Market Chat: Weeks 48 and 49

Capesize values continue to soften

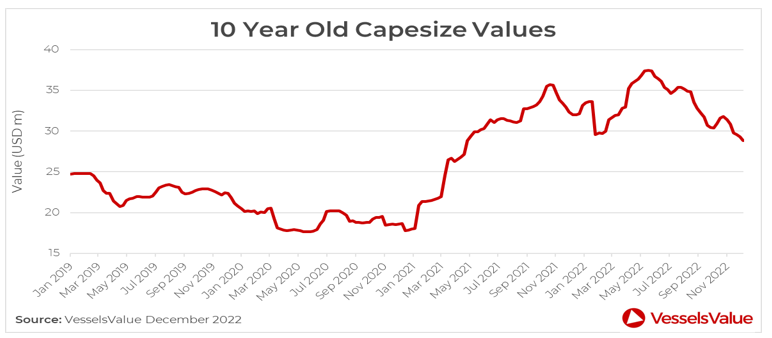

Capesize values have continued to soften. Values for ten year old vessels of 180,000 DWT are down by c.13% since the start of the year, from USD 33.07 mil to USD 28.82 mil. The continued fall in values comes as Bulker earnings remain under pressure, and any hopes that an easing of Covid restrictions in China may provide a boost for Capes have yet to materialise. Freight rates for the Baltic Exchange 54-TCA remain at 13,276 USD/Day, down 66% year on year.

This was supported by the sales of Capesizes, with the Wisdom of the Sea 1 and 2 (180,200 DWT, July 2011, Daehan) having been sold for USD 23.75 mil, VV value USD 24.49 mil, supporting a softening market.

Although there are still healthy amounts of sale and purchase transactions being reported, Bulker sales have declined by 28% from the same period last year. In Q4 2022, there have been 149 Bulker sales reported so far, compared to 206 in Q4 2021.

Tankers remain firm

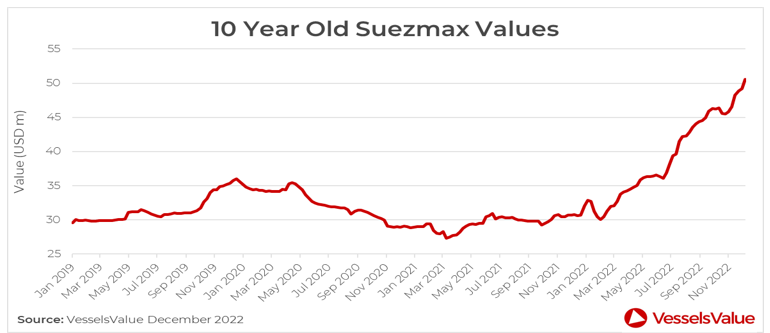

Last Monday signalled the official introduction of the EU and G7 embargo on Russian oil and since then, Tanker rates have shown volatility. VLCC rates on the TD3 TCE Middle East Gulf to China route are currently at 52,619 USD/Day. Suezmaxes stand at 67,974 USD/Day, rates which are still very firm.

Values remain firm for the larger crude carriers. For example, Suezmax values for 10 year old vessels of 160,000 DWT are up by c.3% to USD 50.86 mil. Notable sales include the Ridgebury Mary Jane (150,000 DWT, May 2008, Universal),which was sold to undisclosed buyers for USD 39.5 mil, VV value 38.99 mil.

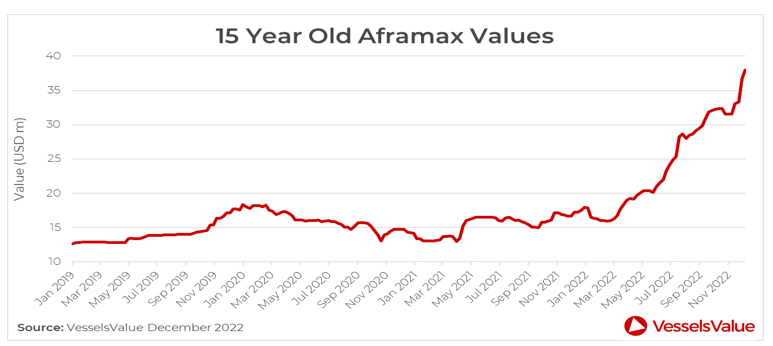

Older Aframaxes continue to firm in value, with fifteen year olds currently valued at USD 37.29 mil, up from USD 32.04 mil at the start of the quarter. These prices are supported by the Seatrust (114,600 DWT, July 2004, Samsung), which was sold to undisclosed buyers for USD 35 mil, VV value USD 31.79 mil. The Antaios (106,000 DWT, Jan 2006, Hyundai Samho Heavy Ind.) was sold to undisclosed buyers for USD 33.5 mil, VV value USD 33.21 mil.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?