Vehicle Carrier and RoRo Review 1H 2023

Vehicle Carriers (PCTC, LCTC)

Asset values finally peaked in the Vehicle Carrier (VC) sector following an exceptional two-year bull run, owing to a lack of liquidity and reallocated demand favouring Container Carriers ex China as the main source of trade growth.

Global cargo miles firmed 2.5% based on 187.7 billon CEU-NM (Car Equivalent Unit per Nautical Mile), confirming strong underlying demand for VCs, but remained 3.5% below pre pandemic levels in 1H 2018 and 1H 2019.

China was the star performer again shipping 1.76 mil light vehicles between January and May, surpassing Japan in Q1 to become the world’s biggest car exporter.

No straight sales of relevance concluded because shipowners could earn more from the charter market capitalising on midterm short supply. VVs 1-Year 6,500 CEU Time Charter Index held stable averaging 105,000 USD/Day, up 110% versus the 1H 2022 average.

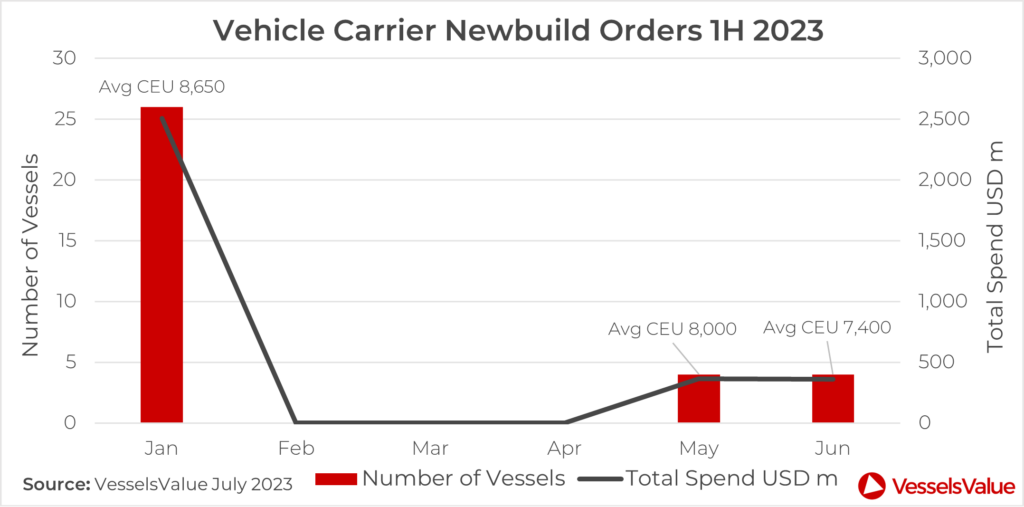

Newbuild activity was down 25% but still remained at healthy levels based on 34 ships confirmed excluding options for a combined total spend of USD 3.2 bn. Whilst no demolition deals transacted which is expected in short supplied markets.

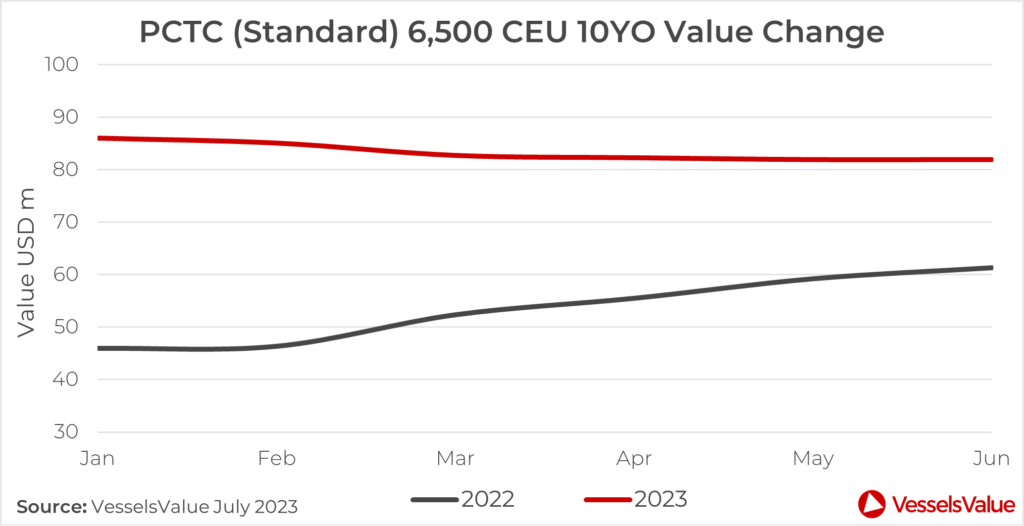

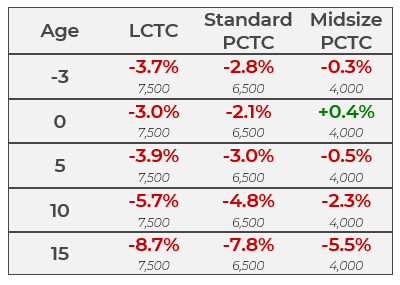

By the end of June, standard PCTC 6,500 CEU 10YO Values had depreciated by 4.7% to USD 82 mil. However, that’s almost 32 mil higher than twelve months previous.

A strong orderbook of 24% versus the live fleet by CEU is going to rebalance this short supplied market from late 2024 / early 2025. The end of the super cycle has begun, but the decline for rates and asset values will be gradual.

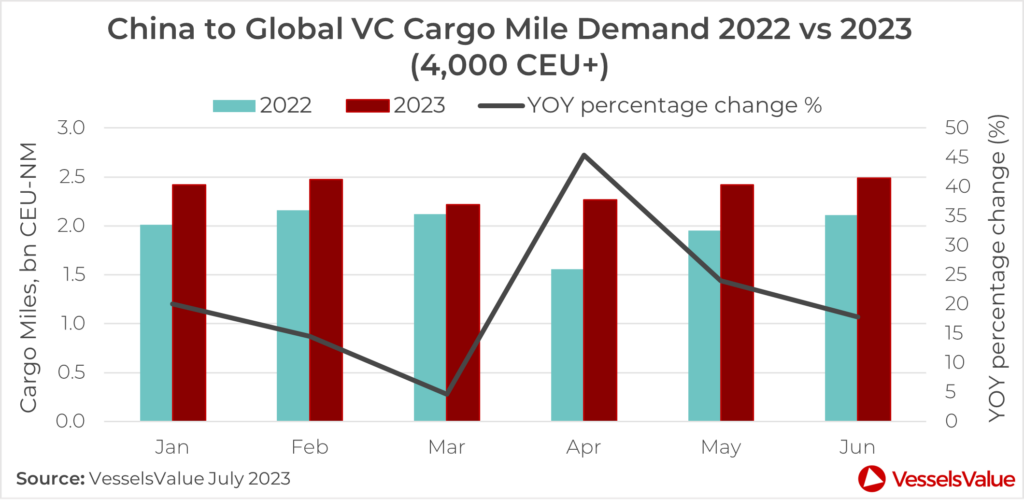

Trade Growth Driven by China

Cargo miles are calculated using distances travelled and vessel capacity (total CEU), which are taken from AIS derived journey information on a daily basis. Typically, if cargo miles are high, it means that vessels are travelling significant distances, reflecting higher utilization, and firming strength in the market

- China to Global Cargo Miles up 19.8% in 1H 23 based on 14.2 bn CEU-NM.

- Surging demand for EVs from China sucked in liner tonnage at the expense of other trades. China overtook Japan as the world’s biggest exporter.

- Expensive freight prices based on insufficient VC capacity encouraged Chinese OEMs to consider Container Carriers for 20-25% of their car exports, reducing demand for VCs completely sold out.

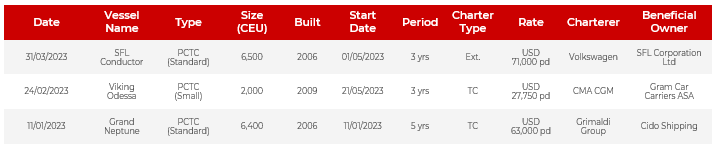

Headline Fixtures:

- No straight sales transacted in 1H 2023 = a charter driven market.

- Minimum 3-Year Time Charters peaked at 71,000 USD/Day in March.

- Extended charters became the norm, as charterers battled to keep hold of tonnage.

Newbuild Activity Slowed

- Shipowners continued to invest into this sector spending over USD 3.2 bn based on 34 ships confirmed, down 26% by ship count vs 1H 2022.

- The average ship size was 8,017 CEU, up 5% vs 1H 2022.

- No Midsize or Small PCTCs were ordered which is ominous for intra-regional supply in Europe and Asia (but net positive for shortsea RoRos and Container feeders taking the overspill).

Values Have Now Peaked

- Values for 10YO LCTCs and PCTCs decreased c.5% in 1H 23.

- Values for 10YO Midsizes decreased c.2%, holding onto value.

- Values peaked at the end of Q1 because no sales transacted, and rates hit a ceiling after demand found alternatives out of China as the main source of trade growth for car exports. Resulting in minor depreciation for values from record all-time highs.

Outlook

We have started to see softening in average light vehicle freight rates (spot / contract) on major China to North Europe routes which have stalled since March. Time Charter rates usually follow.

Additionally, Chinese OEMs are refusing three-year Time Charters, the minimum period offered by tonnage providers resulting in a stand-off. Tonnage providers may need to change their stance in the second half as demand for VCs eases, resulting in lower day rates or more generous terms.

I’m sticking with my original prediction from January, a rebalanced market by late 2024 / early 2025. The good news for investors is that rates should decline gradually, tied to vessel deliveries and healthy overall demand for car transportation. Shipowners still hold the upper hand in rate negotiations with OEMs, but the pendulum has started to swing back towards shipper’s favour.

RoRo 1H 2023 Review

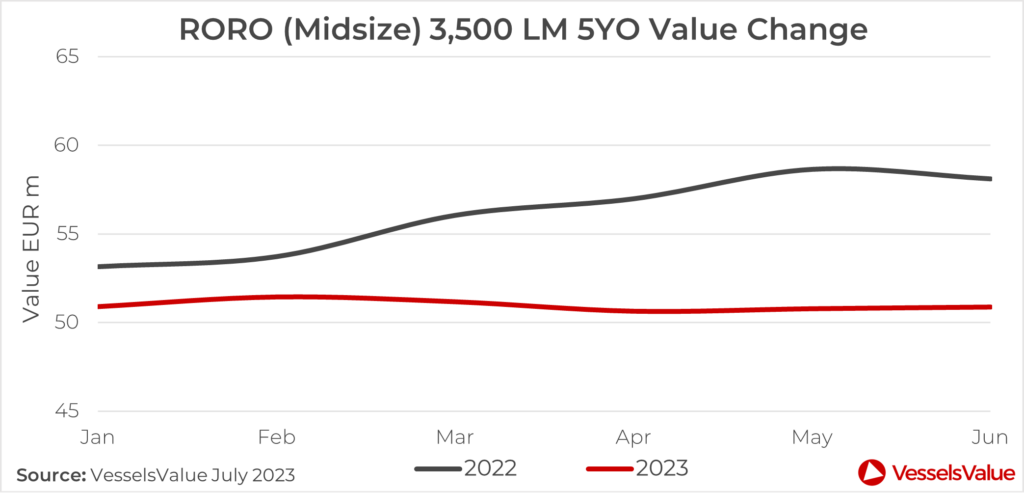

RoRos held their value during the first half of 2023 based on increased buyer interest from the US and Middle East, pushing up secondhand sales prices and stable to firming Time Charters supporting values.

Freight demand weakened in main market Europe due to sanctions imposed on Russia downgrading trade in the Baltic, impacting all leading operators including Finnlines. DFDS reported a negative freight result of 7.5% in June, down 10.9% based on the last twelve months against 39 million lane meters (LM) of cargo transported (from 43.8 million in 2022-21) before adjustments were made for the Channel.

VVs 1-Year 3,500 LM Time Charter Index firmed 8% to 22,974 EUR/Day, confirming a tight shortsea RoRo market in Europe.

Impressive sales prices were achieved by CLdN in the S&P market, selling 20YO Cadena 3 (2,606 LM, Apr 2003, FSG) to Safeen for EUR 21 mil, and 26YO Clementine (2,307, Feb 1997, Kawasaki) to Superfast Ferries for 13.4 mil. Showing strong buyer interest for middle to old aged 2,500 LM RoRos firming values in this segment.

Whilst for large deepsea RoRos, Ignazio Messina timed it perfectly selling off more of their large ConRo fleet to MARAD via Crowley achieving USD 87 mil for the Jolly Quarzo (6,350 LM, Feb 2013, Daewoo).

NB activity was low. A pair of 2,800 LMs were contracted at Jinling Shipyard Weihai by Stena RoRo rumoured to be in the region of USD 65 mil per unit.

Just one demolition deal transacted involving 37YO Super Shuttle RoRo 8 (2,606 LM, Apr 1986, Danyard) for an undisclosed price. Showing supply is tight.

By the end of June, midsize 3,500 LM 5YO values had returned back to their January level of EUR 50.9 mil. We expect values to hold and possibly firm in the second half based on continued tight supply and higher sales prices as buyers compete for tonnage. It’s looking like a good market for tonnage providers, but not so great for charterers light on tonnage.

S&P Analysis

- Sellers CLdN achieved impressive prices for Cadena 3 and Clementine lifting 20/25YO values for 2,500 LM RoRos.

- Buyers Safeen paid a high price to secure Cadena 3 but got a great deal on resale Tennor Ocean paying EUR 60.8 mil in Feb.

- Demand for large modern ConRos approached fever pitch as US and Middle East buyers targeted these niche asset types, ensuring a massive pay day for Ignazio Messina selling the Jolly Quarzo for USD 87 mil SS/DD due.

Newbuild Activity Kept Low

Stena RoRo returned to Jinling Weihai to order a pair of 2,800 LMs rumoured to be USD 65 mil each. A competitive price in today’s high inflation, high labour, and high build cost environment.

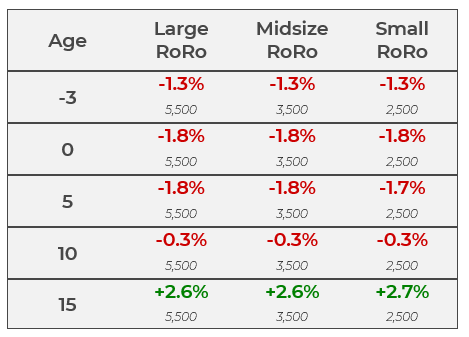

Values Held

- RoRo values held in 1H 23 across all ages and sizes which is a sign of a balanced to under supplied market, underpinned by strong demand for assets despite lower cargo volumes in Europe.

- Older tonnage became more valuable as shipowners realized a longer time horizon until emission regulations really start to bite, increasing desirability for 15/20/25YO units.

Outlook

Rates and asset values to remain stable in the second half based on continued tightness in supply and improved freight demand within Europe supported by easing fuel costs. A strong car market is also supportive for RoRos trading on longer international routes due to a lack of Vehicle Carriers (PCTCs, LCTCs) until 2024/5, meaning RoRos benefit in the interim from the overspill.

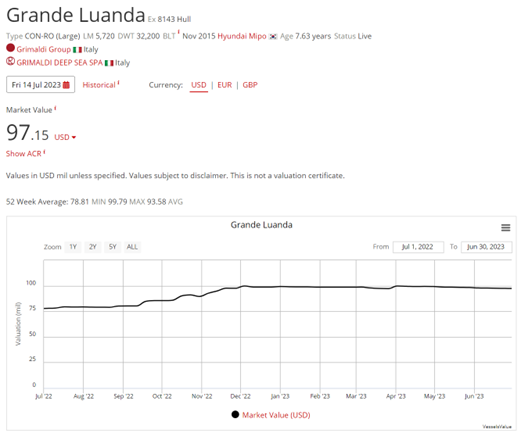

Large ConRo values are now firming higher after Ignazio Messina and RORO Italia (MSC) sold off their remaining fleet of four STX Offshore built 8YO units to Middle Eastern buyers in July for USD 100 mil per vessel. An amazing deal timed perfectly. Perhaps this will persuade Grimaldi to part with one or two of their thirty deepsea ConRos trading live today – if they feel the need, noting market values for ConRos won’t be this high again for a generation.

VesselsValue data as of January 2023.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?