Market Chat: Weeks 14 & 15

New MR sales set higher benchmark for valuations

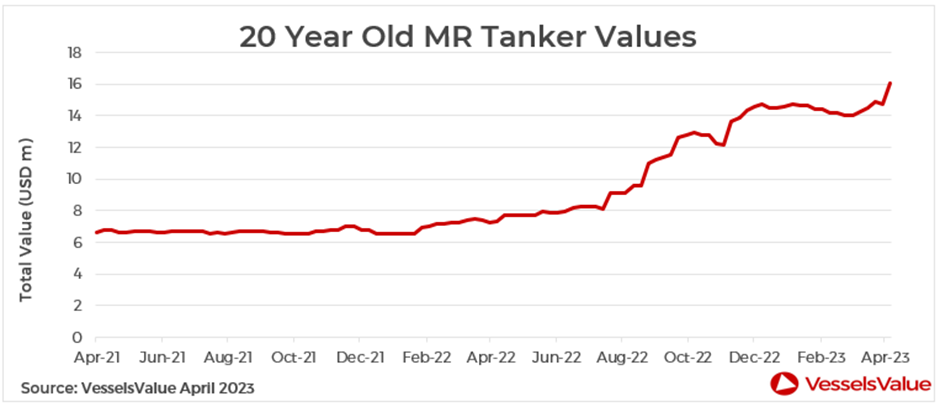

Values for MRs have continued to rise across all ages. Demand for older vessels has gone from strength to strength and so these sectors have seen the strongest increases, since the beginning of the month. Values for 15YO MRs of 50,000 DWT are up by 3.52% from USD 23.03 to USD 23.83 mil. Values of 20YO vessels of 45,000 DWT are up by c.5.91% from USD 14.72 mil to USD 15.59 mil. Having risen steadily since the start of 2022 they are currently at the highest levels since October 2008. The volume of MR sales has firmed, rising by c.39% YoY, with 79 sales reported so far this year. The average age of vessels sold in 2023 to date is 14 years.

This firming in values is a result of recent sales that continue to set the benchmark. Demand for older tonnage has increased as many market players seek to take advantage of the elevated earnings that have come as a result of the sanctions on Russian crude oil and petroleum products. Shifting trade flow patterns that stem from these sanctions have also contributed to elevated earnings for MRs. The spot market remains well above average at around 37,000 USD/Day at the time of writing this article. This has resulted in increased tonne mile demand as Tankers are forced to travel further due to the sanctions on Russian oil.

Notable sales include the Ridgebury John B (46,000 DWT, Jun 2007, Shin Kurushima Onishi) sold to undisclosed buyers for USD 23.5 mil. VV Value USD 19.3 mil. Grace Lucrum (51,400 DWT, Jun 2006, SLS) sold to undisclosed buyers for USD 22.80 mil, VV Value USD 21.2 mil.

Handy Bulker values continue to firm for older tonnage

Values have firmed for modern Handysize Bulkers following positive buyer sentiment and it has been an active start to the quarter for sale and purchase activity. Since the beginning of April, 5YO Handys of 38,000 DWT have increased in value by c. 3.69%, from USD 24.17 mil to USD 25.06 mil. Values have risen steadily since the start of the year, having found a floor in December 2022.

Rates for this sector have picked up and have increased by around c.47% from the low of 7.763 USD/Day in January to around 11,500 USD/Day today. There is optimism that rates will continue to pick up throughout Q2 2023 with dry bulk fundamentals remaining favourable to owners as China recovers from Covid-19, combined with increased coal demand and changing trade flows of coal due to the Russian sanctions.

Notable sales include the Eldoris (36,100 DWT, Oct 2011, Hyundai Mipo) sold to undisclosed for USD 16.5 mil, VV Value USD 17.11 mil.

VesselsValue data as of April 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?