How new EU sanctions will affect the clean Tanker market

New wave of sanctions to hit Clean Tanker market

A fresh round of EU sanctions on Russia that will include refined petroleum products are set to come into force on the 5th of February.

In the run up to this round of sanctions, we have not seen the same soaring freight rates that characterised the December embargo on Russian crude, when rates were at a two year high and hovered around the 70,000 USD/Day mark. Instead, the MR spot rate has dropped to a 12 month low of 10,862 USD/Day, as market participants wait for the new regulations to take effect before making any commercial decisions.

However, we have seen much older MRs bought back to trade on the premiums from the Russian Black Sea and Baltic trades. Previously, there was a surge in sales of vintage units to undisclosed buyers in Q4 of 2022. That being said, MR values overall have now responded to the fall in earnings, and values for five year old vessels have fallen by c.5% MoM from USD 44.15 mil to USD 41.98 mil.

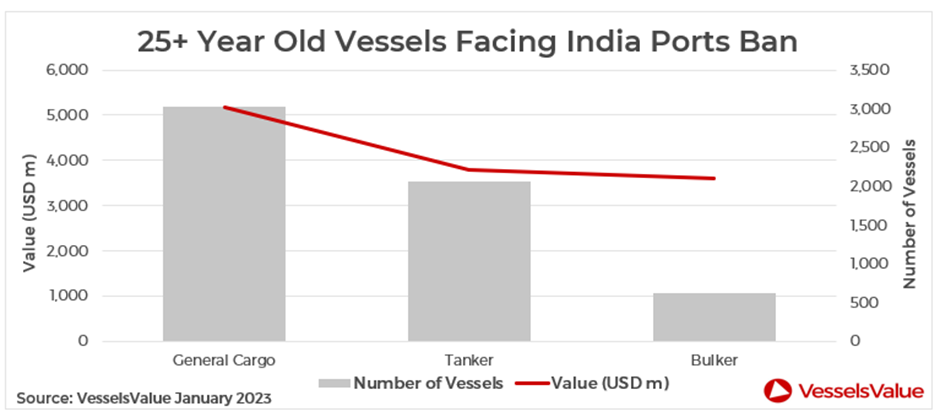

25+ year old vessels facing Indian port ban

In a bid to improve tonnage safety and a move towards younger, more efficient vessels, India has now outlined new legislation to ban both Indian and foreign flagged Bulker, Tanker and General Cargo ships that are 25 years old and over from calling at Indian ports. Gas Carriers, Offshore vessels and Containers will have an age limit of 30 years.

The regulations will have the most impact on the General Cargo sector. A large proportion of live vessels in this sector are over 25 years of age, and c.41% of this fleet will no longer be able to trade in Indian ports, equating to 3,019 vessels worth a total of USD 5.2 bil. In second place is the Tanker sector with a fleet of 2,052 older ships, representing 15% of the overall fleet and is worth c. USD 3.8 bil. In terms of Bulkers, approximately 5% of the fleet is over 25 years of age, which amounts to 623 vessels with a total value of USD 3.6 bil.

VesselsValue’s Trade data indicates that the vast majority of port calls were for vessels well above this age threshold, and therefore this should not have a substantial impact on freight markets. However, the announcement signals a step in the right direction by the Indian government in the movement towards safer, greener and more efficient ships calling at Indian ports.

VesselsValue data as of end January 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?