Remaining constant in a changing world

The shipping industry is in an interesting position. COVID-19 is wreaking havoc across the world, causing regional and national lockdowns, transforming the way in which ordinary people go about their daily lives, and forcing industries to rethink their usual practices. Despite this ongoing situation, the shipping industry still has to function in order to ensure usual supply chains are fulfilled. So, while the world is changing, shipping is remaining constant.

Shipping is a cyclical industry, consistently inconsistent with great volatility. Being successful in the shipping markets is a never ending, complicated and risky challenge. Owners, investors, lenders, charterers and traders financially thrive or suffer by the quality of their decisions. history has shown us that the most successful companies in the shipping markets focus on making a few high quality decisions that will only result in benefits several years in the future. In the simplest sense, this is a principal buying vessels when the market is terrible and waiting for the recovery. At VesselsValue, what we aim to do is provide the data to allow our clients to make these decisions.

Firstly, looking at sale and purchase, and vessel ordering trends, what are they telling us on how various sectors within shipping are coping, and can this indicate where markets will go? An example where this metric is valuable would be in the cruise sector, a less developed market but with interesting results that are applicable to more conventional shipping sub sectors. Pre COVID, cruise vessels were seen as a huge growth market. High value, high utilisation, growing demand, large revenues – results too good to be resisted. An example of this being new market entrants Richard Branson and Virgin Voyages splashing out almost 3 billion dollars on 4 newbuild cruise ships in (3 in 2015, 1 in 2018). Mr Branson and co were not alone in seeing potential in the cruise sector, there are 97 cruise vessels currently on order, this is compared to a current live fleet of 367 vessels – a fleet growth of 26%.

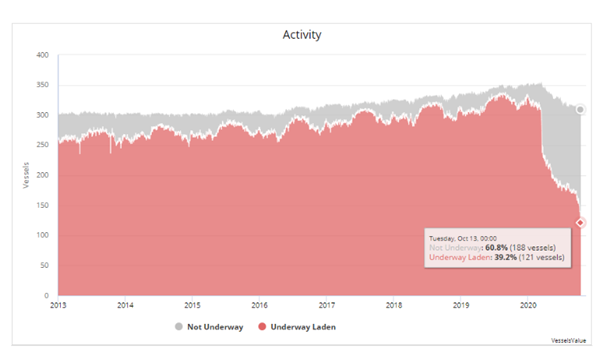

Through VesselsValue online trade service that tracks real time demand for vessels, data shows how COVID-19 pandemic has decimated demand in the cruise sector and has resulted in utilisation to plummet by around 70%. Figure 1 shows the drop in utilisation by means of vessels underway vs not underway, it is worth noting that a number of those underway will be on the way to lay up. Given the number of vessels on order, i.e. future fleet growth, and the lack of demand, expect a market correction. Sale and purchase activity in this sector is thus at its highest in the last 5 years, showing how SnP activity increases in extreme markets.

In the more conventional sectors, the current sale and purchase data is indicating a mixture of varying conditions and uncertainty.

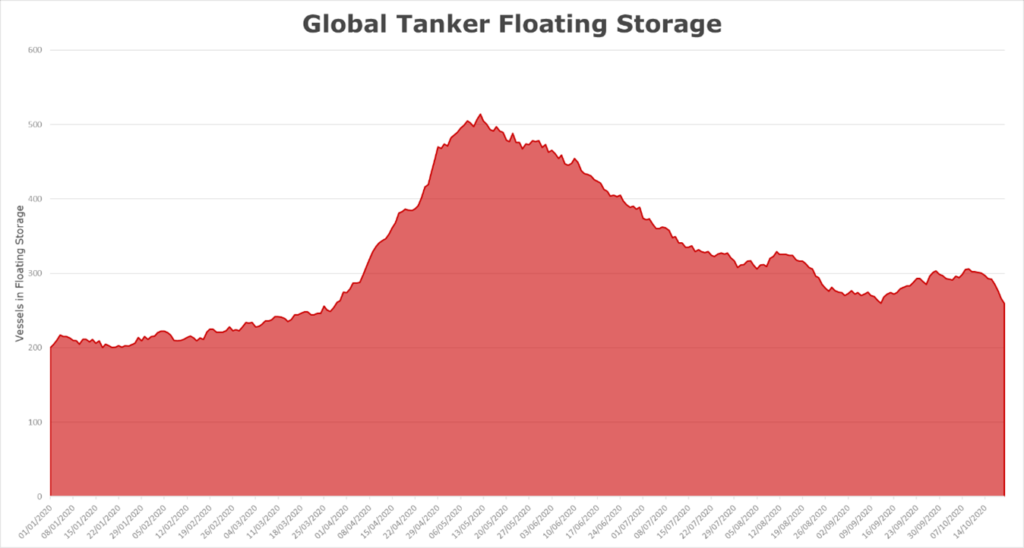

Having had a strong start to 2020, tanker sale and purchase activity is fairly high, with 469 deals concluded so far this year. These elevated levels indicate that a market correction is ongoing. This will predictably be a number of older vessels, that earlier in the year were used for floating storage as oil demand fell due to pandemic related lockdowns.

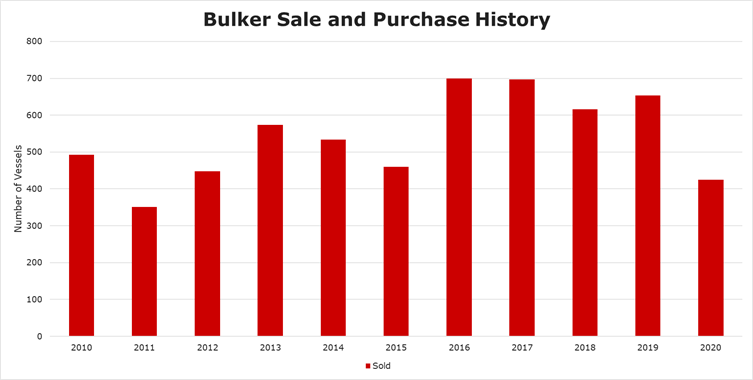

Bulker sale and purchase activity is down at 425 this year compared to 654 in 2019. The bulker market as a whole has experienced very mixed results over the last year, perhaps this lower level of transactions is a manifestation of this uncertainty. Recent positivity has been seen in China’s iron ore trade and Soybean imports, but really this recovery is to near pre pandemic levels which were not necessarily high to begin with.

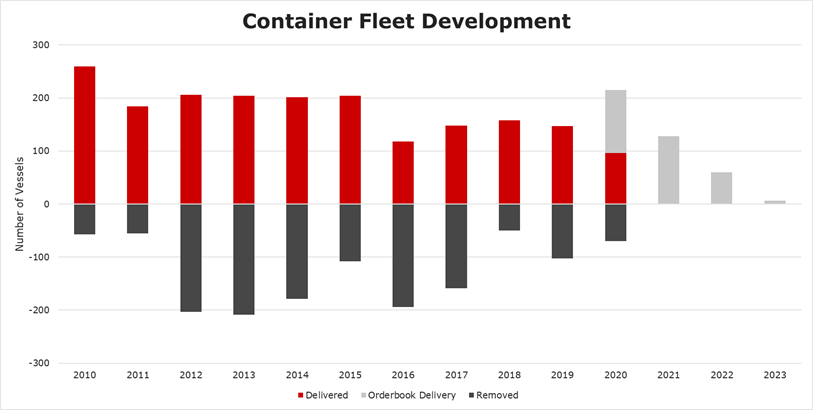

Container secondhand transactions are at their lowest levels since 2012, surprisingly the short term container market has benefitted from pandemic related demand for PPE, restocking and inventory growth ahead of the holiday season to negate any potential future disruption in supplies. Another reason why containers are not suffering as much as other industries is that this sector has made a marked effort in the last decade to control supply of ships and fleet growth. Despite this, the longer term container market is in the balance. As the COVID19 pandemic continues to impact global economies and consumer sentiment, the demand for consumer goods will be surely be negatively affected.

Shipping markets are being impacted in different ways due to their own supply and demand balance, but there is another factor at play. Globally, the measures that have been taken by governments, ultimately have protectionist goals. Each country is individually trying to control the impact of the pandemic and are protecting their own economies at all costs. This fragmentation will affect most shipping sectors as trades are disrupted. In a similar vein, protectionism through geopolitics and other vested interests such as the price and supply of essential commodities also heavily influence the shipping markets and could further disrupt them going forward. Examples of this being US China trade war, Brexit, Middle Eastern Oil exports.

The cyclical nature of shipping has been ever present in the industry. Markets perform well, vessel orders increase, the market shifts either due to oversupply or change in demand (or both), then the market corrects itself. The pandemic has exacerbated this already volatile industry. What is becoming apparent is the need for different thinking in shipping in order to navigate the uncertain future. One consequence of the pandemic that might actually help the shipping industry over the next cycle is the difficulty to obtain finance at the moment for newbuild shipping projects – thus restricting the overdevelopment of fleets. This does not mean that consolidation is the way forward, but rather modernisation, adaptation and unification of thought in an industry stuck in its ways.

Shipping is a very historic industry with huge global importance however, it is an industry that has been relatively slow to modernise given how quickly the world and other technologies have developed around it. Often the industry suffers from the same mistakes repeatedly, particularly on the vessel supply side. This will bring about scrutiny in a world striving for a sustainable future.

Consolidation is not necessarily the answer, the competitiveness breeds quality, but what does need to happen is improvement in the efficiency of the shipping industry. Stricter standards, environmental focus, decarbonization, innovation, utilisation of big data, digitalisation. These have been buzzwords in shipping for many years, with relatively little progress being made. Higher efficiency and less waste, this needs to be the mantra going forward.

For example, the vessels themselves. IMO2020 dragged shipping into a slightly greener space but debate continues on simple and effective efficiency improvements such as slow steaming. Alternative fuels exist in some of the more niche ship types (hybrid offshore ships for example) but are a long way from being implemented in the more conventional types. Shipping ought to be at the forefront of technological advance, not being viewed as the dinosaur industry of the modern world. Consider for example how much innovation and disruption has occurred in the car markets in the last 20 years, while the PCTC that carries them has largely remained the same.

In conclusion, the shipping markets are influenced in many ways by a number of different factors, some that we are responsible for such as vessel supply and geopolitics, but others where we are at the mercy of consumers and unexpected global events such as the pandemic. For a successful future of shipping in this new international trade landscape, what’s needed is the transformation of shipping into an industry that influences the future for the better – championing environmental issues, increasing operational efficiency and exercising control in order to negate future volatility. Shipping will always be the vessel for global trade, but needs to break its current cycle of inefficiency, apathy, and volatility.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?