Decisions + Data + Algorithms

Being successful in the shipping markets is a never ending, complicated and risky challenge. Owners, investors, lenders, charterers and traders financially thrive or suffer by the quality of their decisions.

Amazon CEO, Jeff Bezos, has openly stated that he aims to only make three good decisions in a day. Further to that, these decisions should be focused on the future, not the present.

This mentality has some application to the shipping markets. Of course, at times, we all have to match snap decisions on the immediate situation. However, history has shown us that the most successful companies in the shipping markets focus on making a few high quality decisions that will only result in benefits several years in the future. In the simplest sense, this is a principal buying vessels when the market is terrible and waiting for the recovery.

In theory the best decisions are made using the best possible available data and analysis. However, the ever increasing amounts of data and transparency, can be both a blessing and a curse to effective decision making. Too much data and too much conflicting information can cause us to lose the critical signal in the noise.

We would still strongly argue that even noisy data is better than the old school and often misleading opinion of experts that often have some kind of vested interest in pushing a decision in a way that benefits them. However, none of us should be happy with just being better when it comes to supporting our decisions, we should aim to be the best.

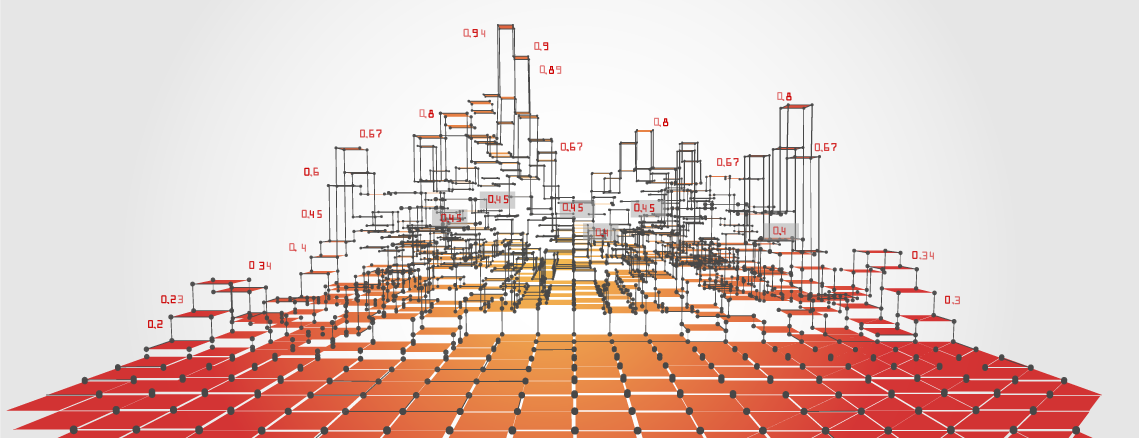

This is where algorithms come in. These clever lines of code are able to process almost unlimited amount of data and, if optimised correctly can find those critical signals amongst the noise to best possibly support our decisions. Further to that, with the rapidly developing field of machine learning, smart algorithms can be trained extremely rapidly using large data sets, leading to potential virtuous automated cycles of continual improved performance and insight to support our decisions. Many of the worlds leading companies recognise this and actively use algorithms to inform their decisions. American fund manager Ray Dalio, and Bridgewater Associates, the company he founded, are prime examples of this, and we look forward to, and in our work try to facilitate, the increased adoption of algorithm supported decision making by ship owners, lenders, investors, traders, insurers and other shipping market players.

Algorithms have a multitude of other benefits, and I have to thank Nick Chubb of Thetius for pointing this out in his fantastic recent article called “Why algorithms beat experts”. Firstly, they are not emotional. Research has shown that when we are hungry, we make worse decisions about everything, not just food. The same is true for buying, selling, fixing or financing vessels. Of course, the best of us are able to mostly eliminate emotions from our decision making, but even so are susceptible to letting them interfere especially at time of high volatility. Secondly, when an algorithm supports a good or bad decision, we can reverse engineer it to understand exactly why and then optimise for its next output to be as good or better. This is very tricky with human decisions as we often misremember all the reasons that drove our thought process and have a preference to impart blame on others. This transparency of algorithmic supported decision making vs pure human is an often overlooked and massively beneficial.

The challenge with algorithms for most of us in the shipping industry is that to effectively use them, we have to take a big step back from the day to day and focus on the future. To benefit from them, we have to invest time into understanding them and often money to bring them in from experts within or outside our organisations. However, this is like buying ships at the bottom of the market, take some time and risk now and you should reap large benefits in the future. The cartoon below captures this ethos.

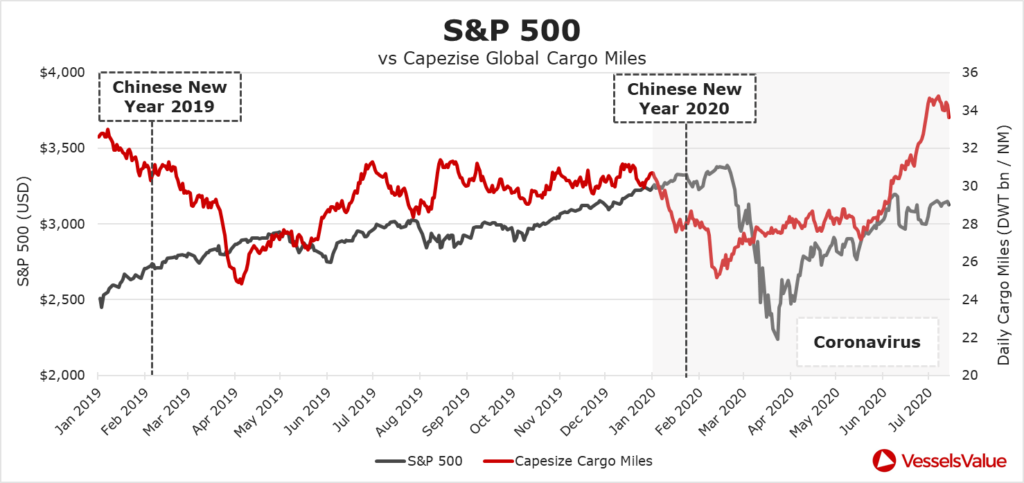

To finish this article, I would like to give one simple example of an algorithm leading to unexpected but potentially beneficial insight. The algorithm in question is our proprietary Trade code that uses AIS, GIS and behavioural analysis to determine if and when vessels have loaded or discharged cargo, if are on a laden or ballast journey and the related ton miles. This is done in real time across the global fleet. When the daily ton miles are analysed for the capesize fleet (c.1680 live vessels), a leading correlation arises between the ton miles and S&P500 (as a general indicator of the stock market).

This correlation was weak before the inset of COVID-19 becoming much stronger from the start of January 2020, but has weakened through July 2020. In this case, using algorithms to support your investment decisions during the height of the pandemic could have been very financially rewarding. We posted this in April, but wanted to come back and refresh the data to show how the correlation is holding up, the results of which you can see on the chart above.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.

Want to know more about how our

data can help you assess the market?