Shipping’s Green Mile

A Roadmap for Fossil Free Shipping

Flows of money were already pouring into sustainable funds prior to Garth Brooks rendition of Amazing Grace at “green president” Biden’s inauguration. Electric Vehicle maker Tesla increased its market cap by an astonishing USD 500 billion in 2020. It is now more valuable than the world’s top eight automakers combined, owing to cutting edge lithium-ion battery technology and the visionary Elon Musk who takes more risks than most. If only such equity returns were possible in the margin thin shipping business.

Last month, Stena Line took the bull by the horns in the RoRo sector by announcing the world’s first fossil free fully battery powered RoPax vessel of its size. At 200 meters in length, the lightweight Stena Elektra will have capacity for 1,000 passengers and 3,000 lane meters of freight, capable of 50 nautical miles on a single charge targeting the Gothenburg – Frederikshavn route. Stena are looking to add fuel cells, hydrogen, and biofuels to extend the power from 60-70 MWh in collaboration with Volvo Group, Scania and the Port of Gothenburg which a smart move. Regrettably, she will not be ordered for another 4 years, launching into service 5 years later in 2030. Rome wasn’t built in a day, but it feels slightly undercooked. DFDS responded soon after in more bullish tones, partnering up with ABB, Ballard Power Systems Europe, Hexagon Purus, Lloyds’s Register, KNUD E. HANSEN, Orsted and Danmarks Skibskredit to develop a ferry 100% powered by hydrogen which could be fully operational by 2027 – if public money from the EU Innovation Fund is approved.

So, we finally have a race towards carbon neutrality in the RoRo sector, which can only benefit the wider industry bringing more investors to the table. Sale and purchase activity has been down prior to Covid-19, with a scarcity of second-hand buyers and new orders stalled as shipowners deliberate on green technology and best timing. Container operator Maersk, pledging carbon neutrality by 2050, will place its first zero emissions order within 3 years, deciding between ammonia, methanol, biodiesel, and lignin fuel. That is a lot of fleet replacement. And if the EU commission makes good on carbon taxation to achieve climate targets by 2030, we could be looking at a major shake-up in the industry.

Premium for Zero Carbon Ships

Transparency is the name of the game in today’s consumer led supply chains. Manufacturers are acutely aware of environmental, social and governance (ESG) standards, using tech such as blockchain for immutability and accountability of supply. Global Forwarders advertise online carbon calculators for sales and emissions clarity, enabling exporters to see the carbon footprint per unit of cargo quoted. DSV is currently working on a digital platform that will enable customers to choose more climate friendly routes and pay extra for green fuel. Whilst Carriers, as transport suppliers to both Manufacturers and Forwarders, must accurately report on CO2 emissions per freight unit to secure long term contract business. Fairly soon the end consumer will expect zero carbon transportation from end to end in the supply chain, on cost parity over land and sea. There lies the drawback for shipowners.

So, what will happen to RoRo asset values as we transition to green? It depends on the cargo mix, respective markets, and the type of RoRo. In the mid-term, we expect to see a divergence in charter rates with stronger relative demand for LNG powered tonnage and battery hybrids. PCTC, RoRo, Ropax and ConRo shipowners already priced-in to LNG such as Siem, UECC, NYK, K-Line, Stena RoRo, WALLENIUS-SOL, Bore, Tallink Grupp, Matson, Crowley, Seaspan are in a favourable position to capitalise over non green assets. Grimaldi’s green battery-in-port hybrids are a clever compromise and values should hold up relatively well especially if the battery tech develops. NYK recently announced they plan to replace existing PCTC fleet with 40 x newly built LNG-fuelled vessels over the next decade, reducing CO2 emissions by 50% per ton-kilometre by 2050. However, these plans could be revised if the EU toughens its policy on emissions pushing through a regional carbon levy as a logical next step. Biden is likely to support it.

A Blueprint from Norway

Latest global predictions from auto analysts suggest 20% of all new car sales will be electric by 2030, rising to 58% by 2040. These are big numbers, and perhaps conservative for Europe noting more than half of Norway’s total was electric in 2020, with many arriving on PCTC’s from Tesla’s Gigafactory in Shanghai (although outsold by Volkswagen). Norway has the highest number of electrical ferries in the world where pioneer Norled is now building a hydrogen driven ferry. The car market transformed due to generous Government tax incentives, excellent stakeholder collaboration, and strong consumer demand for electric vehicles.

GM (General Motors) referenced Norway’s success in their Super Bowl commercial last month employing Will Ferrell to great comedic effect. GM are launching 30 new global electric vehicles by 2025, aiming to be completely electric by 2035. With such development, investment, and demand – it is plausible to imagine a scenario next decade where a leading car manufacturer will insist their sophisticated electric tech vehicles are shipped on zero carbon vessels, paying a premium for the service, bringing value back to shipowners and shareholders invested.

Values as we Transition to Green

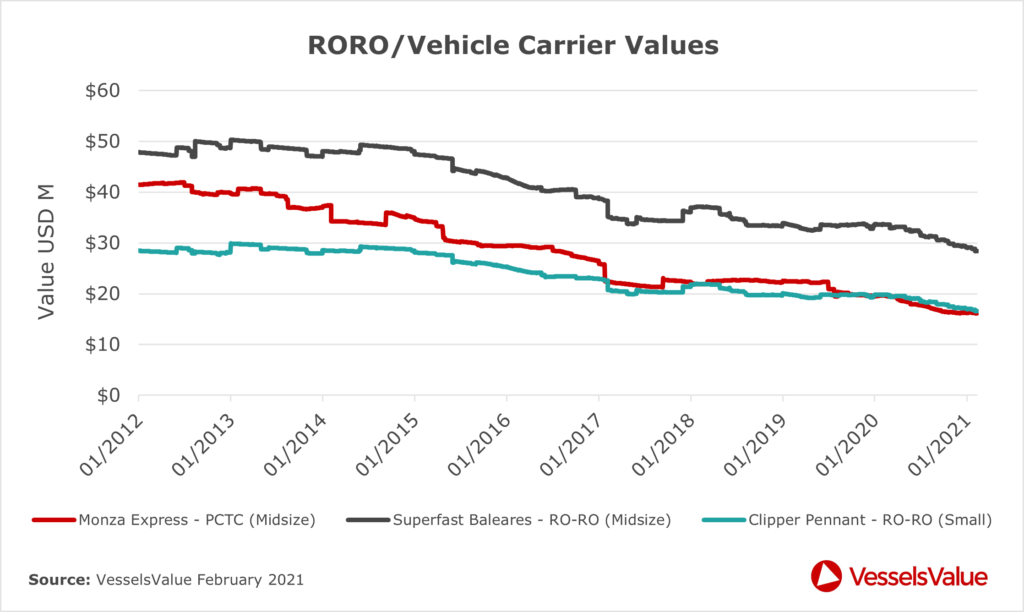

Figure 1. compares historical values for a Vehicle Carrier and two RoRos of similar age, tracking the PCTC-Midsize MONZA EXPRESS (3693ceu, 2009, Hyundai Mipo), the RoRo Midsize SUPERFAST BALEARES (3625lm, 2010, Navantia Carenas), and the RoRo-Small CLIPPER PENNANT (1830lm, 2009, Ast de Huelva) from the 1st of January 2012 until the 31st of January 2021. At VesselsValue, we track the daily value of a RoRo back to 2012.

As per the red trend line, the PCTC depreciated at the fastest rate losing 61% in 9 years. The midsize and small RoRo’s, as per the black and turquoise trend lines, held value depreciating 41% and 42% respectively. Midsize PCTCs were cannibalised by larger vessels during this period, as new Post Panamax deliveries of 7000 to 8,500 CEU (Car Equivalent Units) hit the water from 2013. We are starting to see the same scenario play out today in the European straight ramp RoRo market, with mega sized deliveries of 5000-7800 Lane Meters squeezing out smaller tonnage on competing routes.

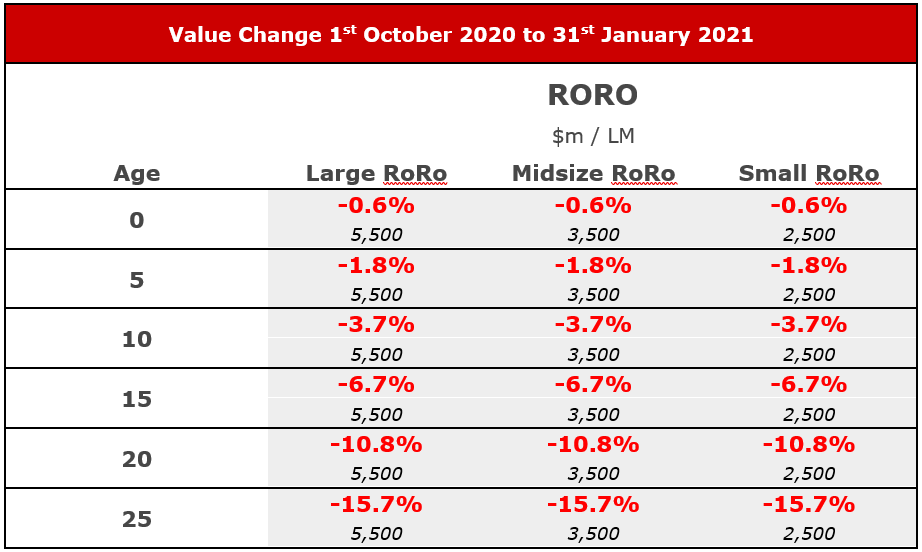

Based on the high proportion of valuable cars on LCTC/PCTC/PCC vessels, Vehicle Carriers will be the first type to go “green.” Closely followed by Ropax Ferries trading on shorter city to city journeys, where passenger income is the driver of earnings. Pure cargo RoRo vessels will enjoy the longest period of grace due to a more diverse cargo mix. The impact to values as non-green assets compete head on with green assets in respective markets is the big unknown. As per figure 2, RoRo values have been falling over the last four months primarily due to an oversupply. Government incentives to encourage scrapping could address this imbalance.

Shipowners report an increasing difficulty in selling small, vintage tonnage, particularly in Europe. The net must be cast wider on a global level, and this is where VesselsValue can help connecting sellers to buyers by utilising our extensive online sales database. Search features such as year built, builder’s yard, lane meter capacity, passenger capacity, engine type, vessel speed, ramp and deck strengths, deck heights and adjustable decks etc are recorded and maintained by our team of researchers. The same database is tracked by our proprietary algorithm to provide real-time market valuations using the latest transactional inputs including time and spot charter, adjusting to the state of the market in the absence of raw sales and purchase data (i.e. built for illiquid and semi-liquid markets). How else can you truly value an asset in a depressed market, or during periods of high volatility?

Values

Final Thoughts

Investing in bridging fuels versus carbon neutral solutions continues to divide shipowners. However, we are beginning to see Carriers take clearer positions with electric, biofuels and hydrogen emerging as front runners in the RoRo sector. Dual-fuel LNG engines equipped with battery packs, which also have the flexibility to run on fossil free liquid or gas are a safe bet. The need for real-time asset valuations has never been greater.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?