Singapore Maritime Fleet

Using VesselsValue data, we take a look at the Singaporean owned fleet, to mark Singapore Maritime Week 2023. The infographic highlights the key Singaporean Shipowners both in terms of the value of the fleets and by number of vessels owned. We will also take a look at the most valuable Singaporean owned cargo vessel.

Top five Singapore Shipowners

Eastern Pacific Shipping is the largest owner based in the Lion City, both in terms of value and number of vessels owned. The total value stands at USD 10.94 bn, of this sum USD 5.1 bn accounts for live vessels consisting of Tankers, Bulkers, Containers, LPG and Vehicle Carriers, USD 5.8 bn of this fleet is currently on order. The total value is more than double the value of the company in second place, Tanker owner AET, who have a fleet value of USD 5.4 bn with USD 4.9 bn live and USD 447 mil on order. Container owner PIL, rank third with an overall fleet value of USD 2.5 bn, this figure includes USD 1.57 bn which is the current value of the live fleet and an orderbook with a value of USD 909 mil. Berge Bulk rank fourth with a fleet value of USD 2.46 bn, no vessels currently on order. In contrast, Container operator Ocean Network Express (ONE) do not currently own any vessels but rank fifth due to the size of their orderbook which is currently valued at USD 2.46 bn. The orderbook consists of 20 New Panamax Container Ships of 13,700 TEU, these vessels are scheduled to be delivered between 2025-2026.

In terms of fleet size, Eastern Pacific rank first overall with 75 vessels trading and 70 vessels currently on order. PIL rank second with a total fleet of 84 vessels, they have a slightly larger live fleet with 76 vessels on the water, however their orderbook is considerably smaller, standing at eight vessels. Miclyn Express Offshore rank third with a total of 71 live vessels and two on order, consisting largely of OSV and OCV vessels. Berge Bulk are fourth with 66 vessels trading, Capesizes, including Newcastlemaxes and Valemaxes, make up c.83% of this fleet, followed by Handy Bulkers at c.3% and Handy Bulkers at c.2%. Tanker operator Hafnia are in fifth place in terms of number of vessels with a fleet of 63 Tankers, including 47 Handy Tankers, 10 Panamaxes and 6 Aframaxes.

Most valuable Singaporean owned cargo vessel

The most valuable Singaporean owned vessel is the three year old Eagle Balder (128,400 DWT, Mar 2020, Samsung). Owned by AET and operated by Equinor, this Aframax Tanker is valued at USD 205.19 mil.

Singaporean owned fleet

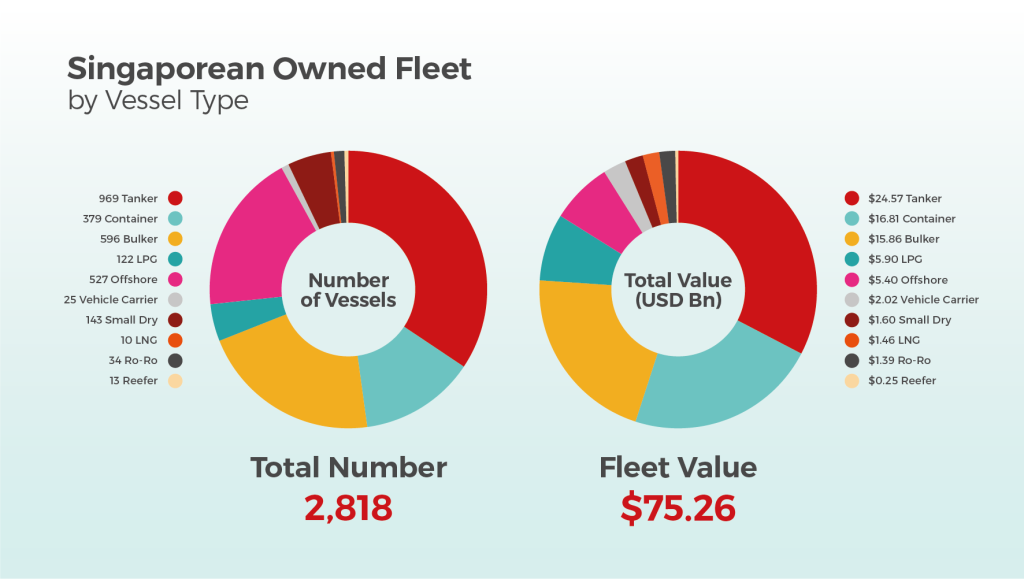

Tankers are the most popular vessel within the Singaporean fleet with a total of 969 vessels including both live and on order, followed by Bulkers with 596 vessels and Offshore with 527 vessels. Tankers are also the most valuable sector for Singapore, worth USD 24.57 bn. This sector is currently experiencing extraordinary increases in values, which have hit 15-year highs in many sub sectors and age categories, due to surging demand. For example, the price of a 15YO is up by c.105% YoY from USD 19.18 mil to USD 39.34 mil. This is attributed to improved demand fundamentals and shifting trade flow patterns resulting from the EU and G7 Sanctions on Russian oil which has resulted in an increase in tonne mile demand. Containers rank second in terms of value, worth USD 16.81 mil, soaring global demand for this sector over the last few years, sent values to record breaking highs last year, they have since corrected lower but remain at high levels. Bulkers are in third place, values for this sector and values have strengthened since 2021, due to a recovery in commodity demand following the pandemic and changing trade flows of coal due to the sanctions on Russia. Although global pressures have created challenges for the worldwide economy and for Bulkers recently, the reopening of China following easing Covid restrictions has boosted demand for iron ore, providing further support for values.

Download the full infographic here.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?