Demystifying the Superyacht Market

In an inversion of what is appropriate, the market only remains opaque for our most important stakeholders.

Tools for Transparency

For years the Superyacht market has been clamouring for data and transparency without, for the most part, defining what transparency means or what data is required. Typically, what people mean when they refer to transparency is that they want to have access to data relating to the industry’s core sectors without sharing their own information. Transparency, as far as VesselsValue is concerned, is about providing stakeholders with the necessary data and tools to make informed business decisions, especially those stakeholders on whom the industry relies in its entirety – the owners.

More often than not, stakeholders hear the word transparency and immediately start thinking about ownership data, whether they are licking their lips at the prospect of finding out who owns what or panicking at the idea of others discovering who their clients are. Of course, it would be interesting to know who the owner of every Superyacht was, but are the names of Superyacht owners really that beneficial to all but a few? I’d argue not, especially given how few businesses require a direct line to these individuals.

Making Data Accessible

In fact, if everyone were to have access to the names and contact information of Superyacht owners they would most probably pull away from the market as every man and his aunt competed for their attention and money.

Nevertheless, by tracking deals we know when a Superyacht changes hands and through various sources we are able ascertain the name of the owning company, what a Superyacht has sold for and, in many cases, the name of the UBO themselves. In this sense, the market is already transparent, so long as you are looking in the right places.

Is the Industry Truly So Secretive?

However, as well as demystifying ownership and sales data for businesses within the market, we should be working harder to demystify the market itself on behalf of the UBOs. Certain factions of the market have painted the picture of an industry that is secretive, opaque, and unquantifiable. In reality, the only people for whom the market remains opaque are the buyers and owners themselves. Transparency has existed for those of us within the industry for many years and there are few unobtainable data sets.

Most Superyacht buyers and sellers are reliant on the information that is provided to them by either their broker or other representatives and associates. We all know that good brokers and advisers are worth their weight in gold and, fortunately, experienced customers largely have access to the right people. However, for those with less experience or who simply want to add another level of due diligence to the process, the data now exists for them to make decisions independent of opinion or bias.

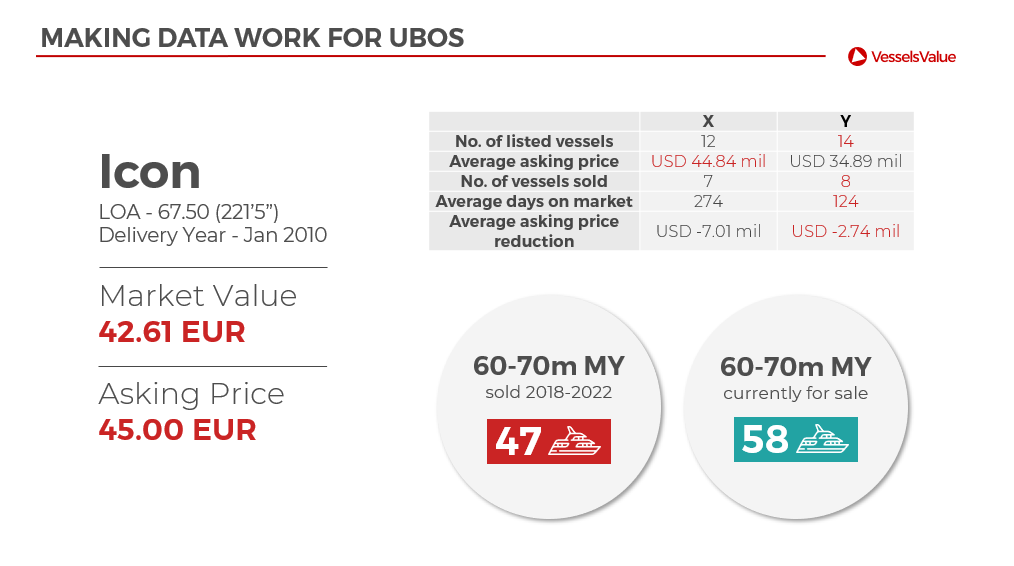

The below example is just a quick snapshot of how this can be achieved. Ignoring for a second the asking price, we can produce an objective valuation for a Superyacht (42.61 EUR). As a seller this figure will enable you to determine whether a particular brokerage house is suggesting an asking price that is too high, given that other houses may be presenting more realistic valuations. As a buyer, you will be able to determine a realistic price to offer on a purchase against the asking price. In this instance, the asking price for Icon (EUR 45 mil) appears to be in line with market value, suggesting the brokerage house in question is pricing accurately.

Perhaps of greater importance, however, we can look into the performances of certain businesses. The example above takes two real brokerage houses (neither of which are the current brokers for Icon) operating in the 60-70m sector. Brokerage X has the higher average asking price, but also applies more price reductions and, on average, the vessels spend a longer time on the market, all the while costing the owner to maintain and operate. Brokerage Y, by contrast, may price lower initially, but the data shows that less price reduction are applied and that the vessels sell quicker, suggesting that the initial pricing was a fairer reflection of market value and that Brokerage Y would be better suited to place a 60-70m Superyacht.

Decisions, Decisions

Do we truly believe that owners, buyers, and sellers would make all the same choices if they had the same access to information and data that we do? Based on what I have seen, I doubt it, and therein lies one of the pervading issues with the Superyacht market today.

The mission statement at VesselsValue is clear, provide businesses and UBOs with the necessary data to make informed and unbiased decisions.

VesselsValue data as of September 2022.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?