for a five year old MR is up by c.45% from the start of the year, from USD 30.32 mil to USD 44.01 mil. Sales for this sector have increased by c.15% from last year and so far in 2022, there have been 218 sales reported.

Notable recent sales include the Celsius Roskilde (46,100 DWT, July 2009, Hyundai Mipo), which was sold for USD 28 mil, VV value USD 24.2 mil. Ultimately, this sale has set the benchmark for firmer MR values this month. Additionally, the Seabreeze (53,700 DWT, Jul 2007, Shin Kurushima Onishi) was sold to undisclosed buyers for USD 19.50 mil (SS/DD Passed), VV Value USD 19.67 mil. The Atlantica Bridge (50,900 DWT, Dec 2005, STX Offshore) was sold to undisclosed buyers for USD 19.75 mil (BWTS fitted), VV Value USD 19.27 mil.

Freight rates for MRs have been volatile throughout the year, but earnings are currently very firm. Baltic Exchange rates on the MR Atlantic Basket (TC2 & TC14) peaked at 66,897 USD/Day last week, up 767% from 7,717 USD/Day this time last year. This has given a rise to speculation that the clean market will now follow the same pattern as the sky high crude market. Due to the upcoming sanctions on Russian crude, this pattern may further strengthen MR values as 2023 approaches. EU sanctions on the import and transportation of Russian petroleum products will come into force from 5th February 2023, just two months after the nearing sanctions on Russian crude oil on 5th December 2022.

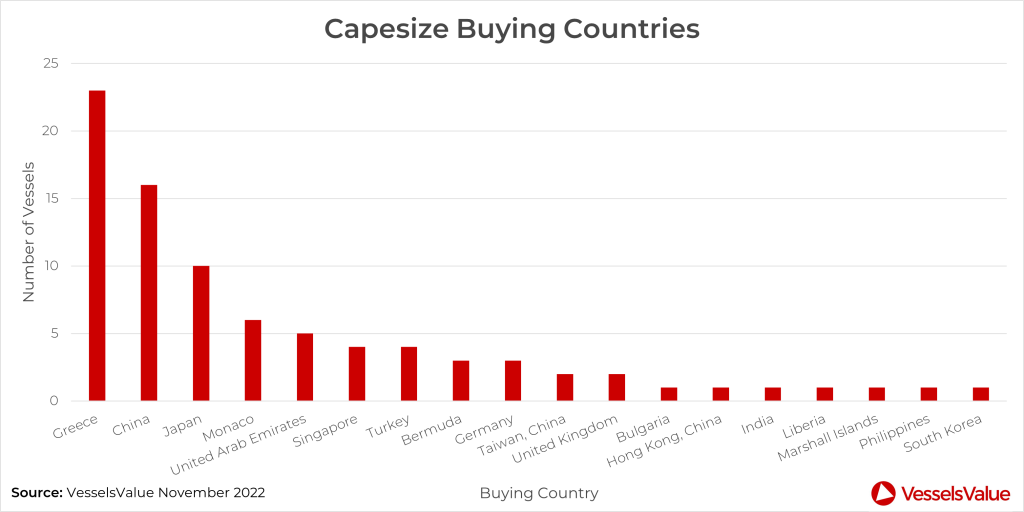

Greek buyers in Capesize assets play as values fall

Bulker values have fallen overall this month, but Capesize asset prices have seen the biggest decrease across all ages. Values for 10 year old Capesizes are down by c.7% to USD 29.45 mil, whereby 20 year old vessels were down by c.10% to USD 13.62 mil.

Greece has been the leading buyer of Capesizes this year, accounting for almost a quarter of all sales. November saw the highest number of monthly sales from Greek buyers this year with six sales reported, indicating that there may be some speculative asset play taking place.

Notable sales include the Aquataine (181,700 DWT, Sep 2010, Imabari), which was sold to Greek buyers for USD 24.75 mil, VV Value USD 25.15 mil.

Capesize earnings have come under pressure in recent months due to low iron ore demand. However, there is growing sentiment that easing of Covid-19 restrictions in China will spark a rebound in demand for Bulkers.

VesselsValue data as of 30th November 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?