Shipping State – Singapore

Whether you are involved in shipping or not, the city state of Singapore makes it hard to ignore. If you happen to find yourself in one of the city’s many sea view establishments or simply indulging in some R&R at the beach on the weekend, shipping is an obvious ever-present part of Singapore’s landscape.

The city state has often been referred to by the wider press as the shining star of South East Asia. The clever development of the economy as a financial hub, negating the lack of natural resources, throughout the latter part of the 20th century opened Singapore up to international business. This transformed the country into the powerhouse it is today, an impressive feat given the fact that in 2020 Singapore is celebrating only its 55th year of independence.

Singapore, however, is not immune to the global challenges faced in light of the COVID-19 pandemic. Although some facets of normal life have returned, unemployment is rising, and the economy contracted by 41.2% the second quarter from the previous three months. YoY the economy shrank 12.6% as tourism, construction and retail took the biggest losses. Footfall at Changi Airport fell by 99% YoY in April, a startling figure released by Changi Airport Group.

Though what metrics can we use for the state of shipping within Singapore? Given its position on the Malaysian peninsula, we can use VesselsValue journeys and stoppages data to analyse how traffic has changed through the port of Singapore and observe the differences between now and pre COVID times.

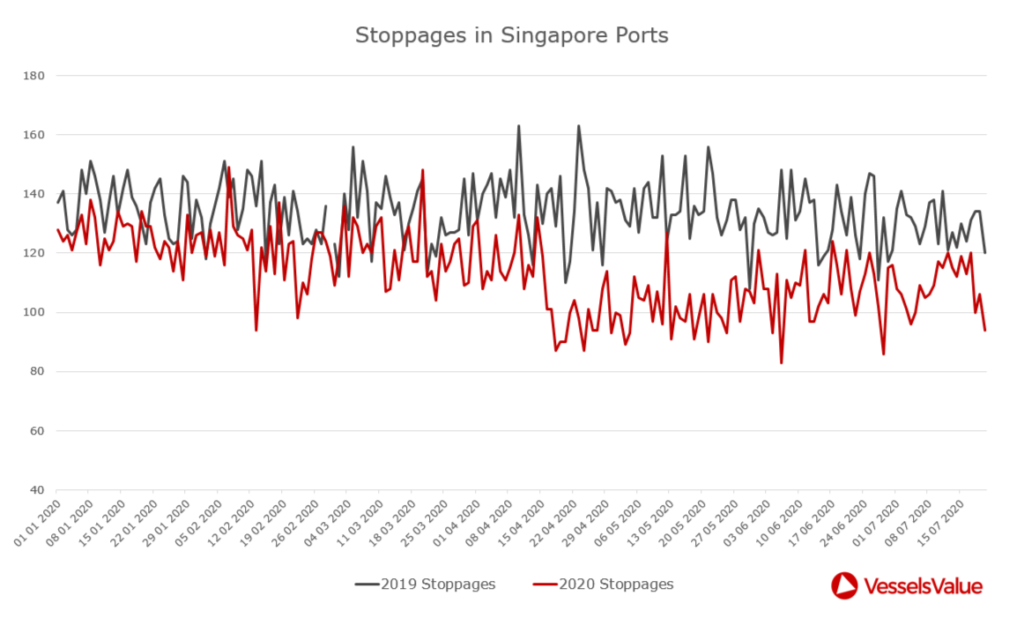

Above is the year on year number of stoppages in Singapore port. Stoppages can range from a number of things; At anchor, discharging, loading, floating storage, drifting, idle or cargo operations. Essentially, this is a measure of activity. This information can be used in a number of different ways, from measuring journeys of individual ships, to identifying most commonly traded routes for entire fleets or particular vessels adhering to a certain search criteria on the VesselsValue platform.

Observing the graph above, we can see the obvious impact that COVID-19 has had on the stoppages in Singapore. The change from 2019 to 2020 fluctuates week on week, but from the graph we can estimate an average difference of c.30% drop from 2019’s activities. Reasons for this are not limited to one factor. China, possibly the world’s most important trader of goods, caused a c.30% drop in global oil demand almost overnight as it was the first country to enforce countrywide lockdowns. With no cross country movement permitted, shipments of goods were significantly delayed, and international vessel owners diverted tonnage from calling in Chinese ports amid uncertainty of 14 day quarantines for crew. China was only one piece of the puzzle, as the virus peaked so did the slowdown in global trade. Results of which are still being felt in Singapore as well as all over the world.

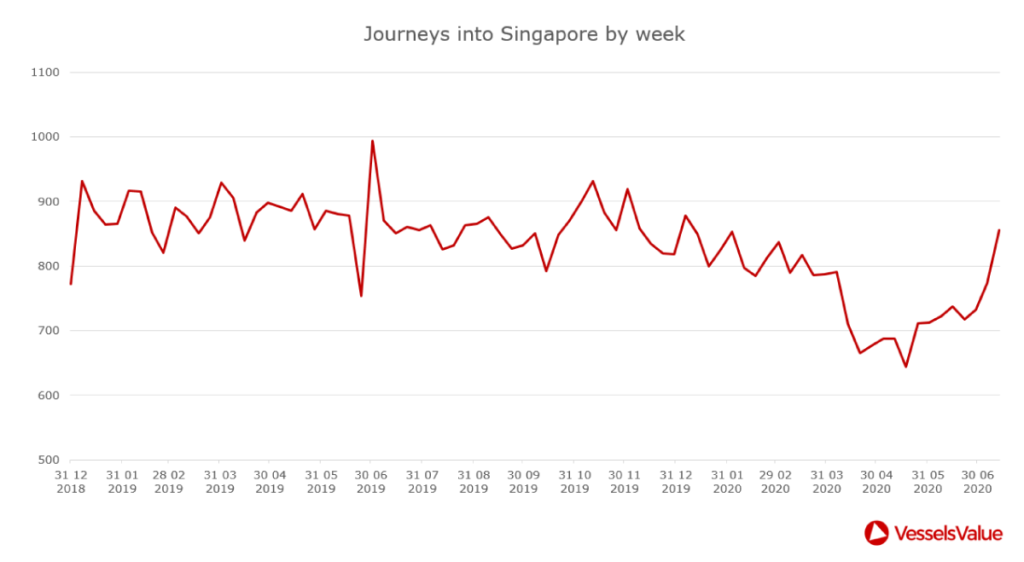

It is not all negative news, however, observing the number of journeys for all ship types into Singapore over the last year, week by week, we can see a recent uptick. As we can see, this has been relatively consistent over the past 18 months, with a very visible drop off due to the COVID-19 pandemic. Journeys to Singapore fell below 700 for the first time in this 18 month period, with many ships sitting idle in its waters during this time. In July, journeys to Singapore have increased to a healthy 855 at the last count. It will be interesting to see if this is maintained.

Out of the current 840 vessels in Singapore territorial waters, over 50% of these are tankers. With strong uptick in sentiment being felt for clean product exports from China, this could benefit Singapore and activity around its ports. Those in the industry will hope this positive sentiment can yield concrete results, in these particularly uncertain times.

From a journey count into Singapore of 800 at the beginning of January, the week of 13th July saw an increase to 855, a rise of 7%. From the low registered in the week of 18th May, that journey count of 855 is a rise of 33%. One thing for certain is that, despite feeling effects of COVID-19 adversity, Singapore is and will remain an important shipping powerhouse.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?