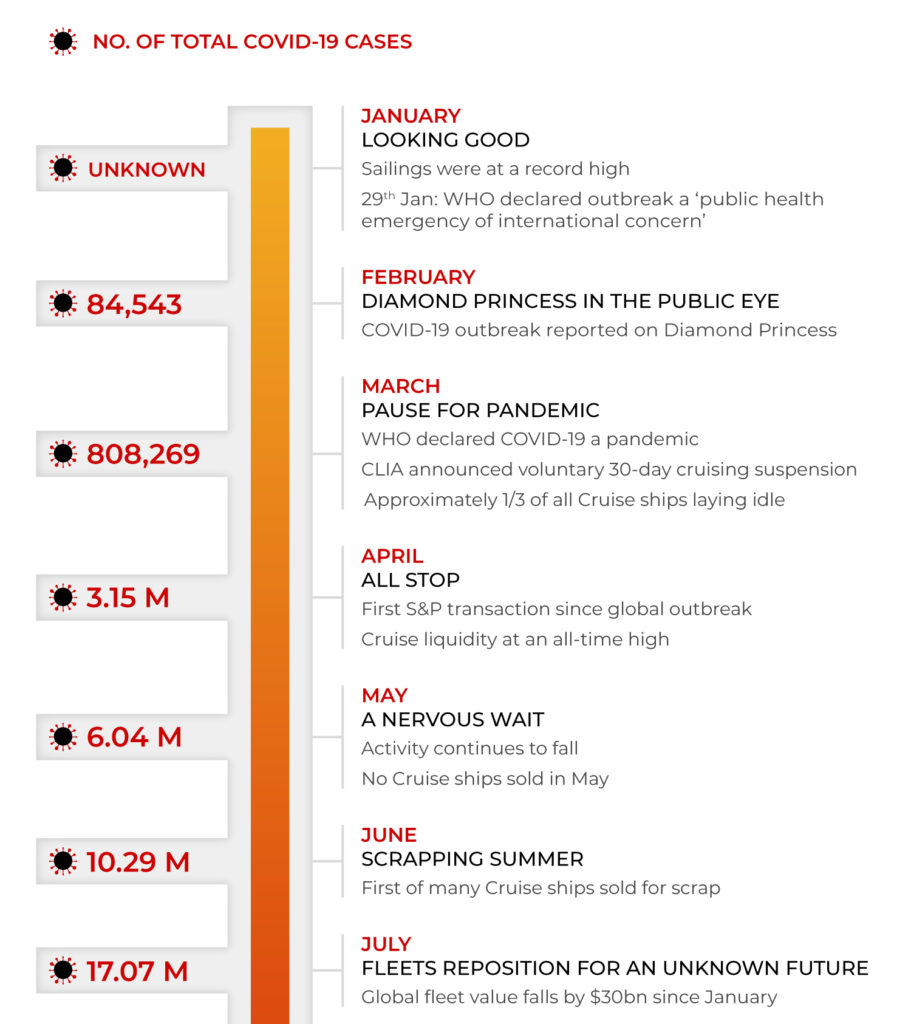

The Covid Cruise Calendar

January 2020: Looking good

Total COVID-19 cases = unknown

The quiet before the storm. The Cruise industry had enormous momentum going into 2020.

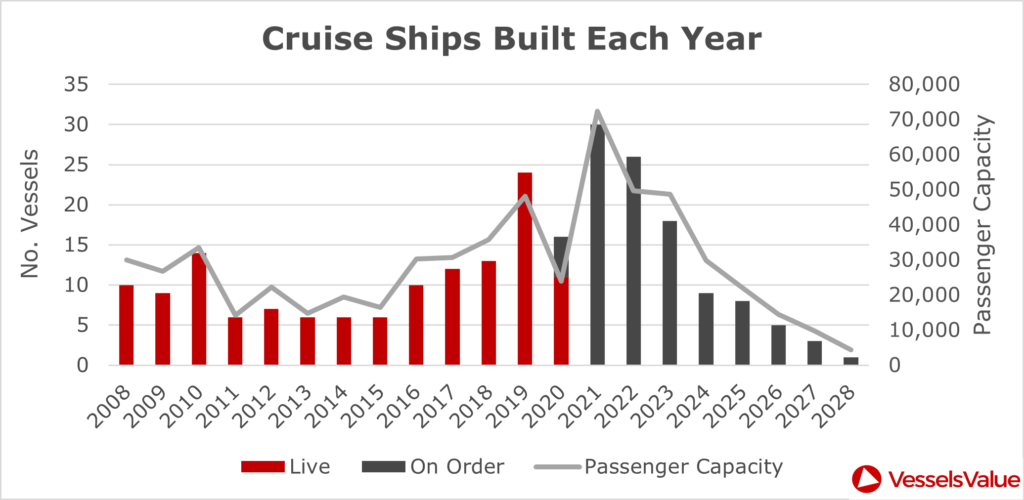

Sailings were at a record high, following a fruitful 2017 and 2018, with 35 and 43 orders placed, respectively. Cruise companies were in good shape, stock for Royal Caribbean Cruises for example was at an all-time high. The number of passengers who travelled in 2019 was setting new records. This positive energy and boom in demand can easily be seen in the graph of new builds below.

The chart resonates the popularity the Cruise industry was exuding leading into 2020. The global Cruise fleet in January 2020 was valued just under USD 170 bn. (The dip in 2020 is a result of ongoing newbuild delays due to COVID-19.)

On the 29th January, the World Health Organisation declared a PHEIC, a public health emergency of international concern, with regards to the coronavirus outbreak. This was only the 6th time PHEIC had been declared since 2005 when the International Heath Regulations came into effect. At this time WHO stated that it “does not recommend any travel or trade restriction based on the current information available”.

February 2020: Diamond Princess in the public eye

Total COVID-19 cases = 84,543

On the 3rd February 2020, an outbreak of COVID-19 was reported on the Diamond Princess Cruise ship which was situated just off the Japanese coast. Over the next month, over 700 people tested positive and sadly 9 died. The fate of the passengers and the response of the authorities was played out on the world media stage.

VesselsValue trade data shows how the Diamond princess was operating her usual Cruising routes until the outbreak onboard which kept the ship in the port of Yokohama for over 6 weeks.

March 2020: Pause for Pandemic

Total COVID-19 cases = 808,269

On the 11th March, the WHO declared the Corona Virus as a Pandemic.

Two days later the CLIA (Cruise Lines International Association), who represent more than 95% of the global Cruise ship capacity, announced a voluntary 30-day cruising suspension.

As one would expect after this announcement, cruising activity fell off a cliff as shown by our VV trade data below.

By the end of March, approximately a third of all Cruise ships were laying idle and this was only the beginning. The unprecedented cessation of operations on such a large scale affected the market dramatically and by the end of March the global fleet had fallen in value by USD 5 billion. Not an insignificant amount, but a 3% drop in the ocean for what is to come.

April 2020: All stop

Total COVID-19 cases = 3.15 million

As cases ramp up and the Cruise “no-sail” orders are extended, asset values fall further. Major Cruise lines begin taking out multi-billion-dollar loans to shore up finances against the lack of profitable operations.

Late April sees the first of what was going to become a trend of Cruise ship disposals and fleet readjustments. Albeit at auction, following an arrest, The Glory Sea (24,318 GT, Apr 2001, Blhom + Voss) sold to Fujian Guohang Ocean Shipping for CNY 38.06 mil. Which marks the first S&P transaction since the global outbreak.

The below graph shows the number of Cruise ships bought and sold on the S&P market in the last 10 years. (inc 2020 up to November)

The financial strains caused by the pandemic has seen Cruise liquidity more than double compared to previous years, setting an all-time high.

May 2020: A nervous wait

Total COVID-19 cases = 6.04 million

A stagnant month as the industry holds its breath waiting to see whether the pandemic would show signs of abating. Cruise ship activity continues to fall, parallel with asset values, as ships enter and remain in costly warm layup. No Cruise ships are sold in May.

June 2020: Scrapping Summer

Total COVID-19 cases = 10.29 million

June saw the first of many Cruise ships sold for scrap to breaker yards. The first to go was Costa Cruises’ Costa Victoria (75,166 GT, Jul 1996, Bremer Vulkan) who was sold for scrap to an Italian breakers yard.

Shortly after, COVID claimed its first Cruise company. Pullmantur Cruises fell into bankruptcy and was forced to scrap their entire fleet. This comprised of 3 small Cruise ships with a combined passenger capacity of 7,800. All were scrapped in a Turkish yard for USD 150 per LDT.

The following chart shows the number of Cruise ships scrapped each year by location.

Traditionally, Cruise ships have been scrapped in India. However, the recent economic climate and low demolition prices at the time saw owners favouring Turkish and even Italian yards.

July 2020: Fleets reposition for an unknown future

Total COVID-19 cases = 17.07 million

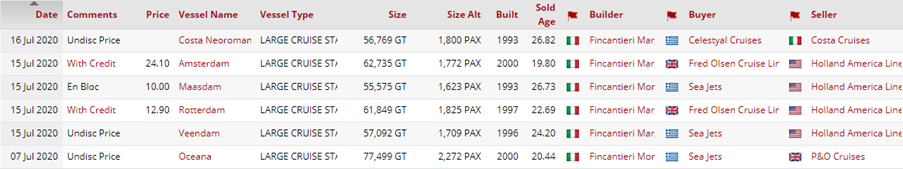

July was the busiest month this year with 6 second-hand transactions beating the whole of 2017’s S&P activity. This was mostly a result of the largest Cruise company in the world, Carnival, announcing it would sell off at least 13 Cruise ships.

Carnival’s Holland America line sold off 4 of its largest Cruise ships, Carnival’s Costa continued its selling by selling off the 1993 built Costa Neoromantica, and P&O waved goodbye to their 2000 built Oceana. These 6 transactions are shown below.

These transactions would see a seasoned ferry owner enter the Cruise market as a new player with “Sea Jets” taking advantage of these older assets going to rock-bottom prices.

By the end of July, the global fleet value had fallen USD 30 billion since January, 17%.

On the 24th July after detailed COVID mitigation preparations, TUI Cruises tested the water with a 3-day scenic (no stops) Cruise of Norway from Hamburg aboard Mein Schiff 2 and Mein Schiff 1 began her own itinerary out of Kiel on July 31st.

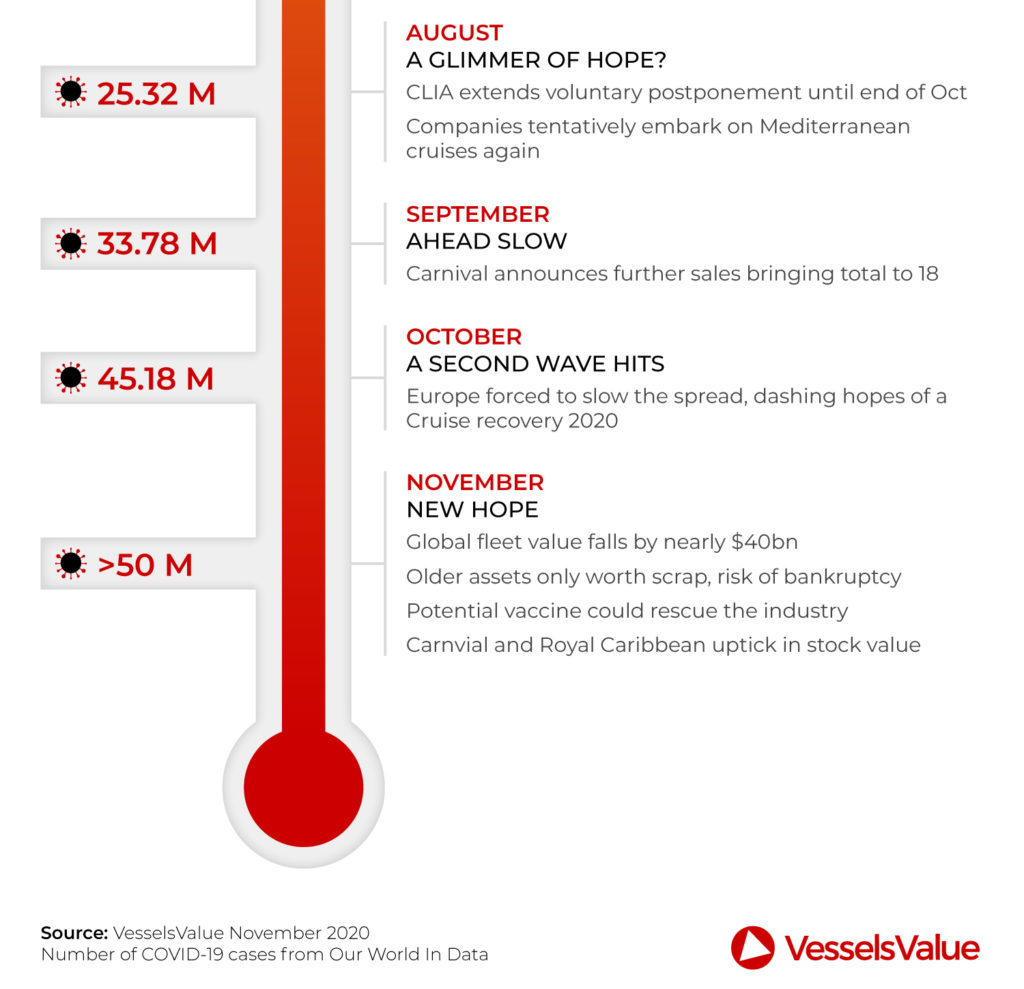

August 2020: A glimmer of hope?

Total COVID-19 cases = 25.32 million

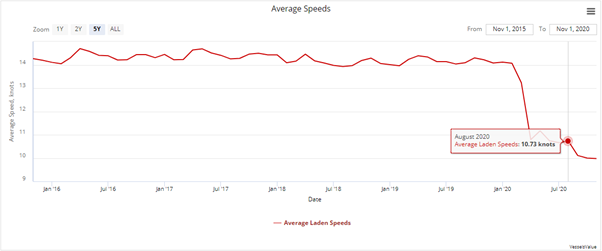

CLIA extends the voluntary postponement on cruise operations until the end of October. This announcement further dampens activity, which can be seen by analysing VV’s speed-trade data as companies desperately try to reduce costs.

The average global speed of the entire Cruise fleet, particularly in recent years has remained very stable ranging between 13.5 knots and 15 knots. However, Cruise ship voyages are now becoming associated with non-profit laying up as opposed to genuine Cruise activity. Since the beginning of the year, average speeds have plummeted to below 11 knots to save on fuel and in-port costs whilst the vessels are en route to their layup locations.

However, with countries coming out of lockdowns, more Cruise companies tentatively recommenced operations. MSC cruises for example embarked on Mediterranean Cruises once again with its two flagships MSC Grandiosa and MSC Magnifica.

September 2020: Ahead slow

Total COVID-19 cases = 33.78 million

Following MSC’s success in restarting operations in August, Carnival’s Costa Cruises also resume their operations in the Mediterranean, under tight new restrictions, guidelines, and protocols to diminish COVID-19.

On the other side of the coin however, Carnival also announced that it would sell a further 5 more ships, bringing the total to 18. By the end of September, the fate of 15 of that 18 are known. 10 were sold for further trading and 5 for scrap.

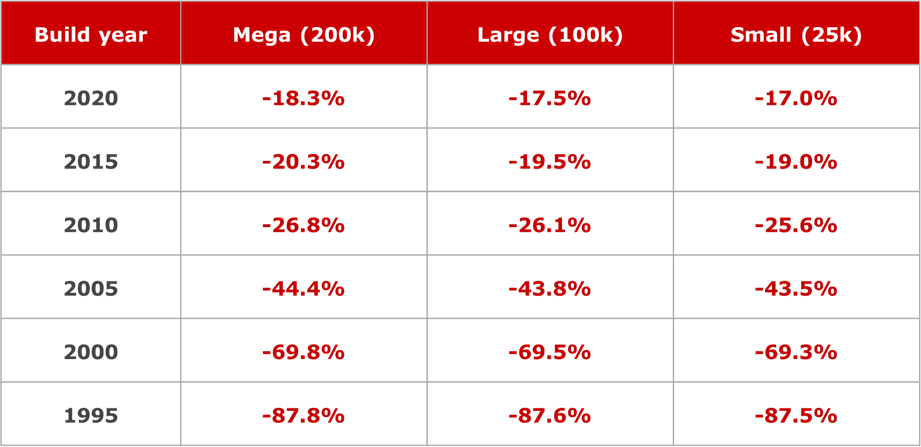

The industry tendency thus far has been to sell off older non-core assets, predominately 20 years or older. This could be interpreted as an effort to streamline and modernise current fleets for an eventual recovery. All sales were concluded quickly and under distressed conditions with the inevitable effect of forcing vessel valuations downwards.

October 2020: A second wave hits

Total COVID-19 cases = 45.18 million

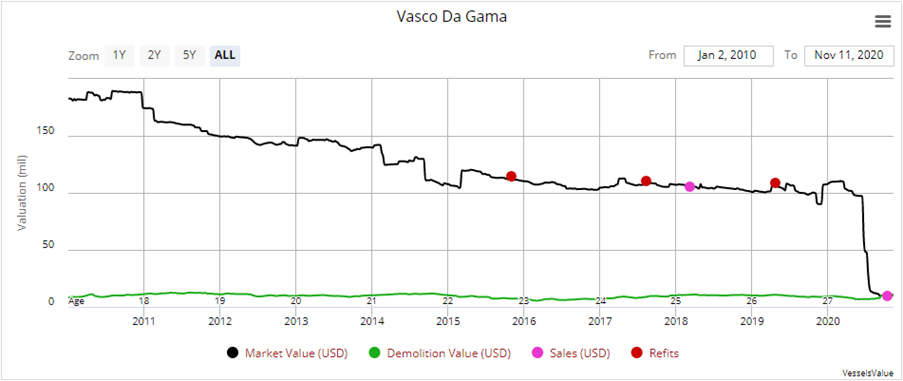

The defunct UK company, Cruise & Maritime Voyages (CMV) vessels were sold in a series of auctions throughout October. Sadly, the sale of Vasco Da Gama portrays and solidified the current depressed Cruise market. The below shows her historical market value leading up to when she was sold.

At the start of January, her VV value was USD 108 mil, this value fell dramatically several times as the pandemic’s effects ripped through the industry. She then sold on the 12th October to Mystic Cruises for USD 10.19 mil, VV’s value on the 11th was USD 9.78 mil.

More widely, USA and India struggle to contain COVID-19 infection rates and Europe starts to see an alarming second wave of cases. Countries in Europe are once again forced to take countermeasures to slow the spread, dashing hopes of any significant Cruise activity recovery in 2020.

November 2020: New hope

Total COVID-19 cases = >50 million

The global fleet has fallen in value by nearly USD 40 billion. Activity is at an all-time low with 61% not underway. The major players are burning anywhere from USD 200 million to an excess of half a billion a month to keep operations afloat. Carnival has borrowed a record amount of close to USD 12 billion since March, due to the pause in guest operations forcing the company to secure substantial additional financing to preserve cash and increase liquidity. Likewise, Royal Caribbean took similar action during this period, securing around USD 5 billion in loans as well as offering just over USD 3 billion in bonds and partaking in credit debt holidays to defer repayments. Older assets are now only worth scrap value and companies are being forced into bankruptcy.

Below is the VV matrix and % change in value since the start of the year.

On the positive side, the recent news of a potential vaccine could be a shot in the arm for the Cruise Industry. Both Carnival and Royal Caribbean enjoyed a well needed uptick in their stock value.

Also positive are the statistics from Cruise companies showing that with the correct procedures and protocols in place, COVID safe Cruises can set sail.

It is too late for 2020 but let us hope these positives help to offer the Cruise industry a favourable environment for a recovery in 2021.

*COVID-19 cases are a cumulative total by end of each month, data from: OurWorldinData

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?