Superyacht Full Year Review 2022

Introduction

During the 2021 Monaco Yacht Show, 2022 was marked as a significant year for the Superyacht market. Despite the numbers recorded by the newbuild and brokerage markets, the general hope was for a return to pre Covid-19 normality for the market. However, the conflict in Russia and Ukraine introduced a new set of challenges and changes for Superyachts. The sanctions imposed due to the conflict produced a significant increase in international interest and scrutiny of the industry; Superyachts became the asset type of choice when commenting on Russian ownership. However, Superyachts were not the only asset type to be highlighted when investigating Russian asset types, as homes, art, classic cars, and private jets had also been topics of interest.

While many feared that the focus on sanctioned individuals and their Superyachts might cause irreparable damage to the industry, the numbers explored herein do not support those initial concerns for the markets reputation. Despite the media attention on the Superyacht industry, when looking at the data we see that demand has remained high, and we continue to see a rise in values for the analysed period.

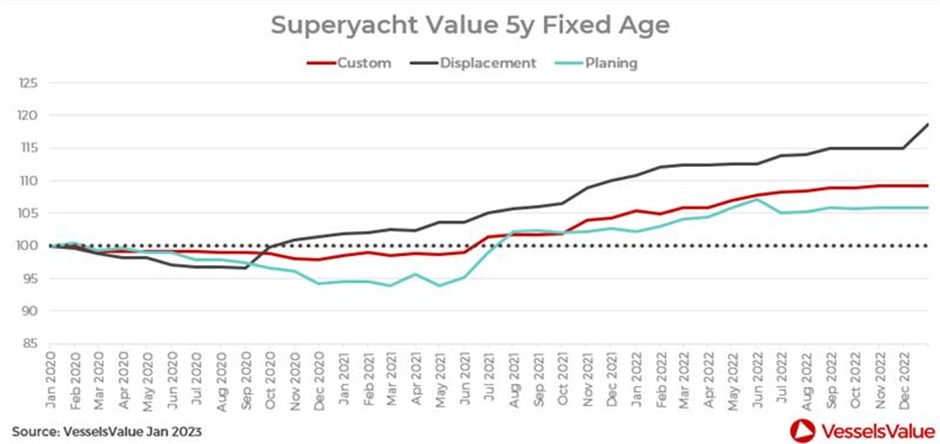

It should be noted that value changes over this period have not been the same across all types and ages of vessels. For instance, Superyachts that are 15 years old or more have not seen the same value increases due to the high saturation level of the market in this sector. By considering the fixed age value of vessels that are five years old, we are able to see the trends that have been discussed widely. Crucially, we can see the increase in values across the various vessel types since January 2020. Displacement and semi displacement production vessels have increased by nearly 20 per cent, customs have increased by nearly 10 per cent, and planning vessels by around six per cent over this period.

While the steep increase in values for displacement and semi displacement production vessels in December 2022 seems somewhat anomalous, we can see that from August 2022 values have begun to stabilise as the market has cooled.

The Russia Ukraine conflict undeniably had an impact on the Superyacht industry in terms of public opinions and active buyers across core sales markets. Regardless, the market has proved itself to be resilient. Thus, this article focuses on highlighting the importance of having objective data and insights to assess sectors.

Liquidity

Liquidity, in a Superyacht brokerage context, refers to the rate at which assets are being sold. In a liquid (sellers) market, transactions will be occurring regularly, and one would expect prices to start increasing. In an illiquid (buyers) market transactions will be happening less regularly, and prices will likely decrease.

Superyacht Sales

Points of Interest

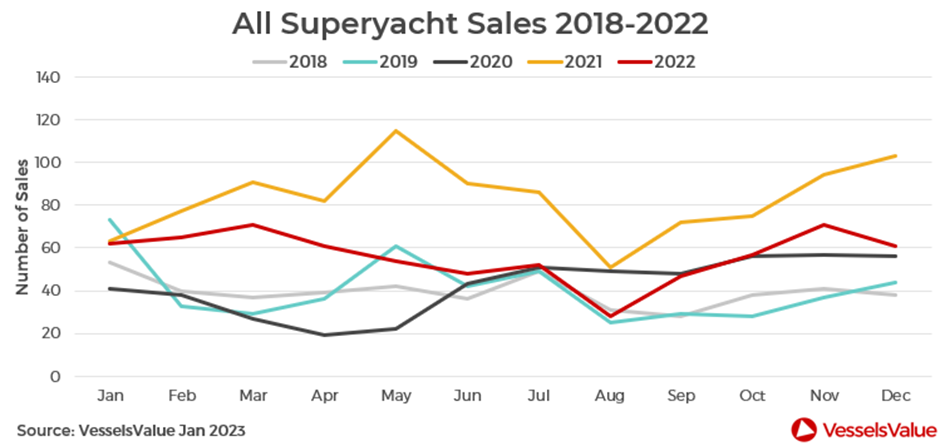

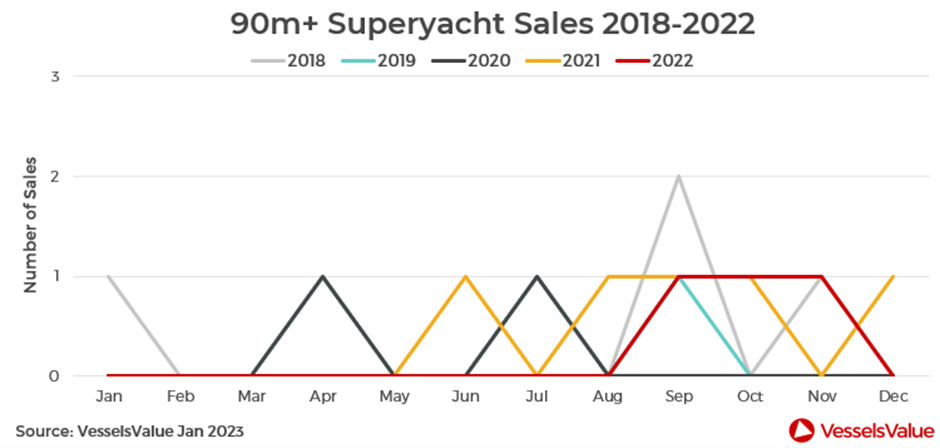

- 2021 saw a record 999 24m+ Superyacht S&P transactions

- Activity remained strong in 2022 with 677 transactions (32% decrease from 2021), significantly outperforming the years preceding 2021

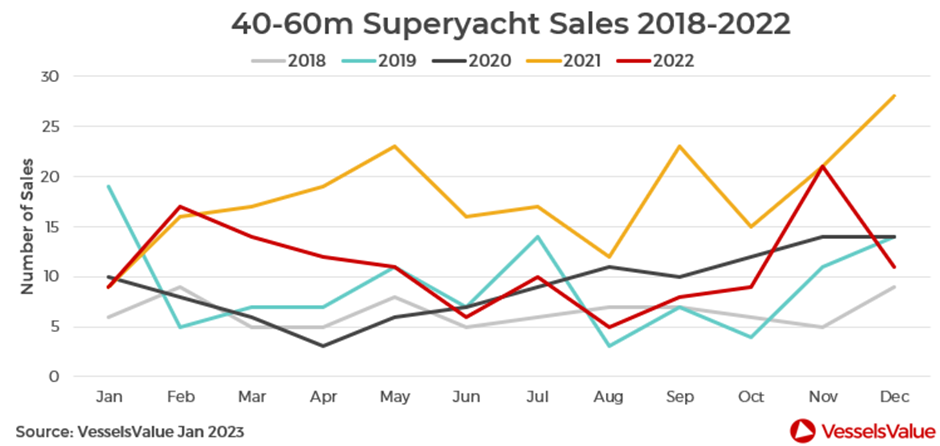

- Most significant decrease in activity (39%) occurred in the 40-60m sector

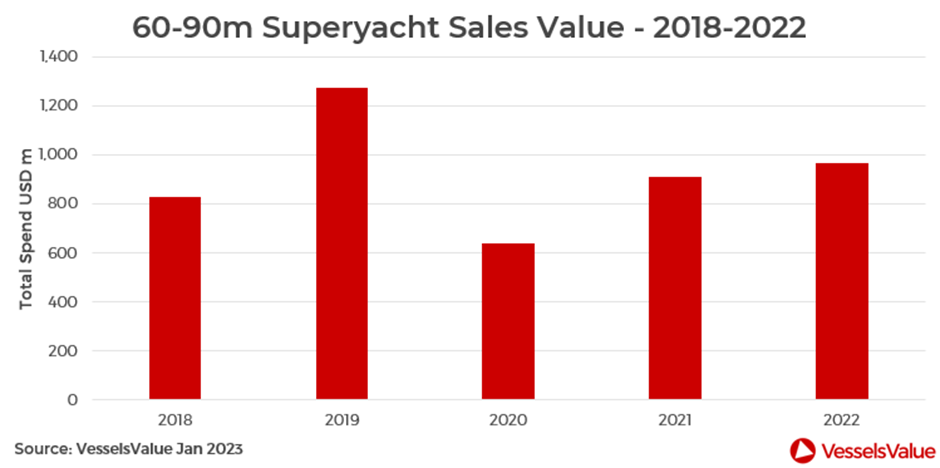

- 60-90m sector proved to be most stable with an 11% decrease in activity

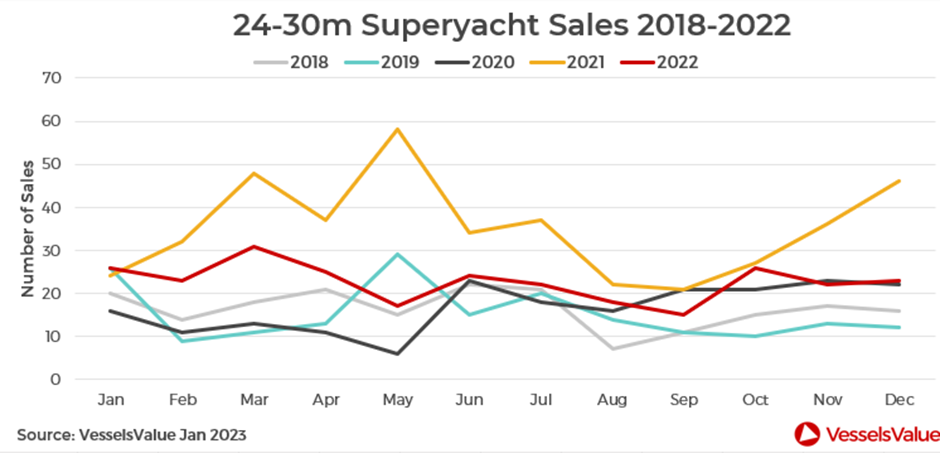

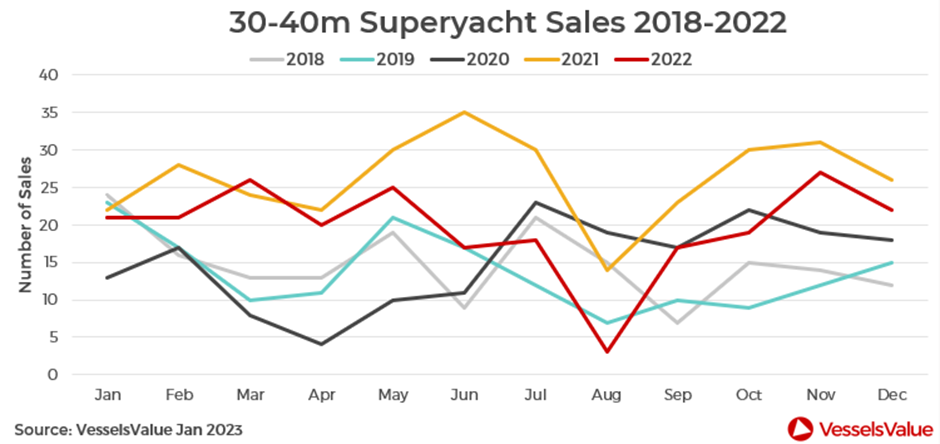

- Seasonality of sales returned to normal in 2022 with sales reducing by 54% and 63% in May and June respectively

By now the excellent brokerage performance of 2021 has been well reported, with various stakeholders and market commentators presenting theories for this boom in activity. Most Superyacht professionals would not have believed the pandemic would result in the best year for the sales and newbuild markets. However, they would later attribute the success of the market to the fact that Superyachts were considered safe havens by the world’s wealthiest.

Conversations with lawyers, brokers, designers, and the various other stakeholders with access to buyers, suggest that this theory was more rhetoric than it was a legitimate hypothesis. Rather, it seems simply that a lot of people made a lot of money, and even the world’s ultra high net worth individuals (UHNWI) were made to come to terms with the finite nature of the human experience. With the mixture of wealth generation and introspection, we saw a lot of first time buyers enter the market.

The big question, however, was whether 2021’s numbers were sustainable and, evening during the boom in 2021, almost all agreed that they were not, and so it has proved to be.

It is accepted that the Superyacht market is finite, and we can see that the boom experienced was not set to last. Seeing the market cool in 2022 suggests firstly that there is less quality capacity left in the market than in 2021. Secondly, the slowing down of activity may be a by product of prices increasing for those vessels that were still available. Add to this a poor economic outlook from the end of 2022 and beyond, and a decrease in activity was inevitable.

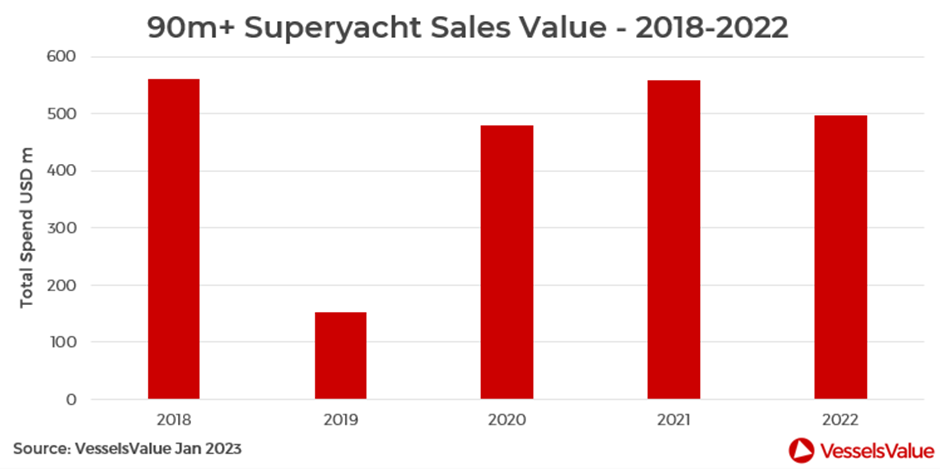

Superyacht Sales Value

Points of Interest

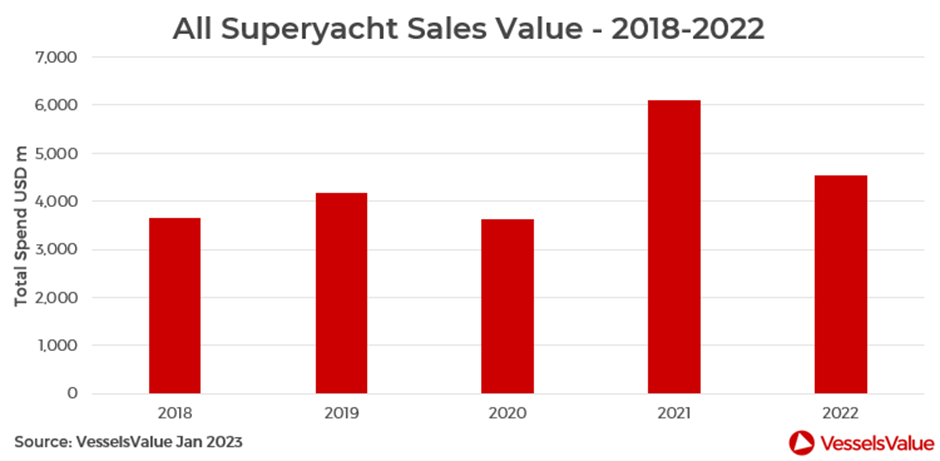

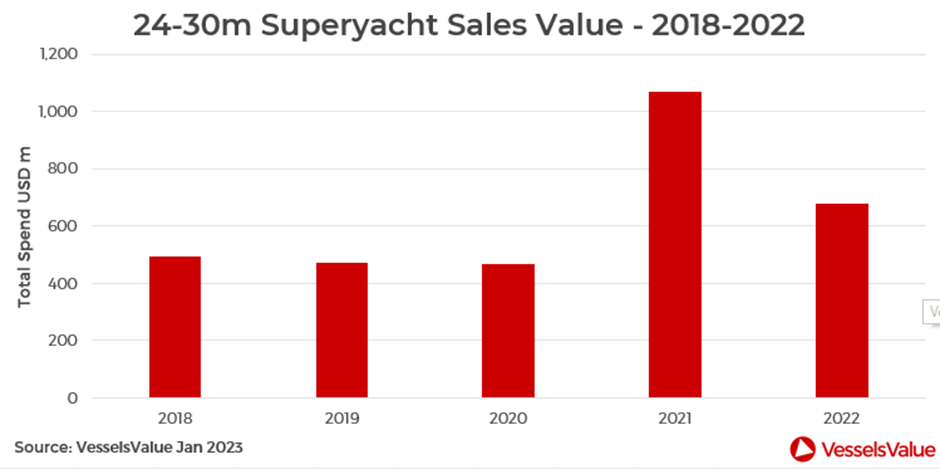

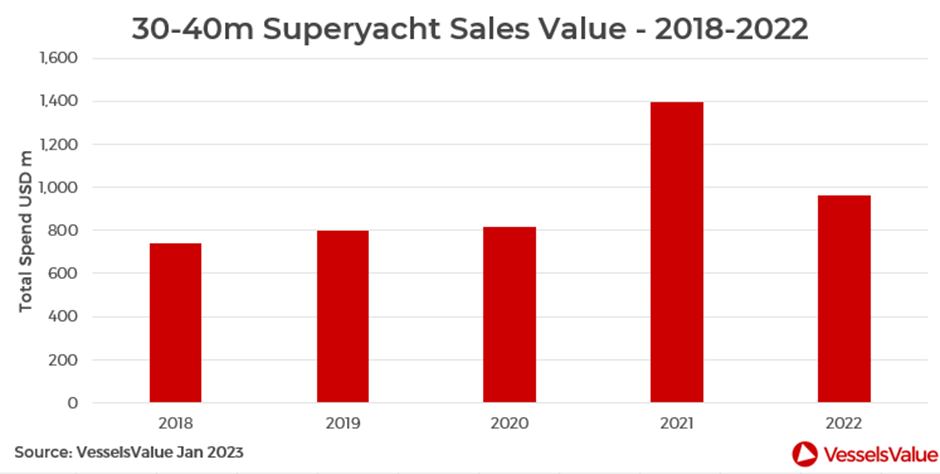

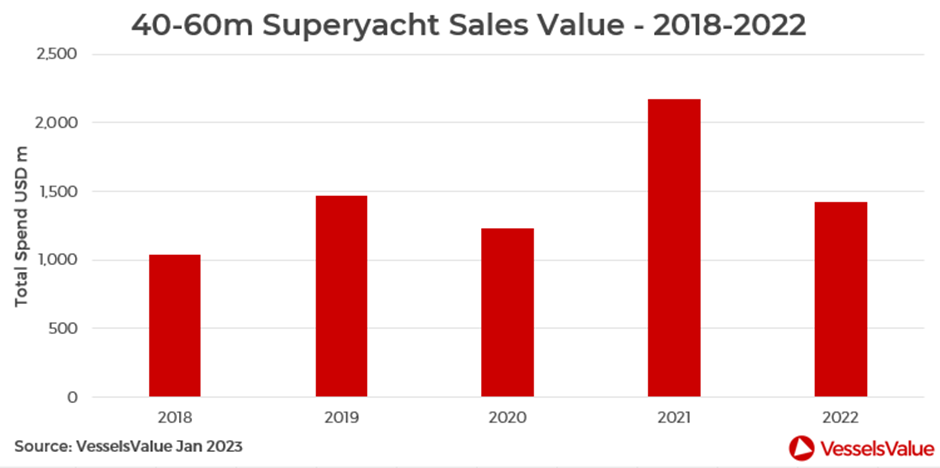

- The decrease in total value of sales (26%) is less than the total decrease in number of sales (39%)

- The most significant decrease in total value occurred in the 24-30m sector (36%)

- 60-90m sector proved to be most stable with an 6% decrease in total sales value

The percentage decrease in total sales value was less than the percentage decrease in number of total sales, which is indicative of an industry that has increased in price on average and maintained a high level of demand. The total value of Superyacht assets sold in 2022, according to VesselsValue and proprietary sales coefficients, is USD 4,528.2 mil compared to USD 6,105.9 mil in 2021.

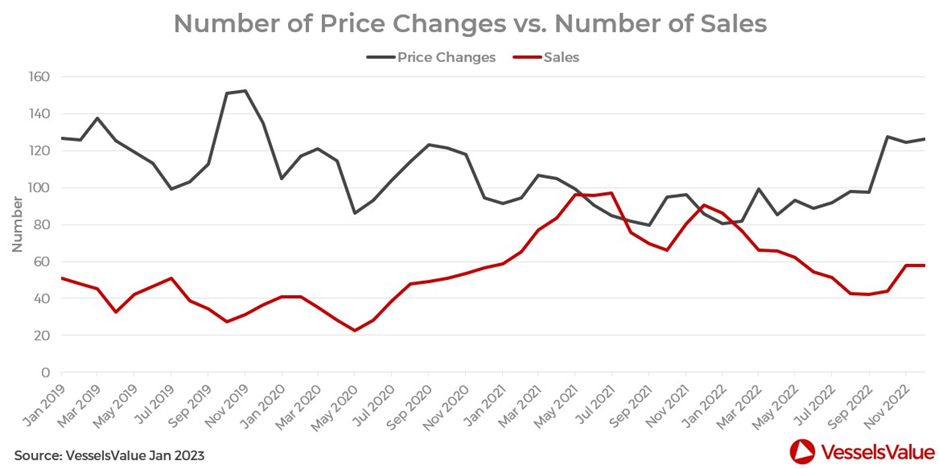

Price Changes vs Sales

Points of Interest

- As sales fall, price reductions increase

- There was a sharp increase in the number of price reductions from September to December 2022

- The sales market was performing optimally in July and November 2021 in comparison with price reductions

- Far greater numbers of price reductions in 2019 and 2020 than in 2021 or 2022

During the periods of economic downturn, the 24-30m market showed the earliest signs of decreasing activity in 2022. Due to financial instability of buyers that ordinarily purchase in this sector, they are usually responsive to both negative and positive economic change compared to those purchasing vessels over 60m. This is reflected in the leap in activity for this sector between 2020 and 2021 and the subsequent dip in activity from 2021 to 2022.

Poor global economic performance will have an impact on most Superyacht sectors. When you consider this in line with a lack of quality inventory available on the brokerage market, as well as price increases, it is little wonder that sales are now decreasing and that price reductions have risen swiftly towards the end of 2022.

Again, it must be noted that 2022 has still been a strong year for secondhand S&P transactions, however the data and evidence from the market itself suggests that 2023 will most likely be a poorer year for sales than 2022.

Sector Breakdown

24-30m

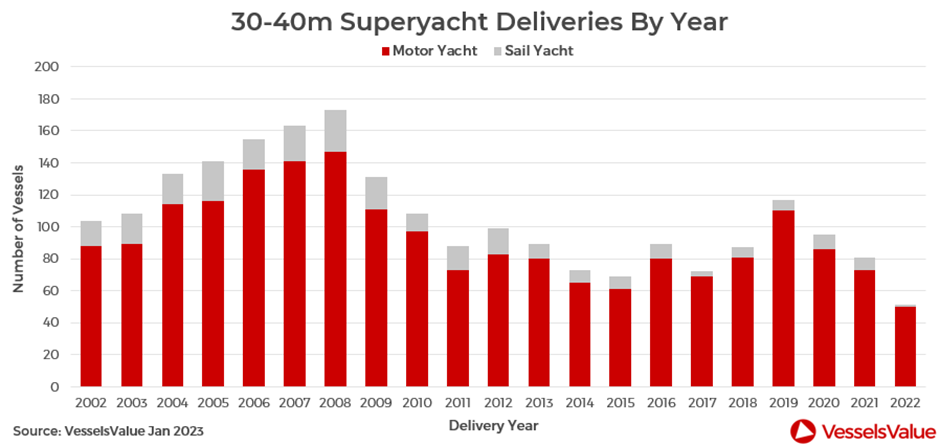

30-40m

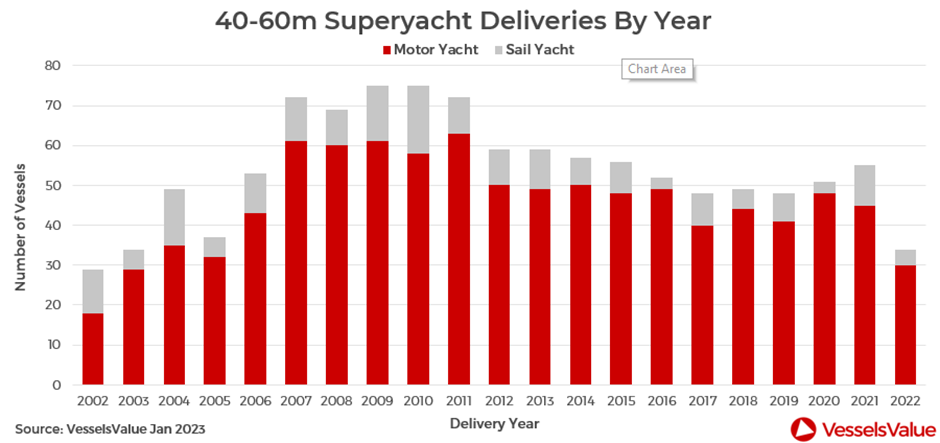

40-60m

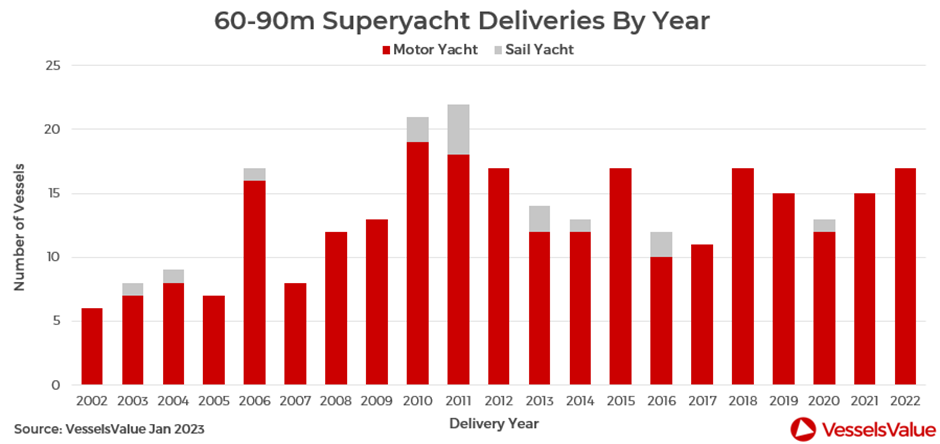

60-90m

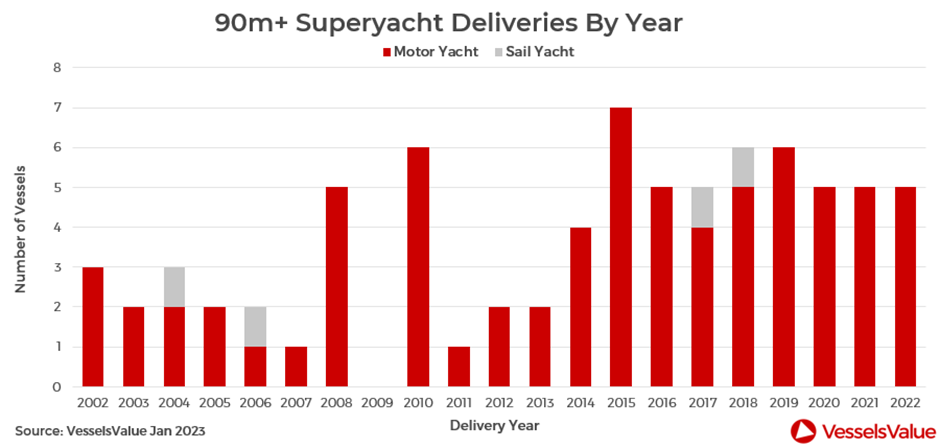

90m+

Supply

Supply in the first example shown below refers to the number of new Superyachts that are entering the global fleet, commonly referred to as newbuild deliveries. In the second example, supply refers to the number of secondhand vessels available for purchase on the brokerage market, also referred to as market saturation.

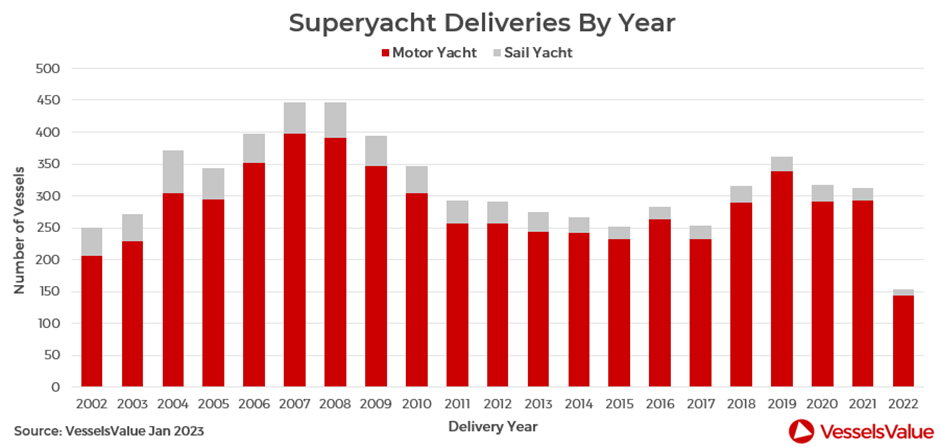

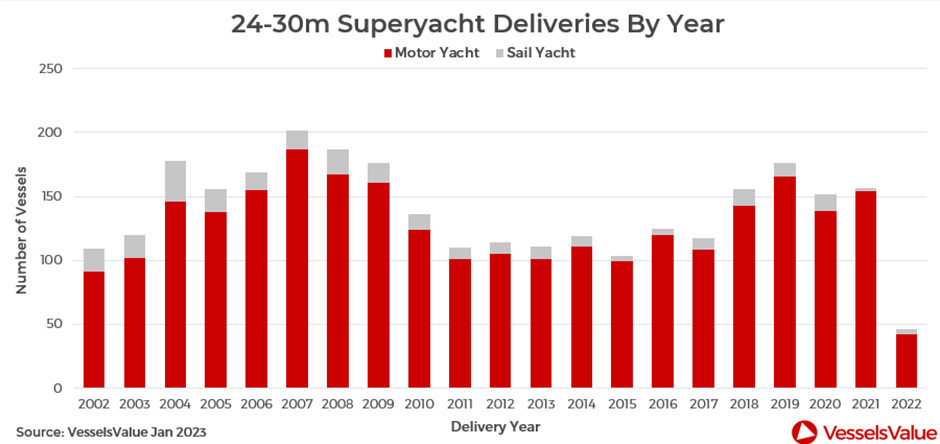

Deliveries By Year

Points of Interest

- Newbuild deliveries fell by 51% from 2021-2022

- Delivery numbers at odds with soaring sales figures for newbuild

- Risk of bottleneck being created by delayed delivery schedules

- Deliveries of 24-30m Motoryachts fell by 73%

- Deliveries of 60-90m Motoryachts fell by 13% and 90m+ Motoryachts remained stable

During a typical year, we expect delivered projects to fall around 10 to 20 per cent short of the scheduled deliveries for the year, and there are various reasons for this phenomenon. Firstly, owing to the complexity of the assets themselves challenges often occur during the build process that can have an impact on the delivery schedule of the vessel, whether that be supply chain issues, a shortage of quality subcontractors, change orders and everything else in between. Secondly, it may be that the owners themselves cause projects to be delayed because of changing personal environments suiting later delivery dates, sanctions, changes of whims, delayed payments, and so on.

However, the 2022 figures fall well short of the expected and accepted 10 to 20 per cent, owing largely to challenges associated with the supply chain. It should be noted that in recent years, certain shipyards have become less transparent with their orderbooks and deliveries. However, the same was also true in 2021 and thus 2022’s figures remain a concern. The generally accepted figure is that the overall Superyacht market had around a 7% exposure to the Russian market and yet even this additional figure is not enough to account for the 51% market decrease from 2021 to 2022.

During the pandemic recovery period, when businesses that had previously exported the raw materials and components had to catch up with latent demand, the relatively small unitary requirements of the Superyacht market meant that Superyacht shipyards were not being prioritised. This situation has only become more exacerbated by the Russia Ukraine conflict, as it has further hampered the supply of certain materials and components. Indeed, while the refit market obviously relies on the same materials and components, it has led some refit operations to rely more heavily on fixing certain components as opposed to replacing them, which is not an option for newbuild yards.

Furthermore, the situation has become so serious that, according to various legal professionals, shipyards and their legal teams are now sending out force majeure letters to some of their clients. All the while, shipyards and brokerage houses are regularly putting out content that outlines the value and size of the orderbooks.

UHNWIs who continue to purchase build slots, regardless of the supply chain issues, certainly suggests that there is still high demand for new Superyachts. Indeed, from a buyer’s perspective, waiting for the delivery schedule to normalise before ordering a project does not mean that they will get their Superyacht faster. As such, we continue to see orders being placed, with some orderbooks stretching into 2026 and beyond. It could also be argued that the hampered delivery schedule may prop up the brokerage market and slow the cooling period by leaning on buyer capacity that might otherwise have engaged in a new build.

Sector Breakdown

24-30m

30-40m

40-60m

60-90m

90m+

Supply of Candidates

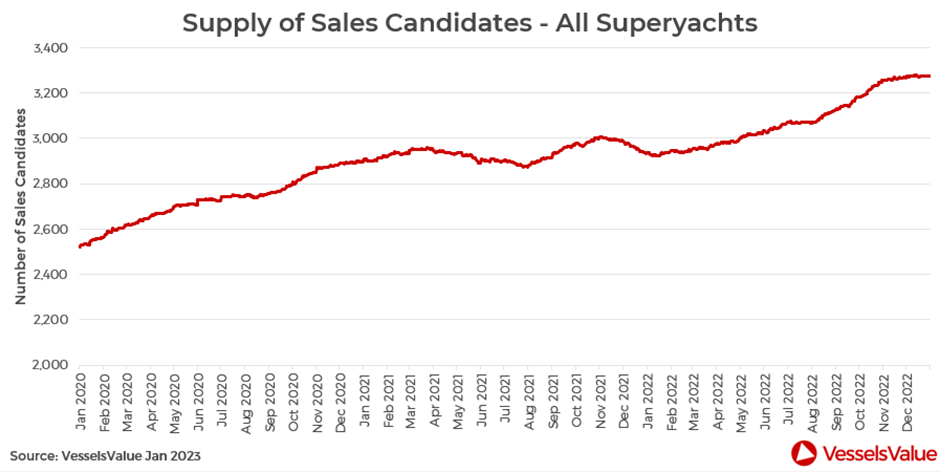

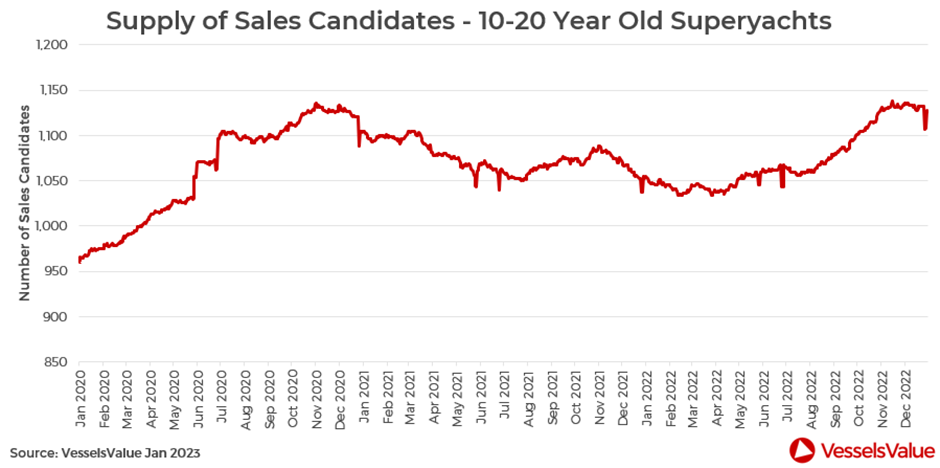

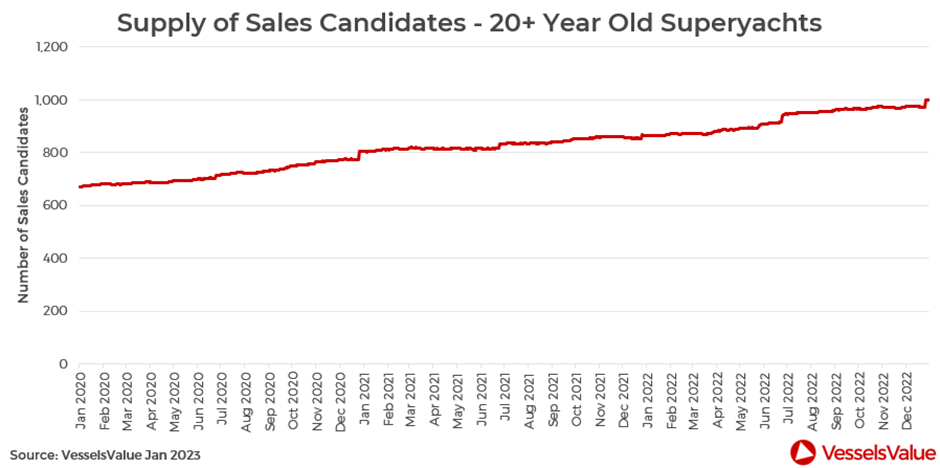

Points of Interest

- While the brokerage market seems to be cooling, supply continues to increase, which is add odds with the reports from the brokerage market.

- Significant capacity has been added to the market from July 2022.

- Between March to August 2021 and November 2021 to January 2022 the overall supply of Superyachts available to purchase fell.

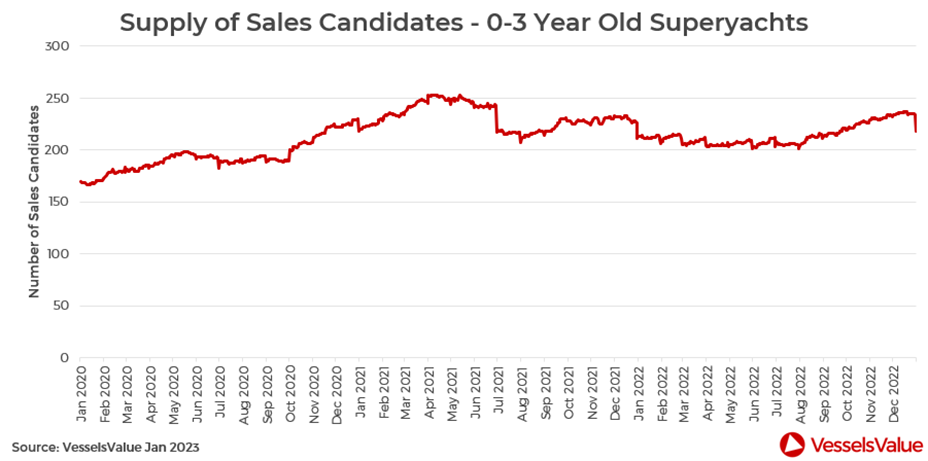

- Least growth experienced from 0-3 years old (2.3%).

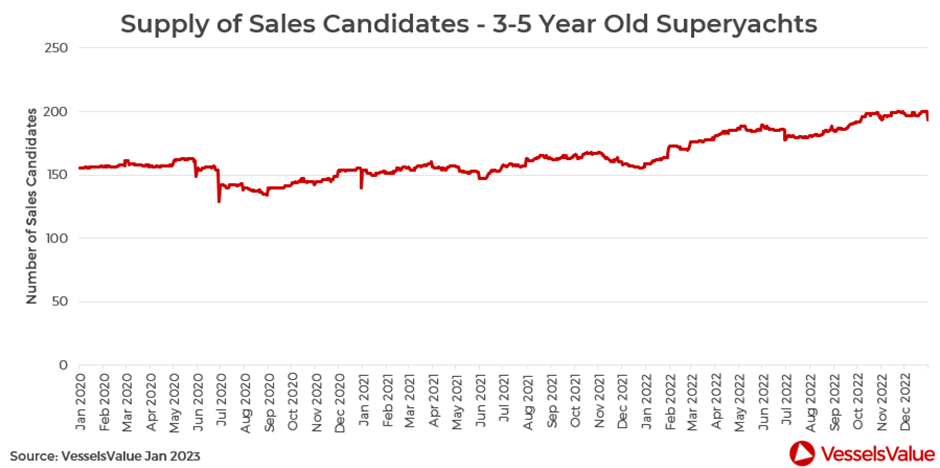

- Most growth experienced for vessels 3-5 years old (21.4%), although in a unitary sense, this is only 34 vessels.

- Highest number of new units added to 20+ years sector, with 157 more Superyachts available to buy since 1 January 2021.

When commenting on market liquidity, it was suggested that there is a lack of ‘quality capacity’ on the market. The ‘quality’ distinction is an important one because the supply of candidates graph clearly highlights that the number of Superyachts available to purchase is growing. When one considers this in line with brokerage market cooling, it suggests that there is a saturation of Superyachts of a certain age or type that are available to buy, especially within a market that has seen prices increase over the last year. Which begs the question, what do the buyers want?

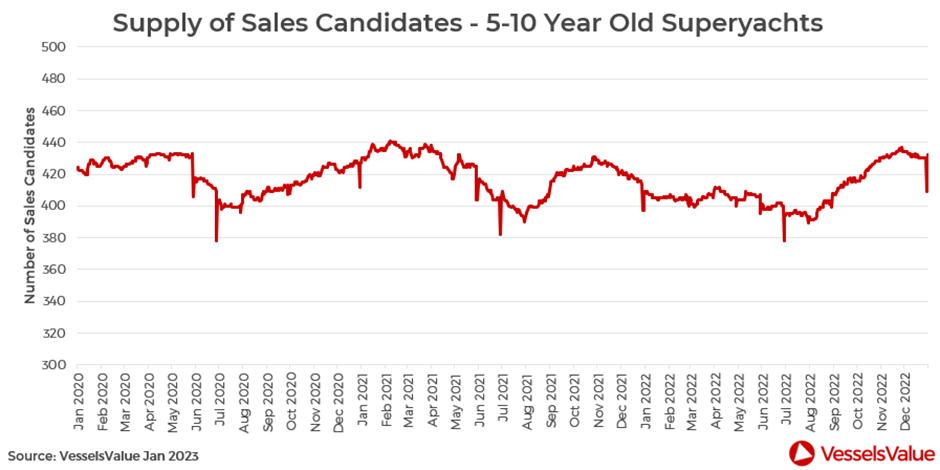

Across all age ranges, except 20+ years old, there have been significant fluctuations in market saturation since January 2021. However, none of the age ranges have been so significantly reduced that one can point clearly to a lack of capacity. Perhaps then the lack of capacity often cited by the brokerage market exists within a narrower view of the market, where demand far outweighs supply. At the time of writing, for instance, there are only eight Superyachts available to buy that are between 0 to 3 years old and 50-60m.

During periods of market saturation, the rhetoric from the market often shifts to suggest that are vessels ripe for picking up at reasonable prices that have a great deal of refit potential. Indeed, this is a notion that is often repeated by various stakeholders and market commentators. However, the cost of a significant refit to such vessels rarely results in an increase in value matching the cost of the refit itself. As such, older vessels that need a significant amount of work do not represent savvy investments, however, this is not to say that they do not make excellent passion projects.

Sector Breakdown by Vessel Age

0 to 3 years

3 to 5 years

5 to 10 years

10 to 20 years

20+ years

Demand Utilisation

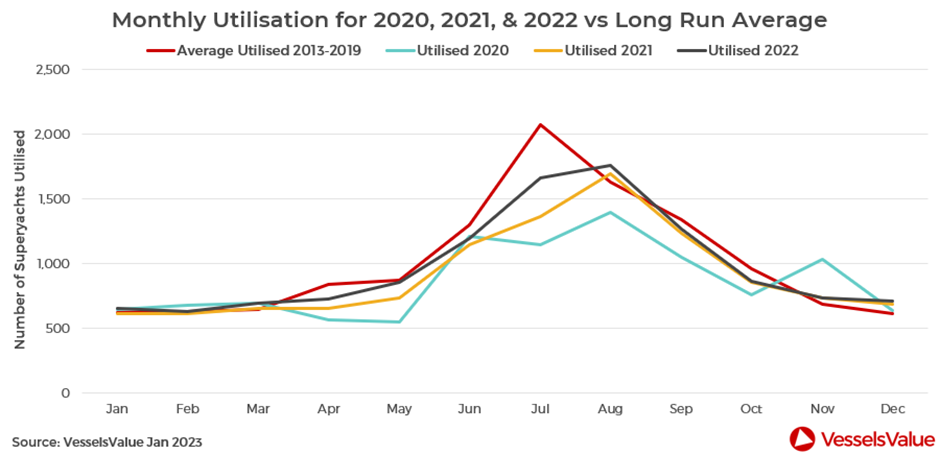

Even when Superyachts are static, i.e., in marinas or shipyards, they send out AIS signals. Therefore, when analysing activity or utilisation, simply counting AIS signals and unique vessels is not sufficient. VV’s utilisation model only considers those vessels that have pinged AIS signals from an outside shipyard or marina polygons.

Points of Interest

- Utilisation levels in 2022 are not yet higher than the pre pandemic average

- Greater Superyacht utilisation in 2022 than 2021

- August in 2021 and 2022 had higher utilisation levels than in previous years.

- Peak of activity in November 2020 is a by product of the pandemic and not yet an indicator of the Superyacht market significantly growing beyond the usual seasons

- Regardless of record sales across brokerage and new build in 2021, Superyacht usage has not grown significantly

Conclusion

One might expect, given the booming performance of the brokerage market and the lessening of Covid-19 protocols around the world in 2022, that Superyacht utilisation would be significantly on the rise. Whilst it is an oversimplification, it would be logical to assume that more Superyacht sales equalled more Superyacht cruising activity as buyers looked to make the most of their new assets. The data, however, does not support these assumptions, which in turn raises some interesting questions. Indeed, while activity in 2022 exceeded that in 2021, utilisation levels are yet to exceed those of the pre pandemic era. It is true that the Superyacht industry in much of the world has lost custom by way of its inability to conduct business with Russian clients, but this is not true globally and we know that Russian Superyacht users have still been active in certain regions.

The rhetoric surrounding the 2021 sales boom was that the market was experiencing record numbers of new and younger buyers. However, at the risk of stating the obvious, there must have also been a record number of people exiting the market by dint of the fact there were plenty of superyachts being sold.

It is perhaps more likely that those buyers who were already on their Superyacht journeys used 2021 as the time to upgrade their Superyachts with larger, newer, or more feature rich models. Yes, 2021 may have seen a record number of new buyers, but during a record year for sales this is hardly surprising, and one assumes that the number of repeat buyers still far outweighed new buyers in both 2021 and 2022, which would explain why there has not been a dramatic uptick in Superyacht utilisation.

Unsurprisingly, the months of June, July, August, and September proved to be the most prolific for Superyacht utilisation owing to the continued popularity of the Mediterranean across these months. From 2020 to 2022, the most active month has been August, whereas in the pre pandemic world it had been July.

VesselsValue data as of end January 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?