Market Chat: Week 16

Post Panamax Container values soften on MSC’s latest purchase

Post Panamax values have softened as a result of MSCs recent purchase of the Lisbon (6,078 TEU, May 2003, Hanjin Heavy Ind) sold to MSC for USD 22 mil (SS/DD Due), VV Value USD 25.53 mil.

Values for this sector have fallen since the beginning of the month for vessels over 10 years of age. 20YO vessels of 6,500 TEU have seen the most significant drop in values and are down by c.5.05% from USD 40.23 mil to USD 32.13 mil.

Container earnings found a floor in March and have since started to edge upwards. Post Panamax one year time charter rates are currently at 43,500 USD/Day, this figure remains well above the historical average for this sector.

The purchase of the Lisbon brings the total of Container vessels bought so far this year by MSC to 12, this figure includes nine Post Panamaxes and three Panamaxes with an average age of 20 years. In addition to these secondhand purchases, the Geneva based company has ordered a further 10 x 11,400 TEU New Panamax newbuildings this year. These vessels have been contracted to be built at Zhoushan Changhong International and scheduled for delivery between 2025-2026. These purchases bring the total of the MSC fleet to 394 live vessels and 86 on order, this equates to an overall market value of USD 19 bn.

MSC have been involved in a buying spree over the last few years, with a total of 234 Containerships having been purchased since January 2021 to date. The most popular sector was the Sub Panamax range, accounting for c. 25.2% of purchases, followed by Panamaxes at c. 24.8% and Post Panamax vessels ranked third with c.23.9%. Handy Containers made up c.13.7% of purchasing activity, Feedermaxes c.11.5% and New Panamaxes, 0.9%. In addition to these acquisitions, 92 newbuilding contracts have been placed over the same period of time, more than half of these orders were in the New Panamax sector at 56.5%, followed by Post Panamaxes at c.22% and Handy Containers at c.11%, Panamaxes account for c.6.5% and ULCVs 4%.

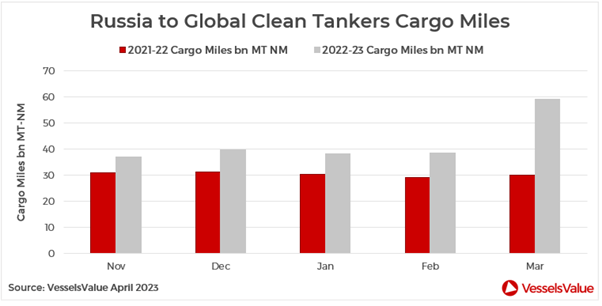

Russia Clean Tanker cargo miles soar

VesselsValue Trade data indicates that Russia to Global Clean Tanker cargo miles increased rapidly in March, despite the EU and G7 sanctions on Russian petroleum products that came in to force on the 5th February 2023. Clean Tanker cargo miles for journeys originating from Russia increased by c. 53% MoM to hit 59 bn MT NM in March, this figure was up by around 97% YoY.

Sales for MRs have increased by c.33.33% YoY with 84 purchases recorded so far this year. With an average age of 14 years compared to 10 years for the same period in 2022, the majority of sales were to unknown buyers, accounting for just over a quarter at c.26%, as a growing number of buyers seek to obscure vessel ownership in order to take advantage of the high premiums associated with sanctioned trades. To put this figure in to perspective, there were just two sales to unknown buyers between January- April last year.

This increase in demand has had a significant impact on values for older tonnage. Values for 20YO MR tankers of 45,000 DWT have firmed by 10.41% from the start of the year from USD 14.60 mil to USD 16.12 mil, moving back up to the highest levels since October 2008.

Volatility continues to characterise earnings for this sector which remain above average and are currently up by c.6.3%YoY to 38,365 USD/Day. Notable sales include the MR2 Di Matteo (46,600 DWT, Oct 2009, Naikai Setoda) sold to undisclosed buyers for USD 24.00 mil, VV Value USD 23.01 mil – BWTS.

VesselsValue data as of April 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?