Market Chat: Weeks 3 and 4

Ice class Tankers are the talk of the town

The number of ice class Aframax Tanker transactions that took place in 2022 increased by 140% year on year. The majority of sales took place in the second half of the year and the average age of vessels sold was 15 years. Values for this sector have increased by c.140% year on year from USD 16.34 mil to USD 39.19 mil.

Currently, Ice class 1A fitted Aframaxes can command a premium on the S&P market, given their ability to trade on certain routes. With Russian crude cargoes now sanctioned since December, there is speculation that owners operating in the Baltic regions on trades out of Primorsk. With the advantage of ice class vessels, this could make large margins by purchasing cheap oil and transporting it to refineries elsewhere to sell at higher levels.

Aframax earnings are currently outperforming those of much larger counterparts including Suezmaxes and VLCCs and are up an astonishing 1644% year on year from 3,693 USD/Day to 64,438 USD/Day.

Notable recent sales so far this year have all been to unknown Middle Eastern buyers and include the LR2 Leo (112,800 DWT, Aug 2010, New Times Shipbuilding) that sold for USD 42 mil, VV value USD 43.65 mil, the LR2 Seamagic (116,900 DWT, Mar 2007, Hyundai Heavy Ind) also sold by USD 41.77 mil, VV value USD 41.49 mil and the Aframax Syra (105,700 DWT, Mar 2010, Sumitomo) sold for USD 39.5 mil, VV value USD 41.7 mil.

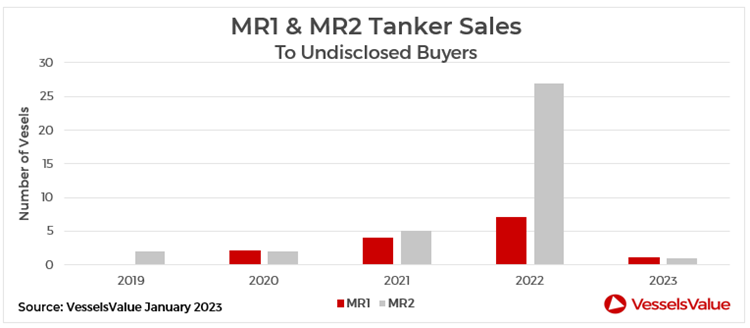

MR sales with undisclosed buyers surged in 2022

Sales of MR2 Tankers with undisclosed buyers rose sharply during 2022 with 27 sales reported in 2022, compared to just five sold in 2021 and three sold in 2020. This increase follows on from patterns seen in the Crude market, where a growing number of Tankers with unknown buyers have been sold into the ‘dark fleet’ in order to continue trading sanctioned cargoes and take advantage of any premiums available on the charter routes. Almost half of these sales took place in Q4 2022, ahead of the sanctions on Russian oil that came in to force in December 2022.

The average age of the MR2 Tankers sold in 2022 was sixteen years. This has supported a firming particularly for vintage units which have seen the most impressive gains. For example, 45,000 DWT, 20YO MR2s increased by c.123.5% from USD 6.56 mil in 2021 to USD 14.66 mil in 2022, the highest levels seen since October 2008.

Recent deals include the Challenge Passage (48,700 DWT, Apr 2005, Iwagi Zosen) which sold to undisclosed for USD 17.50 mil, VV value USD 16.61 mil and the Nave Dorado (48,000 DWT, Aug 2005, Iwagi Zosen) which sold for USD 15.6 mil, VV Value USD 16.71 mil.

VesselsValue data as of 26th January 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?