Offshore Half Year Review 1H 2023

It has been a busy six months within the Offshore sector.

The main highlights have been:

1. Tidewater acquiring 37 high specification PSVs from Norwegian offshore owner Solstad Offshore

At a global level Tidewater have set the bar for the rest of the market. The US based powerhouse has been on the offensive since early 2022. First with the takeover of Swire Pacific Offshore, adding 50 OSVS (29 AHTS and 21 PSV’s) to their fleet and now with the acquisition of Solstads whole PSV fleet. Moving forward, smaller owners will find it harder to compete with Tidewaters economies of scale. It will be interesting to see how they evolve and change to deal with the new and improved Tidewater.

2. Hornbeck Offshore acquiring six high specification Jones Act PSVs from fellow US vessel owner Edison Chouest.

Across the pond in the US GOM – while Tidewater have been focusing their efforts on plays outside of the US jones act fleet – one local owner has been slowly and strategically growing their jones act PSV fleet. Since 2018 Hornbeck Offshore have added 19 PSV’s to their fleet, majority modern and high specification deep water units. Although 19 vessels doesn’t seem like a huge number when compared to Tidewaters acquisitions , within the extremely closed and tight US GOM Jones Act market 19 vessels is a remarkable feat. Hornbeck now rank no. 2 in terms of deepwater PSV fleet numbers – behind only Edison Chouest.

3. Vroon offshore services fleet up for sale as part of their restructuring process.

Vroon cannot be ignored – how this deal will eventually turn out remains to be seen. There are so many banks and people involved that the timeline could surpass the 18-month target proposed in the initial press release. However, there have been several rumours in the market that the company has been purchased by a Middle Eastern interest.

4. Bourbon (whole company) marketed for sale.

Sale brochure has been circulated offering Bourbon for sale (the whole company). Reminder Bourbon is controlled by Société Phocéenne de Participations (SPP), which is formed by the following banks: BNP Paribas, Caisse Régionale de Crédit Agricole Mutuel Alpes Provence, Caisse Régionale de Crédit Agricole Mutuel de Paris et d’Ile de France, CM-CIC Investissement SCR, Crédit Lyonnais and Natixis and Société Générale.

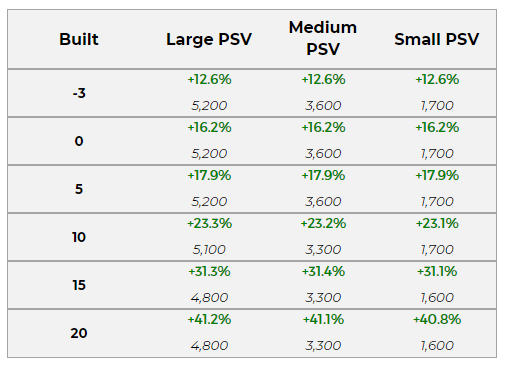

PSV Values

PSV’s have firmed over the last six months across the whole age and size curve. The firming is due to the very similar factors mentioned in VesselsValue’s 2022 Offshore Yearly Review.

Supply

- Lack of newbuild orders.

- Majority of Chinese resale tonnage now sold.

- Significant reduction in second hand sale and purchase candidates.

- Large number of OSVs scrapped during downturn.

- Larger owners completed their mass fleet sell offs.

- Large number of vessels sold out of the Offshore sector.

- Large number of vessels sold into Chinese markets, which rarely return to international market.

Demand

- Strong oil price.

- CAPEX increases from oil majors.

- Geopolitical instability and energy security.

- Increased renewables demand.

- General increased demand within operating regions, such as Saudi Arabia.

- Increased charter rates.

Notable PSV Asset Plays

July 2023 – Standard Duke (ex-Highland Duke) 3,1000 dwt blt 2012 Rosetti Marino sold for USD 11 mil. VV value 11.27 mil. This vessel was originally owned by Tidewater Marine, who sold it to a Chinese entity, who subsequently flipped the unit to Standard Supply for USD 5 mil. Standard Supply spent USD 2 mil reactivating the unit.

March 2023 – Laskaridis owned Crusader (ex Havila Crusader) 5,400 dwt blt 2010 Hellesoy Verft sold for USD 19.1 mil, SS/DD due and laid up since 2019. VV Value USD 21 mil. Laskaridis originally purchased the vessel in September 2021 for USD 11.5 mil with a plan to convert it out of the sector. However, as the offshore market began to recover, they opted for an asset play, taking advantage of the firming values.

The Newbuilding Conundrum Continues

Since the offshore downturn there hasn’t been a meaningful newbuild program for any type of offshore vessel. However, as the market has improved significantly questions are being asked if / when newbuilds will appear. Unfortunately ordering vessels in 2023 is a very different scenario than pre downturn. Below outlines some of the various hurdles faced by owners.

- Finance

Many financial institutions are still wary of oil and gas investments, some were burnt badly during the last downturn and are more than happy to not be involved with the sector again. Also, there is a large push at the moment for more environmentally friendly investments. Oil and Gas can cause headaches for many institutions ESG targets / visions. - Future fuels

What fuel to utilise for the future OSV fleet is an ongoing debate, and one with no clear-cut answer. LNG, Hydrogen, Methanol, hybrid, ammonia, biofuels, energy storage systems, plug in electric have all been touted and some are more conceptually viable than others. But until the sector understands which will provide highest future viability and be accepted by the market – it remains unlikely newbuilds will occur. This is because no owner will want to risk spending large amounts of money on a new vessel (and the engine / propulsion technology) and then find themselves 2-3 years down the line with a redundant or non-accepted system and /or little infrastructure in place to support it. Also, the rules and regulations surrounding alternative fuels are still developing and the guidelines remain somewhat vague. Again, owners could unknowingly find their newbuild project on the wrong side of the changing guidelines. - Newbuild prices non-viable

Newbuild prices have firmed to levels that make them a non-viable investment. Although charter rates have increased significantly, they are still not high enough to support the newbuild economics. For example, a newbuild large PSV in the US is priced around c. USD 85-90 mil. The current market cannot provide the $$$ to support that loan, and you cannot ignore that with prices at USD 85 – 90 mil, the breakeven timeline alone would be unviable. In a cyclical market like oil and gas you easily run the risk of that vessel becoming a very expensive asset on your balance sheet if / when the next downturn occurs. - Availability and ability of yard to build OSV’s

The final thing to consider is if the yard can build your vessel. The landscape of yards capable of building offshore units is very different from 2010 – 2015. Many have disappeared as victims of the downturn. Examples include (non-exhaustive list): Simek shipyard closed in 2018 with the loss of 150 employees, Fincantieri closed two of its Vard yards (Vard Aukra and Vard Brevik) in 2019 with loss of 200 employees, Harvyard Leirvik closed down newbuild operations and laid of around 100 employees in 2020. Not only is this a significant loss in actual yard space and infrastructure but also workers with expertise in building offshore assets disappears.

Over the in the USA there are similar issues as Norway, workforce shortage, declining number of capable yards. However, owners also face competition from the US Government for yard space – with many yards being utilised by the state for their internal needs. All of which could mean your OSV although ordered, takes significantly longer, or is just never delivered.

Over in Asia – you are competing with conventional shipping (bulker, tankers, container, LNG, car carriers etc) big ticket items that can be built quickly and provide the biggest returns for the yards. Offshore vessels are complicated, time consuming, require significant project management and have a lot of extra technology which all costs extra time and money….thus lowering profit margins for the yard.

However, even with the above, Norwegian company Agalas ordered its second newbuild (its first was announced in Dec 2022). The new vessel is an NSK Design subsea support vessel built to cater to the growing activity in offshore energy markets. According to the company the vessel will be the world’s first green offshore subsea vessel in its category. The vessel will be built in Sefine shipyard Turkey and is due to be delivered in 2025, right in time for their predicted market upswing.

VesselsValue data as of June 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?