What have we learnt from COVID-19 so far?

The markets, particularly for shipping, oil and stocks, have been highly volatile over the last few months and the news cycle endless. In these times of uncertainty, real time and objective data is critical to understand and take advantage of the ever evolving situation. Below are three thoughts on what we have recently learnt from our data over this time, and one comment on how the world may finally be perceiving cargo shipping in a new positive light.

Shipping demand can be used to predict the stock markets

As we all know, March 2020 was a poor month for the stock markets. This was driven by a global sell off in equities due to the expected reduced economic activity from the effects of COVID-19. April 2020 was a great month, with the global markets pricing in a quick recovery.

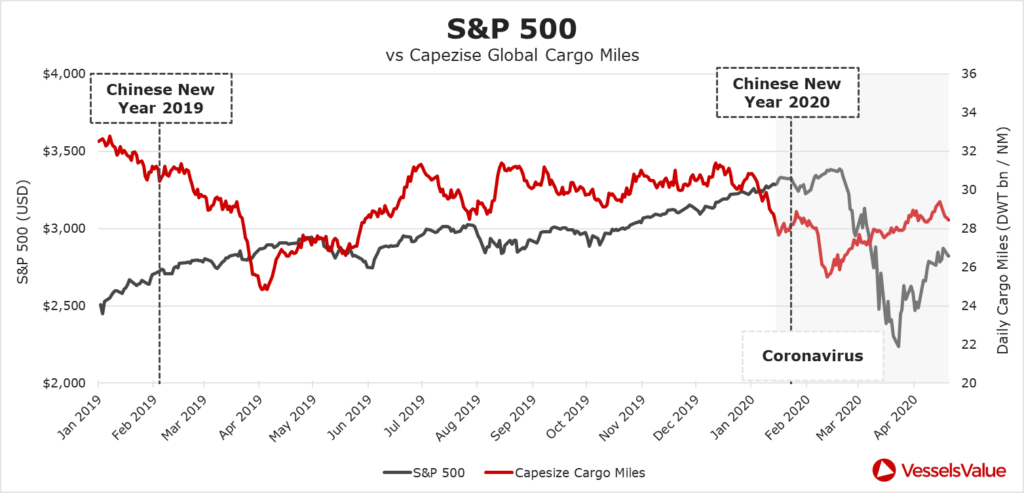

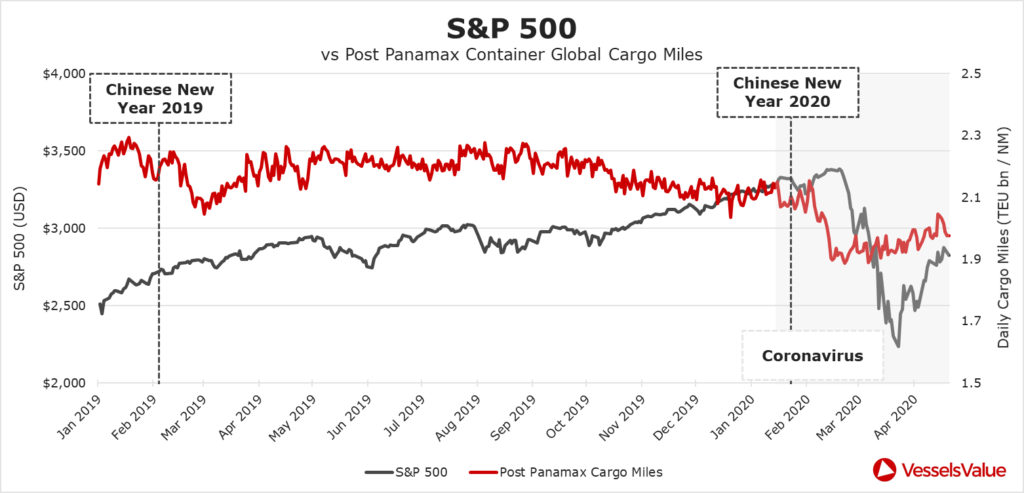

Interestingly, daily trends in global cargo mile demand data, as observed through our Trade service, forecasted this sharp decline and the recovery in the stock markets. This can be seen in the charts below relating to daily updated Capesize and Post Panamax cargo mile demand (red line) to the S&P 500 (grey line).

For Capesizes, a bell weather of industrial activity, cargo miles started to decline sharply in mid January, about a month before the stock markets started to crash. Cargo miles started to recover early March, again about a month before the stock markets started reaching their inflection point and started their recent upwards trajectory. For Post Panamax Containerships, a good indicator for trade in consumer goods, the decline in demand came slightly later at the start of February but still preceded the stock market selloff in early March. The shape and speed of recovery was similar, starting in early March and foreshadowing the recovery in the stock markets in from the start of April.

Hindsight is a great thing, and these calls would have been very hard to make while watching the stock markets dive through March. However, there was potentially a lot of money to be made by reading the tea leaves of shipping for those who know where to look and how.

When it comes to the fate of the Tanker market, politics really does trump oil demand

The Tanker market is undeniably affected by politics and the level of oil supply. It is also reasonable to believe that the demand for the finished products of oil, such as for transportation and petrochemicals, is as significant to the fate of the market as supply volumes. However, events throughout the COVID-19 pandemic should really make us question this belief that consumer demand for oil is at all relevant to short term Tanker rates.

The world has never experienced such a massive and widespread drop in oil demand as we are currently seeing. Ask a person on the street what this should mean to the market for transportation of oil, and they would likely answer that it should be awful. Low demand should mean less oil transportation, negative rates and laid up Tankers.

This could not be further from reality. We are in fact seeing the best crude Tanker market in history. Political manoeuvres have conspired to send oil supply skyrocketing, prices crashing, contango arriving and offshore storage thriving. The effects of demand have been pretty much irrelevant.

Sometimes it takes colossal events, such as a global pandemic, to separate the signals from the noise. In this case, it has confirmed that the short term fates of the Tanker market are all about oil supply, and it really doesn’t matter if the demand isn’t there.

From an economist’s point of view, this may be somewhat counter intuitive to classic supply and demand analysis. The way to settle this is to see that oil supply sets the short term Tanker market levels, and oil demand sets the long term trend.

Asia, particularly China, is amazingly nimble for a heavyweight

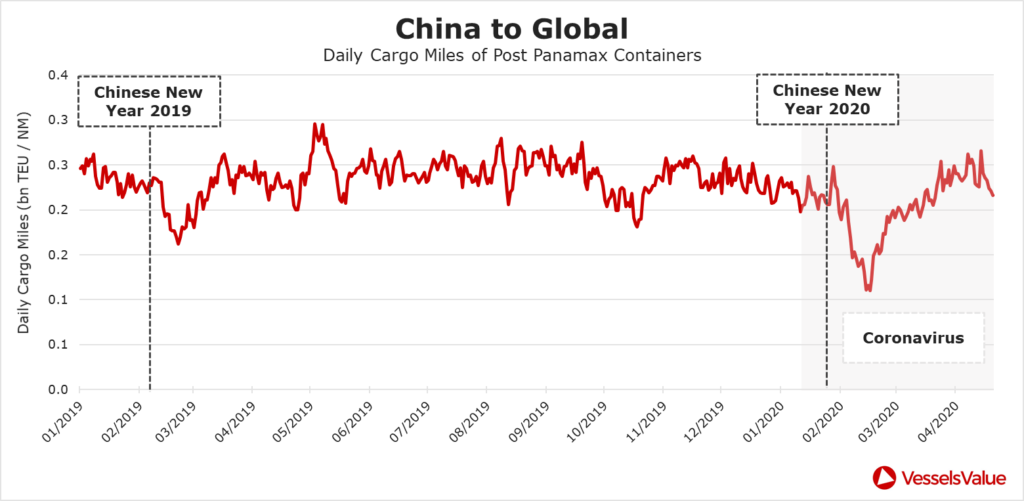

Asia, and particularly China’s, rapid recovery in demand for Container vessels and their capacities is an incredible testament to the region’s agility.

It is no surprise that Asia, especially China, is the driving force behind the demand for vessels. When COVID-19 hit there it had a massive impact on industry and business. This resulted in immediate and significant falls in demand for vessels, their imported cargoes and exporting capacity. However, as quickly as the numbers fell through late January and February, they recovered rapidly through the later half of March and April.

This can be seen in the charts below looking at daily updated cargo mile demand for Post Panamax Container ships leaving China.

This is an encouraging sign for the Container markets, and really the world economy as a whole. It is impressive how quickly China can get back to work, as evidenced by this objectively observed data.

Shipping finally steps out of the shadows

“It’s all about the supply chain, stupid”

COVID-19 has focused many people’s minds on the importance of an effective and flexible supply chain. Ships are an integral part of this and are finally being appreciated for the critical benefits they give to the world.

There was a recent article in the UK’s top populist tabloid, the Sun, about five large cargo vessels appearing off the coast of Wales. Many of the papers readers were speculating what they were carrying and hoping that they were bringing the critical PPE supplies for the healthcare workers. These speculations were most probably wrong, but highlights that cargo vessels are now being discussed in a positive light rather than the usual negatives of pollution, oil spills, sanctions busting and piracy.

Shipping has been like a shadow economy for many decades now. As ship sizes and land prices grew, major cargo shipping ports moved out of urban centres and into the outskirts. This has led to ships and what they do becoming less and less visible. This is especially true in the west, with London over the centuries, being the prime example and first mover. You can still see ships near city centres in Asia such as Singapore and Shanghai, but not likely for much longer.

It looks like the world’s new, and correct obsession with supply chains, is bringing shipping out of the shadows. This may not last for long but will hopefully bring more appreciation and support for one of the world’s oldest and most important industries.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?