Tanker Market

Overview

After a positive autumn and winter, recent events have resulted in an increasingly pessimistic short term outlook for the Tanker market. In short, factors contributing to supply growth and demand constriction have combined to bring down Tanker rates.

The Past

Last summer, the US put sanctions on a number of Chinese Tanker owners. Due to the opaque ownership structures of the fleets, charterers stayed well clear of any vessel possibly related, thus reducing the available supply ultimately causing rates to peak at a 10 year high. Combined with terrorist activity in the gulf, and a number of other vessels going out of service to have regulatory equipment installed e.g. exhaust gas scrubbers, the Tanker market has been looking healthy with owners enjoying the increased rates throughout autumn and winter.

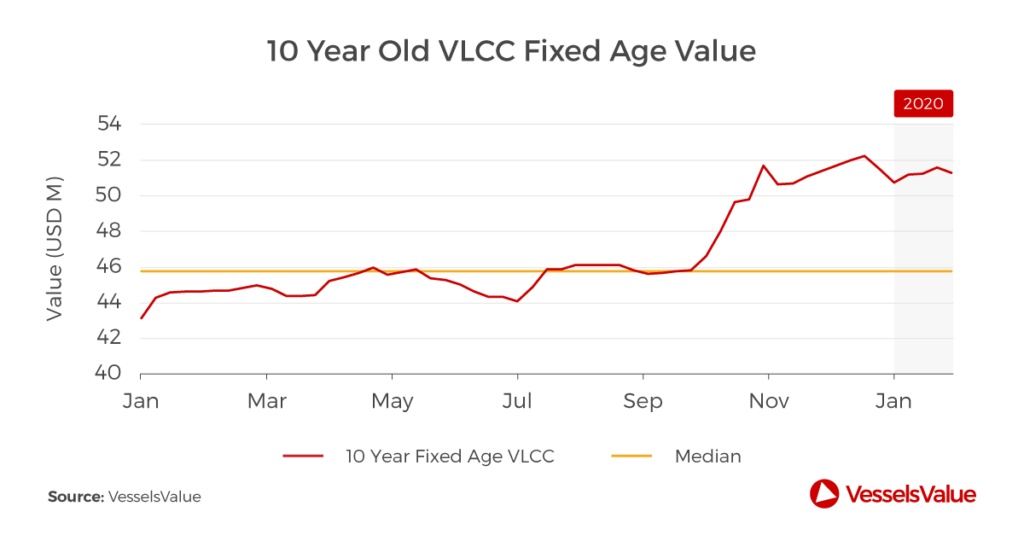

The below chart shows the value of a 10 year old VLCC over the past 12 months. Over the latter part of 2019, it can be seen that the value of these assets had been increasing.

The Now

It has just been announced that the US sanctions have been lifted, bringing over 40 units back into the general market, which has effectively increased crude Tanker supply adding downward pressure.

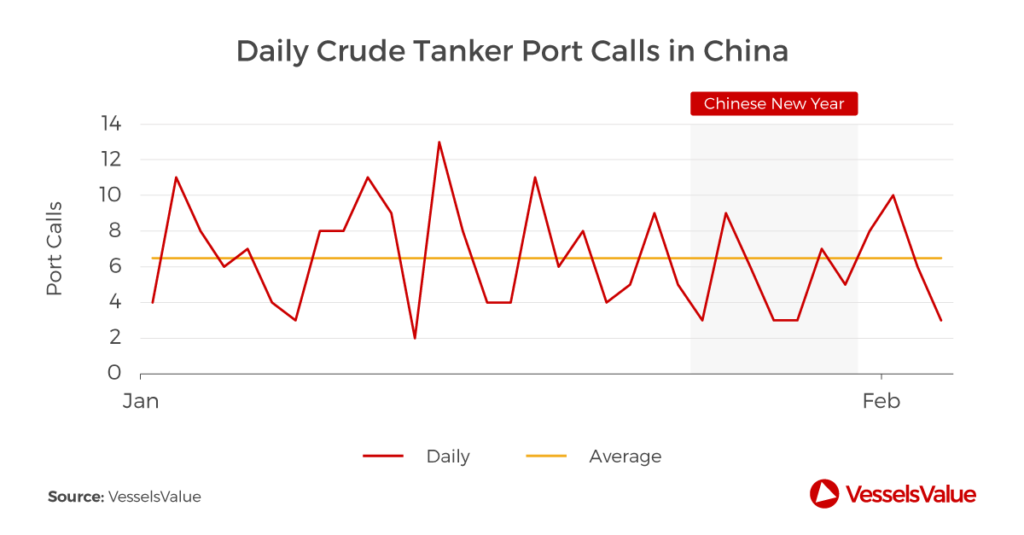

There have been a number of additional downward pressures; Chinese New Year and now Coronavirus. These should have an impact on the Chinese use of Tankers, but interestingly the data isn’t showing this. See chart below with no significant downward trend. However, the full impact of the Coronavirus may not have been felt yet so prolonged continuation could present risk to Chinese oil demand, port calls and hence the tanker market. See chart below showing daily crude Tanker port calls in China.

Secondly, there are the beginnings of the usual seasonal downturn as the west turns into the spring period.

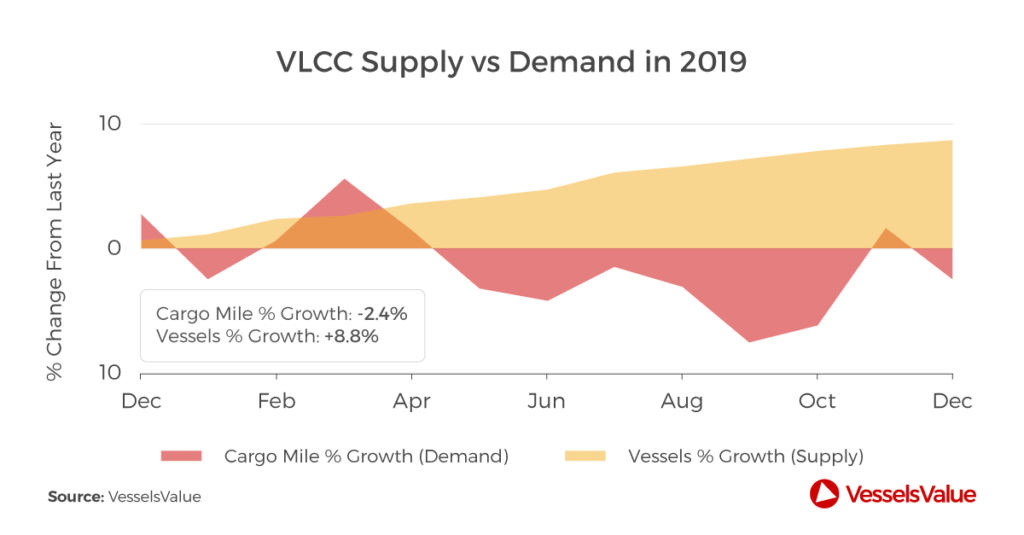

Thirdly, since April 2019, the percentage increase in supply for VLCCs has outstripped the percentage change of demand. According to VesselsValue data, in April 2019 there were 741 live vessels, and currently there are 785 units representing a 6% supply increase.

These combined factors provide a number of early warning signs for the tanker market.

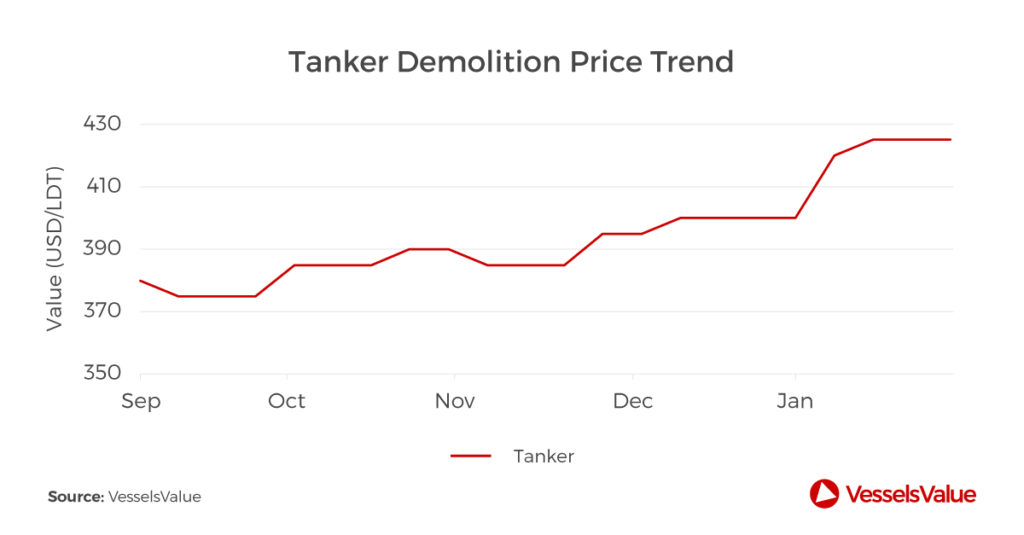

We do, however, still have the issue of oversupply, but the demolition price trend has been on an upward trend from summer 2019 which means that if the market does remain low for a while then we may see the older, less economical tonnage removed from the fleet.

Disclaimer: The purpose of this blog is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this blog.