Market Chat: Global Clean Tanker Trade from Russia Climbs

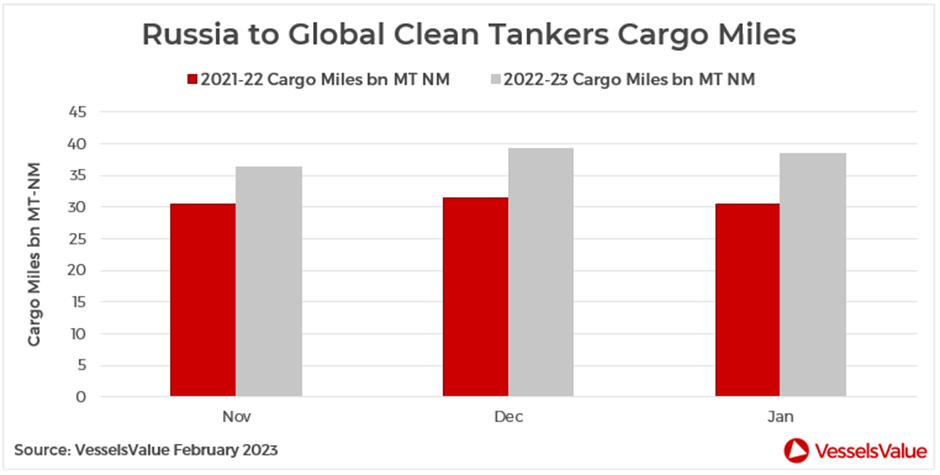

Ahead of the sanctions on Russian Clean products that came in to force on 5th February 2023, Russia to global Clean Tanker cargo miles continued to climb YoY. VesselsValue’s Trade data shows that Russia to global Clean Tanker cargo miles increased by c.26% YoY in January to c.38 billion MT NM.

Overall, Russian oil exports have increased significantly to countries such as China, India and the UAE over the last year, with oil trade to India expanding by as much as 577%. Sanctions have also resulted in a reshaping of trade patterns, with new routes emerging. For example, Clean Tanker tonne miles from Russia to Brazil have increased by approximately 43% YoY, from 0.9 BN-MT NM to 1.3 BN-MT NM.

The shift in trade flows, both from the rerouting of sanctioned cargoes and from EU and G7 countries now sourcing from further afield in order to secure energy sources and reduce reliance on Russian exports, has aided Clean Tanker earnings, which are up by c.76% year on year. However, the highly volatile MR market plunged this week, as US cargo momentum slowed and earnings went down from this year’s peak of 55,857 USD/Day earlier in February, to 28,803 USD/Day today.

Sale and purchase activity for MRs remains firm with levels up by c.49% YoY. Overall, values for Clean Tankers have corrected so far this year but remain high, with the exception of older MRs that have continued to gain steam. Values for 20 year old MRs have risen by c.6.24% to USD 16.17 mil.

Notable sales include the MR2 Ibis Pacific (50,000 DWT, Jun 2007, STX Offshore) sold to undisclosed buyers for USD 22.00 mil (SS/DD Passed), VV Value USD 20.87 mil.

Aframaxes earning over 40K USD/Day

Aframaxes have earned over 40,000 USD/Day since July of 2022, due to improving market fundamentals. In turn, this has had an impact on sales for this sector.

2022 was a record breaking year for Tanker sale and purchase transactions, of which Aframax sales accounted for just under a quarter of these sales at c.22%. This trend looks set to continue in 2023; in the first two months of the year, sale and purchase activity levels for Aframaxes are up by c.33% YoY, and continue to be led by demand for vintage tonnage. This includes Aframaxes 15 years and older, accounting for 63% of sales over the first two months of this year.

In terms of price levels, values for 15 year old Aframaxes hit 15 year highs in February and are currently at USD 38.79 mil, an increase of c.142.75% YoY. For more modern tonnage, demand for older vessels is pushing up values, despite lower sales levels. However, the following sales have set the benchmark lower for newbuild Aframaxes. Delaware Star and Galveston Star (115,000 DWT, Apr 2023, DH Shipbuilding) sold to GNMTC in an en bloc deal for USD 152 mil (Resale), VV Value USD 154.73 mil.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?