RoRo Cargo Demand Drives S&P Transactions

After a slow start to 2021, there looks to be light at the end of the tunnel highlighted by P&O Ferries recent announcement to take back market leadership on the English Channel. Owned vessel THE PRIDE OF BURGUNDY (28,128gt, 1900 LM, 1420pax, March 1993, SSW Fahr) has become P&O’s fifth vessel on the Dover-Calais route this week, increasing from four. A mutual space charter agreement was signed with DFDS for three of their vessels operating on the same route – the COTE DES FLANDRES (33,940gt, 2000 LM, 1900pax, Mar 2005, STX France), COTE DES DUNES (33,796gt, 2000 LM, 1900pax, Nov 2001, STX Finland) and CALAIS SEAWAYS (28,883gt, 1784 LM, 1100pax, Oct 1991, Boelwerf) to enable departures every 36 minutes between Dover and Calais from the summer, reducing the gate to gate transit time by 30 minutes for freight only vehicles.

Customer demand is surging as per pure freighter Cobelfret. The UK, as a major demand market for pan-European RoRos, has just had its strongest month of economic activity for seven years with the Bank of England forecasting a 7.25 percent growth rate for 2021 – a seventy year high. Double-digit growth for 2022 from an unleashing of pent-up demand and excess household savings of £150 billion (€173 billion). Other operators have been anticipating as much for the region, adding tonnage to premier routes on the Channel, Celtic, Baltic, Biscay, Balearic and Tyrrhenian Sea. Last week, a Baltic charterer complained they had struggled to secure a small RoRo for a spot project, a remarkable turnaround considering the general over-supply prior to Covid 15 months previous.

This article reviews recent S&P activity generating in the RoRo sector as a result of this increasing demand, including commentary on Vehicle Carriers which rebounded from late 2020. We conclude with Fixed Age analysis – a useful tool for any investor, lender or shipowner with a vested interest in Roll-on, Roll-off assets.

RoRo Transactions

Q1’21 operator results were generally positive. DFDS reported a 23% EBITDA increase based on a fast recovery from the Brexit transition, higher than expected earnings in the Med, and increased cargo volumes in the Baltic improving the group revenue outlook by 20-25% versus 2020. Demand for freight has recovered, and S&P activity is warming up. Heavyweight’s Cobelfret and DFDS concluded a swap plus cash deal for the MELEQ (4076 LM, Apr 2017, FSG) and GOTHIA SEAWAYS (2475 LM, Oct 2000, Flender Werft) in April. The MELEQ was purchased by Cobelfret in January 2020 for €50 million, and has a VV value of €43.8 million today trading as the ACACIA SEAWAYS. The GOTHIA SEAWAYS has a VV value of €9.2 million, renamed the MAXINE by new owners Cobelfret. In March, the UNDINE (1604 LM, Dec 1991, Dalian) was sold in the mid to low €2 million range (VV at €2.17 million day before sale).

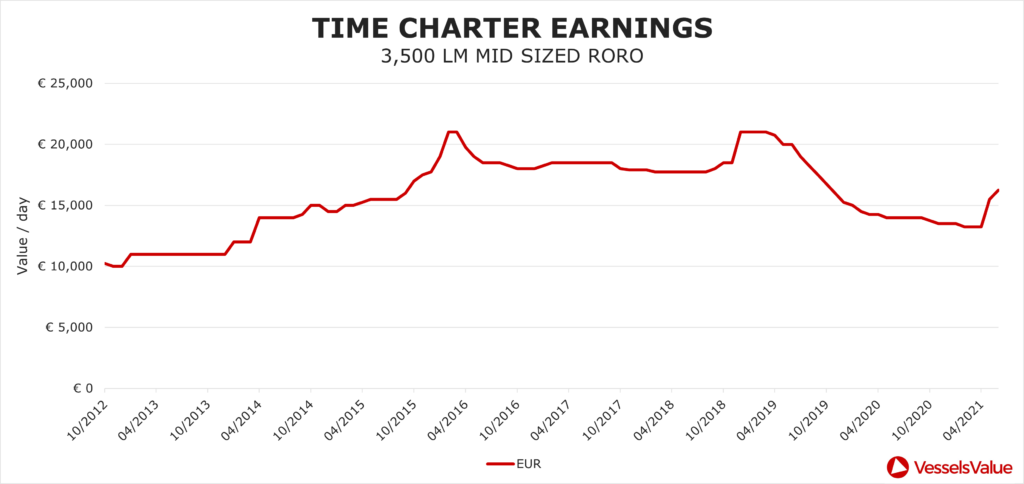

On the earnings side, the ALF POLLAK (4076 LM, Oct 2018, FSG) was fixed in the range of €17,000 – €20,000 per day in May, a €4,000 per day premium versus her sister of similar age extended only four months previous. This is a clear signal that sentiment is firming. Earnings have remained broadly flat over the last 12 months as can be seen on the VesselsValue time series graph (chart 1.1). However, a rebound was seen in May and continued to climb through June, with rates now tracking the peaks of 2015/16 when period charters exceeded €20,000 per day. It will be interesting to see what happens with the HONFLEUR (42,500gt, 2400 LM, 1680pax, July 2021, FSG) whether sold or chartered, and route deployed. There are rumours we may see her trading on the Channel next quarter.

Auto Demand Driving Growth

April trade data from Japan confirmed a 45% increase in exports to the US, and 39.6% growth to Europe – the most since 1980. Two of the top three traded commodities were finished cars and auto parts which good news for Vehicle Carriers and RoRos contracted to carry car manufacturer business.

Interest in second-hand PCTC tonnage has been strong, but the volume of transactions has kept relatively low due to a lack of available tonnage. Twenty two year-old PERSEUS LIBERTY (6,400 ceu, Jan 1999, Imabari) was purchased by Doriko for $13.8 million following an increased counter offer to fend off competition. The GLOVIS COMPANION (6340 CEU, Feb 2010, Mitsubishi HI) was sold by its Norwegian owners to Korean buyers in the low $30 million range (VV at $29.53 million). Earnings have hardened month-on-month this year. Rates for a 6500 CEU PCTC have increased by 54% since January based on a 12 month time-charter. Midsized units have followed the same trend. A midsize 4000 CEU unit was fixed between $16-$17,000 per day in early May, an increase of $2,000 per day versus the April average.

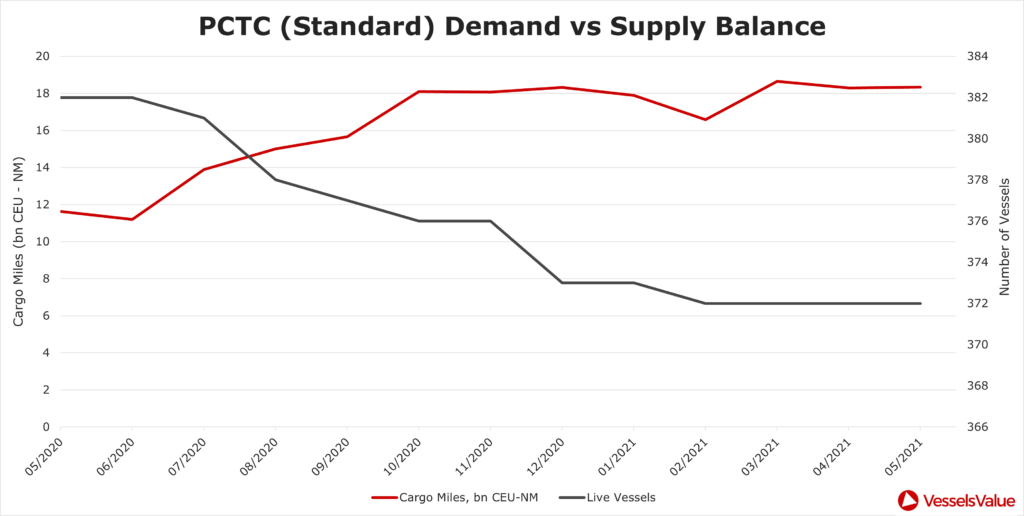

Tonnage providers have capitalised on firmed demand and tight supply fundamentals concluding longer term fixtures at higher daily rates, despite the headwinds of a global microchip shortage restricting seaborne exports, and reactivated vessels returning from cold lay-up. A low orderbook and near record high scrapping activity in 2020 laid solid foundations for the positive conditions we are seeing today, driven by an underlying demand for cars from consumers with pent-up savings. This is perfectly illustrated in chart 1.2 based on a 6500 CEU PCTC, the workhorses of the car carrier fleet. Cargo demand expressed in billion CEU-NM improved steadily from August 2020, whilst the vessel count moved in the opposite direction reducing to 373 vessels by April 2021.

A Good Time To Buy

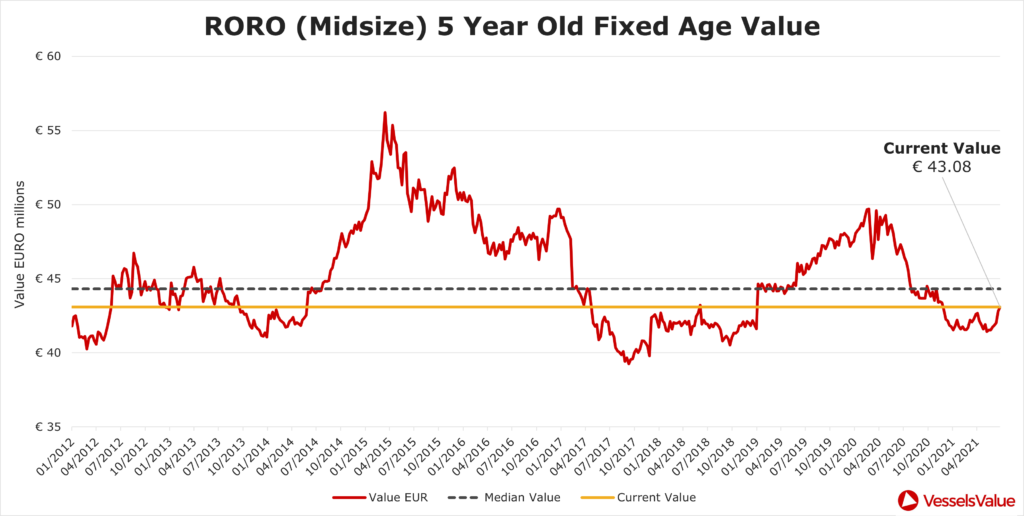

By using VV’s Fixed Age Analysis module, we can visualise the historical distribution (i.e. statistical probability) of market values for different generic vessel types and ages with intra year depreciation removed. This is particularly useful for shipowners evaluating a sale or purchase opportunity.

We have selected a midsize five year old RoRo to compare against historical values tracing back to 2012 (chart 1.3). The current value is circa €13 million less than the peak of 2015 at €56 million, and €1.5 million below the historical median. Considering the improved freight sentiment and forward demand prospects from operators, the timing of the MELEQ (4076 LM, Apr 2017, FSG) sale looks to be good value for DFDS.

Conclusion

Demand optimism is outweighing concerns related to Covid and inflation. High business confidence and pent-up consumer demand are unleashing in vaccine powered economies led by the UK in Europe. Services have been upgraded by operators in response to surging customer demand, including lane meter space sharing agreements for a bigger slice of the desirable Dover-Calais freight market. S&P activity is picking up, and we are starting to see time charters fixed at levels of past peak years. A global commodities boom is expected to further support demand for RoRos carrying high & heavy rolling machines in addition to OEM car business. The OECD (Organisation for Economic Cooperation and Development) recently said it will take three years until many of Europe’s economies have recovered to pre-pandemic levels. Based on current trade sentiment, we expect sooner.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?