The Future for Offshore Renewables

Global renewable energy could help a post COVID-19 economic recovery according to the International Renewable Energy Agency (IRENA).

According to IRENA offshore wind costs have fallen by 29% between 2010 and 2019 from £124 per Mwh to £88 per Mwh (megawatt hour). This lowering of costs can be attributed to increases in turbine technology including larger megawatt turbine ratings.

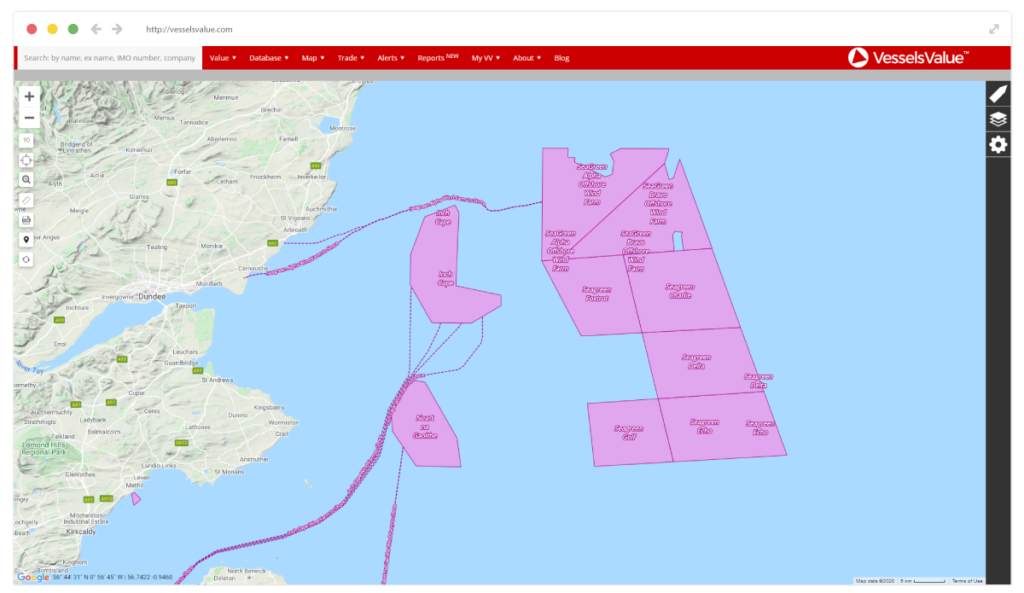

One major area for investment is in Scotland where Crown Estate Scotland have a new round of offshore wind development with an expected investment of more than £8 bn. This is expected to eventually generate enough electricity to power every house in Scotland. This includes the £1.8 bn Neart na Gaoithe windfarm currently under construction off the coast of Fife operated by EDF Renewables and ESB.

A major development in recent years is the introduction of floating semi-submersible wind farms allowing turbines to be placed in deep-water areas over 50m deep where wind speeds are generally higher thus increasing turbine efficiency.

The end of 2020 should see the world’s first floating wind farm completed, the Portuguese WindFloat Atlantic Project. In addition, various deep-water floating wind farm projects in Japan are now under construction or are in the planning phase.

Post COVID-19 impacts for offshore wind have not been as significant as the rest of the offshore sector because many projects for 2020 and 2021 are already under construction or nearing completion. The countries with the most investment in offshore wind farms at present are China, North America and Europe.

Global windfarms, corresponding wind farm cables and turbine locations can be found on the Mapping & Tracking module of the VesselsValue platform. Additional information such as Mw capacity, number of turbines, turbine manufacturers and project operators can be seen along with the locations of substations and transformers.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?